Question: please explain with full detail and proper methods!! super important. thank you! 1. GridCo Analytics needs to purchase new land surveying equipment. GridCo's after tax

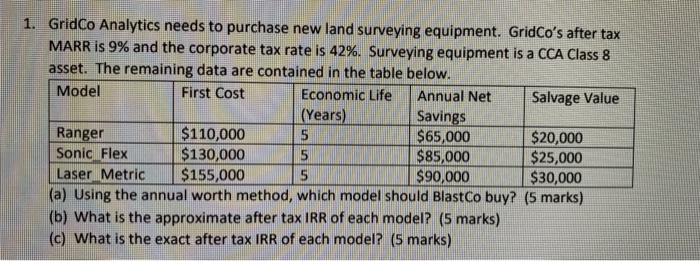

1. GridCo Analytics needs to purchase new land surveying equipment. GridCo's after tax MARR is 9% and the corporate tax rate is 42%. Surveying equipment is a CCA Class 8 asset. The remaining data are contained in the table below. Model First Cost Economic Life Annual Net Salvage Value (Years) Savings Ranger $110,000 5 $65,000 $20,000 Sonic Flex $130,000 5 $85,000 $25,000 Laser Metric $155,000 5 $90,000 $30,000 (a) Using the annual worth method, which model should BlastCo buy? (5 marks) (b) What is the approximate after tax IRR of each model? (5 marks) (c) What is the exact after tax IRR of each model? (5 marks) 1. GridCo Analytics needs to purchase new land surveying equipment. GridCo's after tax MARR is 9% and the corporate tax rate is 42%. Surveying equipment is a CCA Class 8 asset. The remaining data are contained in the table below. Model First Cost Economic Life Annual Net Salvage Value (Years) Savings Ranger $110,000 5 $65,000 $20,000 Sonic Flex $130,000 5 $85,000 $25,000 Laser Metric $155,000 5 $90,000 $30,000 (a) Using the annual worth method, which model should BlastCo buy? (5 marks) (b) What is the approximate after tax IRR of each model? (5 marks) (c) What is the exact after tax IRR of each model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts