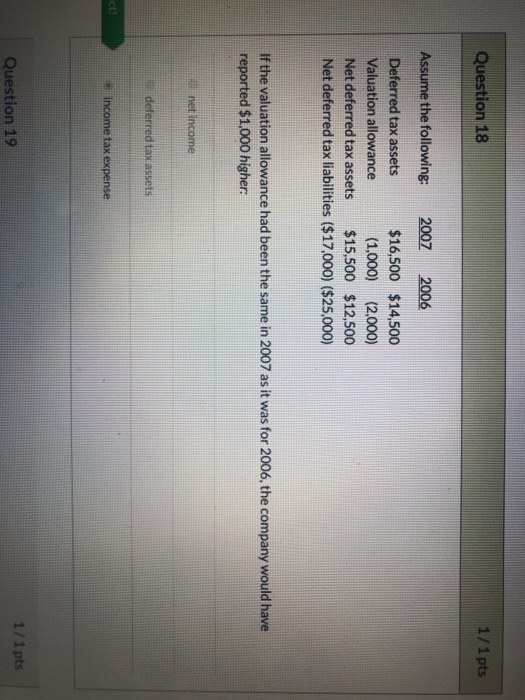

Question: please explain why this is the answer Question 18 1/1 pts Assume the following: 2007 2006 Deferred tax assets $16,500 $14,500 Valuation allowance (1,000) (2,000)

Question 18 1/1 pts Assume the following: 2007 2006 Deferred tax assets $16,500 $14,500 Valuation allowance (1,000) (2,000) Net deferred tax assets $15,500 $12,500 Net deferred tax liabilities ($17,000) ($25,000) E If the valuation allowance had been the same in 2007 as it was for 2006, the company would have reported $1,000 higher: net income deferred tax assets ct! income tax expense Question 19 1/1 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts