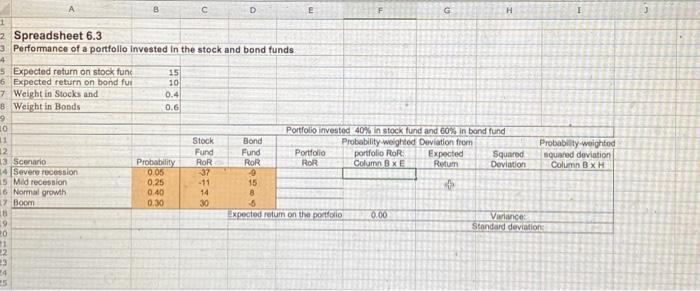

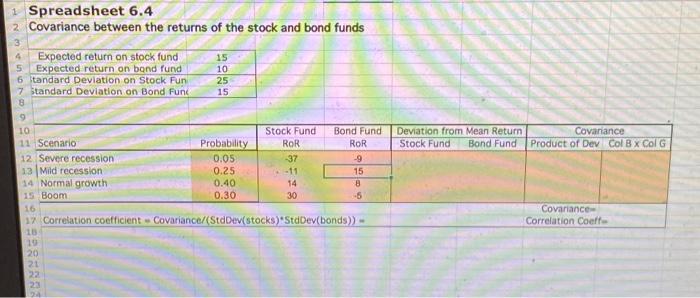

Question: please explain with excel formulas the first excel sheet is for questions 6 and 7 the seconf excel sheet is fot questions 8 and 9

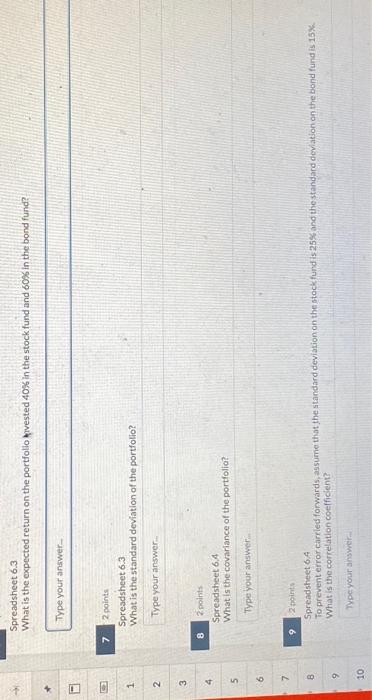

Performance of a portfollo invested in the stock and bond funds Spreadsheet 6.4 Covariance between the returns of the stock and bond funds Correlation coefficient = Covariance ( StdDev(stocks) StdDev(bonds) )= Spreadsheet 6.3 What is the expected return on the portfolio kivested 40% in the stock fund and 60% in the bond fund? Type your answer- 2 points Spreadsheet 6.3 What is the standard deviation of the portfolio? Type your answer... 2 points Spreadsheet 6.4 What is the covariance of the portiolio? Type your answer: 2 theints Spreadsheet 6.A To preventerror carried forwards, as sume that the standard deviation on the stock fund is 25% and the standard deviation on the bond fund is 15 What is the correliation coelficient? Performance of a portfollo invested in the stock and bond funds Spreadsheet 6.4 Covariance between the returns of the stock and bond funds Correlation coefficient = Covariance ( StdDev(stocks) StdDev(bonds) )= Spreadsheet 6.3 What is the expected return on the portfolio kivested 40% in the stock fund and 60% in the bond fund? Type your answer- 2 points Spreadsheet 6.3 What is the standard deviation of the portfolio? Type your answer... 2 points Spreadsheet 6.4 What is the covariance of the portiolio? Type your answer: 2 theints Spreadsheet 6.A To preventerror carried forwards, as sume that the standard deviation on the stock fund is 25% and the standard deviation on the bond fund is 15 What is the correliation coelficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts