Question: Please explain with all relevant calculations We currently have 3 'custom build' contracts in progress at the year end. We have recorded the costs incurred

Please explain with all relevant calculations

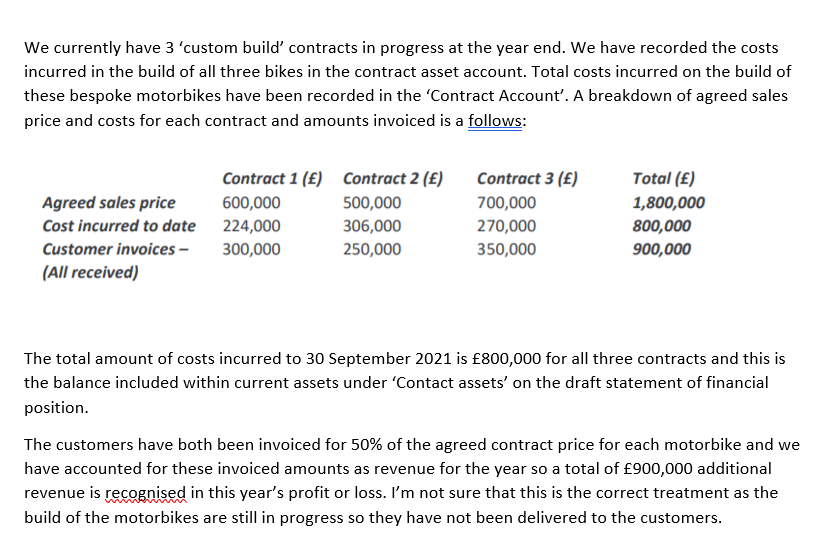

We currently have 3 'custom build' contracts in progress at the year end. We have recorded the costs incurred in the build of all three bikes in the contract asset account. Total costs incurred on the build of these bespoke motorbikes have been recorded in the 'Contract Account'. A breakdown of agreed sales price and costs for each contract and amounts invoiced is a follows: Contract 1 () Contract 2 () Agreed sales price 600,000 500,000 Cost incurred to date 224,000 306,000 Customer invoices - 300,000 250,000 (All received) Contract 3 () 700,000 270,000 350,000 Total () 1,800,000 800,000 900,000 The total amount of costs incurred to 30 September 2021 is 800,000 for all three contracts and this is the balance included within current assets under 'Contact assets' on the draft statement of financial position. The customers have both been invoiced for 50% of the agreed contract price for each motorbike and we have accounted for these invoiced amounts as revenue for the year so a total of 900,000 additional revenue is recognised in this year's profit or loss. I'm not sure that this is the correct treatment as the build of the motorbikes are still in progress so they have not been delivered to the customers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts