Question: Please explain why the answer become that What is the equivalent annual cost for a project that requires a $40,000 investment at time zero, and

Please explain why the answer become that

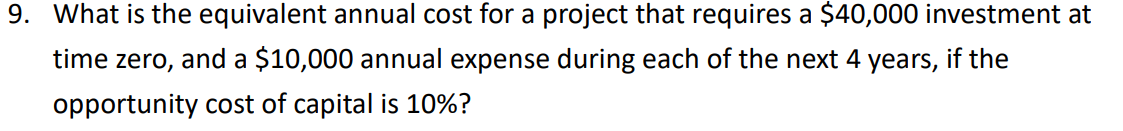

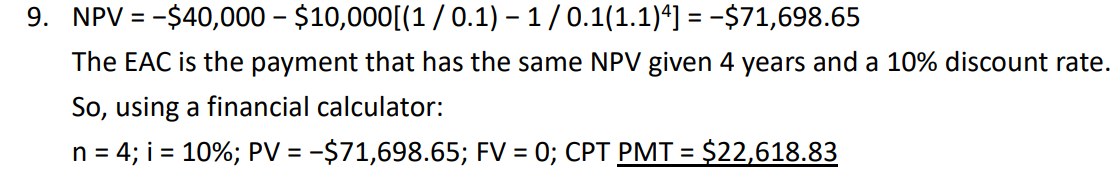

What is the equivalent annual cost for a project that requires a $40,000 investment at time zero, and a $10,000 annual expense during each of the next 4 years, if the opportunity cost of capital is 10% ? 9. NPV=$40,000$10,000[(1/0.1)1/0.1(1.1)4]=$71,698.65 The EAC is the payment that has the same NPV given 4 years and a 10% discount rate. So, using a financial calculator: n=4;i=10%;PV=$71,698.65;FV=0;CPTPMT=$22,618.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts