Question: please explain Will DEPS be presented? why or why not? thanks Cosco Company had 300,000 shares of common stock issued and outstanding at December 31,

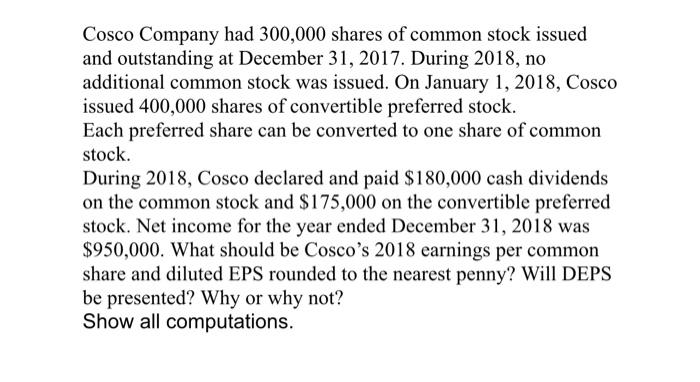

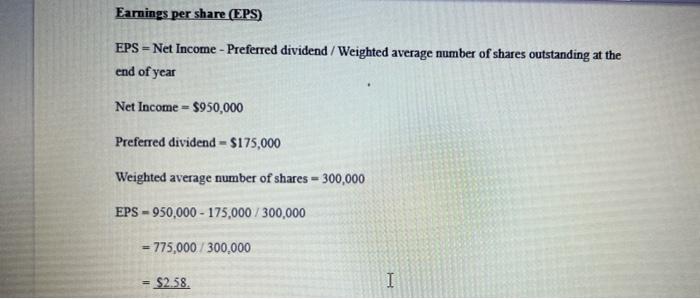

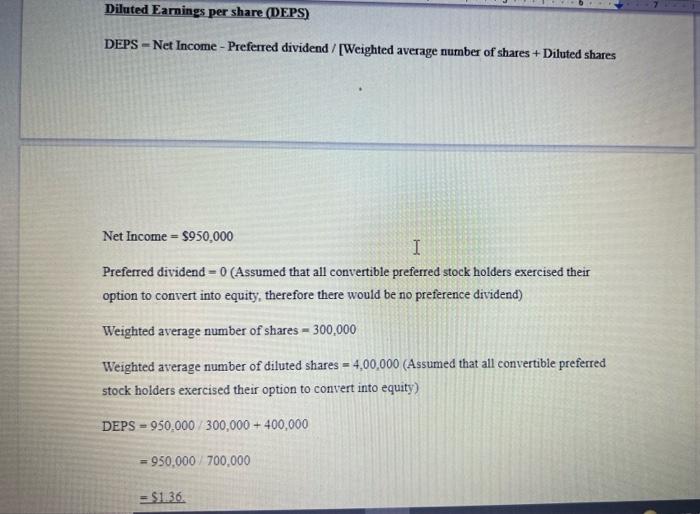

Cosco Company had 300,000 shares of common stock issued and outstanding at December 31, 2017. During 2018, no. additional common stock was issued. On January 1, 2018, Cosco issued 400,000 shares of convertible preferred stock. Each preferred share can be converted to one share of common stock. During 2018, Cosco declared and paid $180,000 cash dividends on the common stock and $175,000 on the convertible preferred stock. Net income for the year ended December 31, 2018 was $950,000. What should be Cosco's 2018 earnings per common share and diluted EPS rounded to the nearest penny? Will DEPS be presented? Why or why not? Show all computations. Earnings per share (EPS) EPS - Net Income - Preferred dividend / Weighted average number of shares outstanding at the end of year Net Income $950,000 = Preferred dividend - $175,000 Weighted average number of shares = 300,000 EPS-950,000-175,000/300,000 =775,000/300,000 $2.58. I Diluted Earnings per share (DEPS) DEPS-Net Income - Preferred dividend / [Weighted average number of shares + Diluted shares Net Income $950,000 = I Preferred dividend - 0 (Assumed that all convertible preferred stock holders exercised their option to convert into equity, therefore there would be no preference dividend) Weighted average number of shares- 300,000 Weighted average number of diluted shares = 4,00,000 (Assumed that all convertible preferred stock holders exercised their option to convert into equity) DEPS-950,000/300,000+400,000 =950,000/700,000 = $1.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts