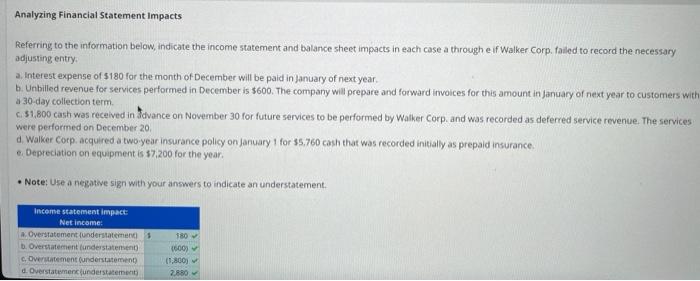

Question: Please explain why those 2 answers were considered wrong Analyzing Financial Statement Impacts Referring to the information below, indicate the income statement and balance sheet

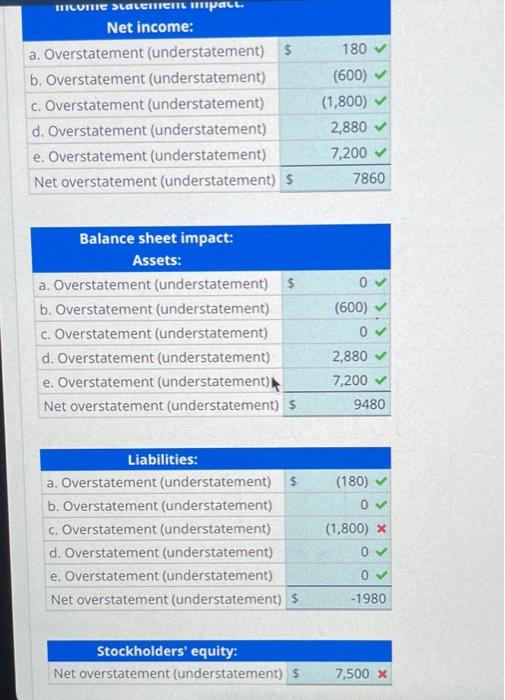

Analyzing Financial Statement Impacts Referring to the information below, indicate the income statement and balance sheet impacts in each case a through e if Walker corp, falled to record the necessary adjusting entry. a. Interest expense of $180 for the month of December will be paid in january of next year. b. Unbilled revenue for services performed in December is $600. The company will prepare and forward invoices for this amount in january of next year to customers with a 30 -day collection term. ci $1,800 cash was received in 3 dance on November 30 for future services to be performed by Watker Corp. and was recorded as deferred service revenue. The services Were performed on December 20, d. Walker corp. acquired a twb-year insurance policy on january 1 for 35,760 cash that was recorded initially as prepaid insurance. e. Depreciation on equipment is $7,200 for the year. - Note: Use a negatwe sign with your answers to indicate an understatement. \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Balance sheet impact: } \\ \multicolumn{1}{|c|}{ Assets: } \\ \hline a. Overstatement (understatement) & $ \\ \hline b. Overstatement (understatement) & (600) \\ \hline c. Overstatement (understatement) & 0 \\ \hline d. Overstatement (understatement) & 2,880 \\ \hline e. Overstatement (understatement) & 7,200 \\ \hline Net overstatement (understatement) & $9480 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

The two incorrect answers are related to 1 c Balance Sheet Impact Liabilities 2 e Balance Sheet Impa... View full answer

Get step-by-step solutions from verified subject matter experts