Question: Please explain with Excel formulas What would be the equation for Cumulative Returns in Excel? In the first tab 'Cumulative Return', the monthly prices for

Please explain with Excel formulas

What would be the equation for Cumulative Returns in Excel?

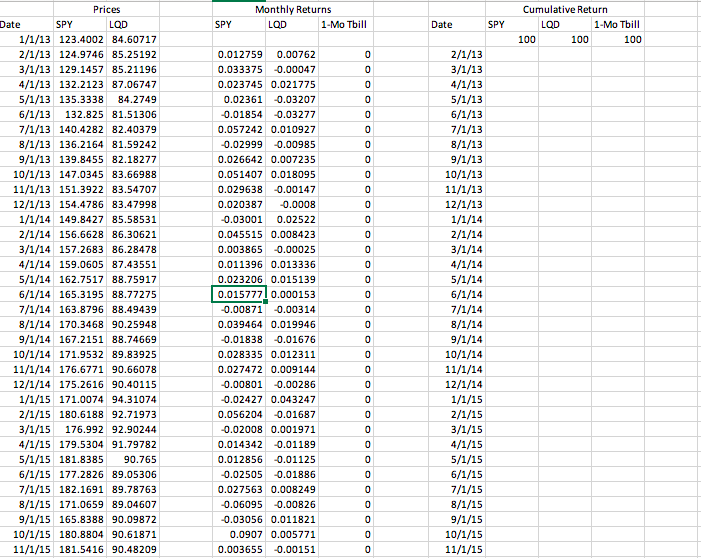

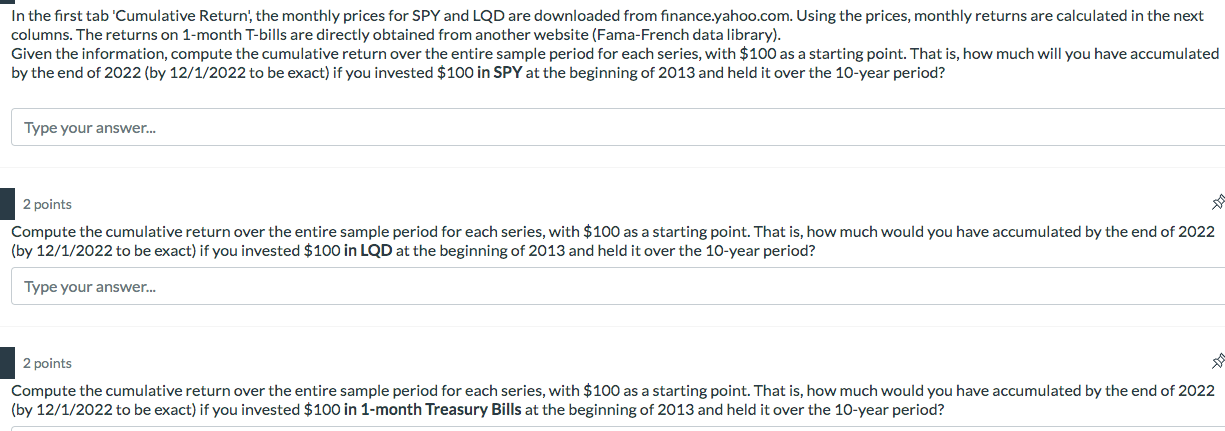

In the first tab 'Cumulative Return', the monthly prices for SPY and LQD are downloaded from finance.yahoo.com. Using the prices, monthly returns are calculated in the next columns. The returns on 1-month T-bills are directly obtained from another website (Fama-French data library). Given the information, compute the cumulative return over the entire sample period for each series, with $100 as a starting point. That is, how much will you have accumulated by the end of 2022 (by 12/1/2022 to be exact) if you invested $100 in SPY at the beginning of 2013 and held it over the 10-year period? Type your answer... 2 points Compute the cumulative return over the entire sample period for each series, with $100 as a starting point. That is, how much would you have accumulated by the end of 2022 (by 12/1/2022 to be exact) if you invested $100 in LQD at the beginning of 2013 and held it over the 10-year period? Type your answer... 2 points Compute the cumulative return over the entire sample period for each series, with $100 as a starting point. That is, how much would you have accumulated by the end of 2022 (by 12/1/2022 to be exact) if you invested $100 in 1-month Treasury Bills at the beginning of 2013 and held it over the 10-year period? In the first tab 'Cumulative Return', the monthly prices for SPY and LQD are downloaded from finance.yahoo.com. Using the prices, monthly returns are calculated in the next columns. The returns on 1-month T-bills are directly obtained from another website (Fama-French data library). Given the information, compute the cumulative return over the entire sample period for each series, with $100 as a starting point. That is, how much will you have accumulated by the end of 2022 (by 12/1/2022 to be exact) if you invested $100 in SPY at the beginning of 2013 and held it over the 10-year period? Type your answer... 2 points Compute the cumulative return over the entire sample period for each series, with $100 as a starting point. That is, how much would you have accumulated by the end of 2022 (by 12/1/2022 to be exact) if you invested $100 in LQD at the beginning of 2013 and held it over the 10-year period? Type your answer... 2 points Compute the cumulative return over the entire sample period for each series, with $100 as a starting point. That is, how much would you have accumulated by the end of 2022 (by 12/1/2022 to be exact) if you invested $100 in 1-month Treasury Bills at the beginning of 2013 and held it over the 10-year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts