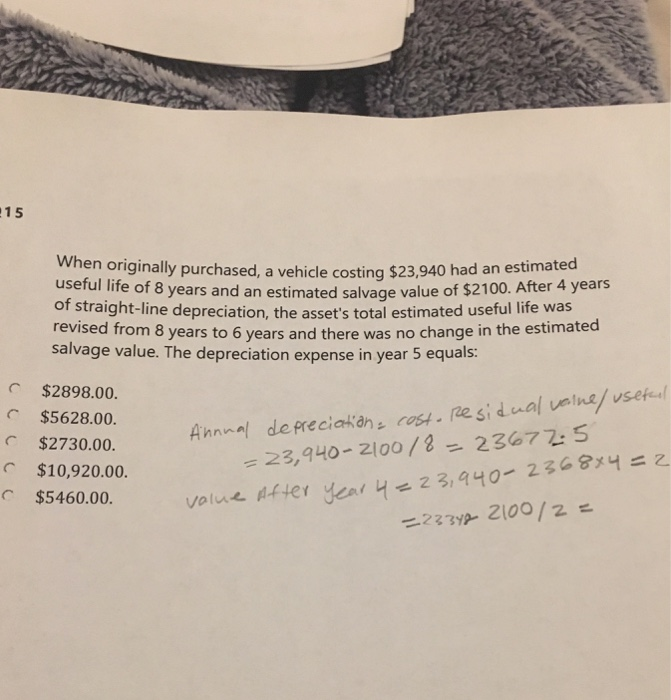

Question: Please explain why the answer wrong 15 When originally purchased, a vehicle costing $23,940 had an estimated useful life of 8 years and an estimated

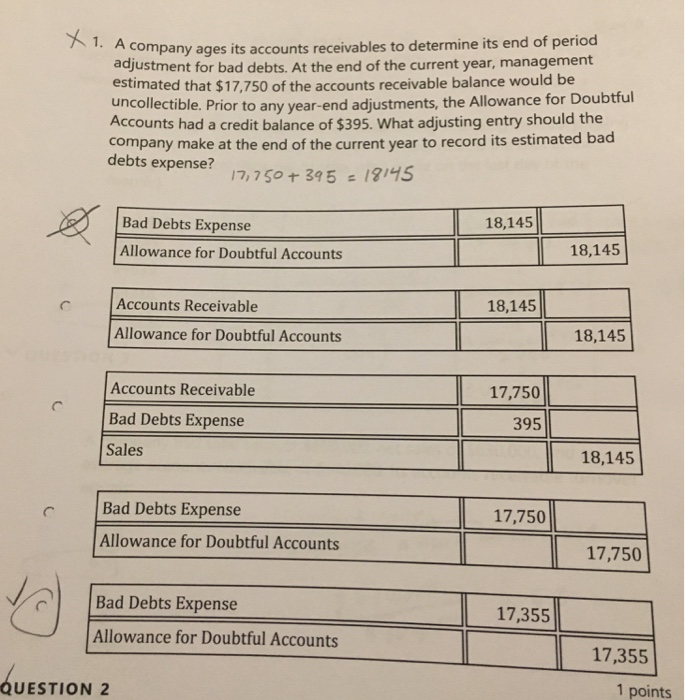

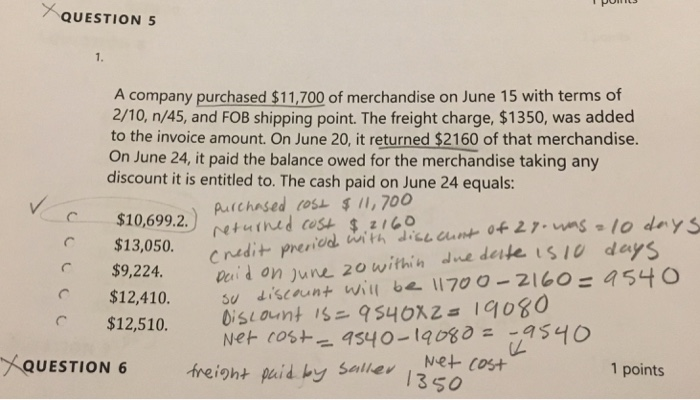

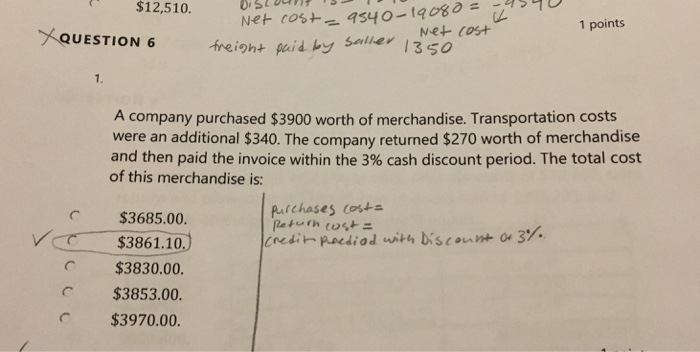

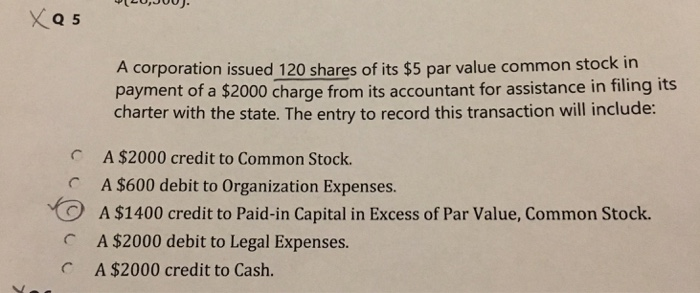

15 When originally purchased, a vehicle costing $23,940 had an estimated useful life of 8 years and an estimated salvage value o of straight-line depreciation, the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated f $2100. After 4 years salvage value. The depreciation expense in year 5 equals: $2730.00. lde preciakancossidual vene vsek $10,920.00. $2898.00. $5628.00. 23,940- 2l00/2 236725 volue Atter yey2 3,440 2368142 $5460.00. Acompany ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $17,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $395. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? 1,750 395 134 1'5 Bad Debts Expense Allowance for Doubtful Accounts 18,145 18,145 Accounts Receivable 18,145 Allowance for Doubtful Accounts 18,145 Accounts Receivable Bad Debts Expense Sales 17,750 395 18,145 Bad Debts Expense 17,750 Allowance for Doubtful Accounts 17,750 Bad Debts Expense 17,355 Allowance for Doubtful Accounts 17,355 UESTION 2 1 points QUESTION 5 A company purchased $11,700 of merchandise on June 15 with terms of 2/10, n/45, and FOB shipping point. The freight charge, $1350, was added to the invoice amount. On June 20, it returned $2160 of that merchandise. On June 24, it paid the balance owed for the merchandise taking any discount it is entitled to. The cash paid on June 24 equals: $%10,699.2.tu $13,050. rudit P Dei'd on June 20 within due derte isio de su d/scount will 6 11700-2160 = 754 o $12,410. 1 points freight paid by saller Net cost $12,510. 1 points >..QUESTION 6 freight paid 350 A company purchased $3900 worth of merchandise. Transportation costs were an additional $340. The company returned $270 worth of merchandise and then paid the invoice within the 3% cash discount period. The total cost of this merchandise is: Rutchases cost $3685.00. $3861.10 $3830.00 $3853.00 $3970.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts