Question: Please explain with step wise formulas. Consider a project with the following input data: Projekt Input Data Investment in capital equipment (in thousand)initi inratnant 2.300

Please explain with step wise formulas.

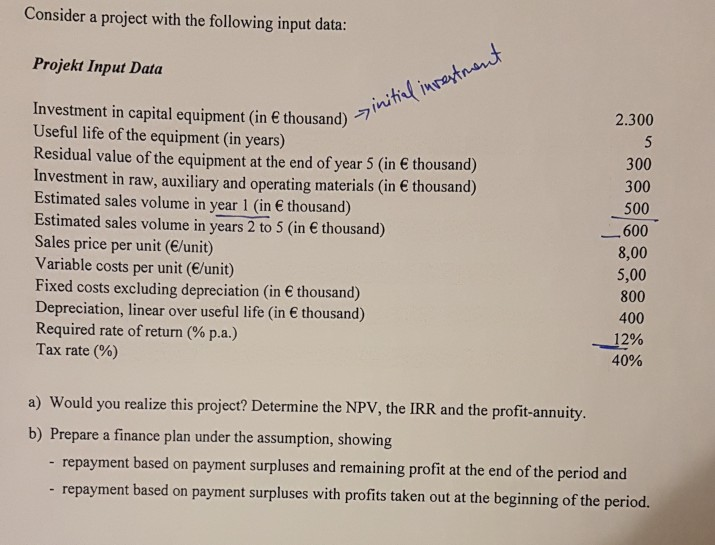

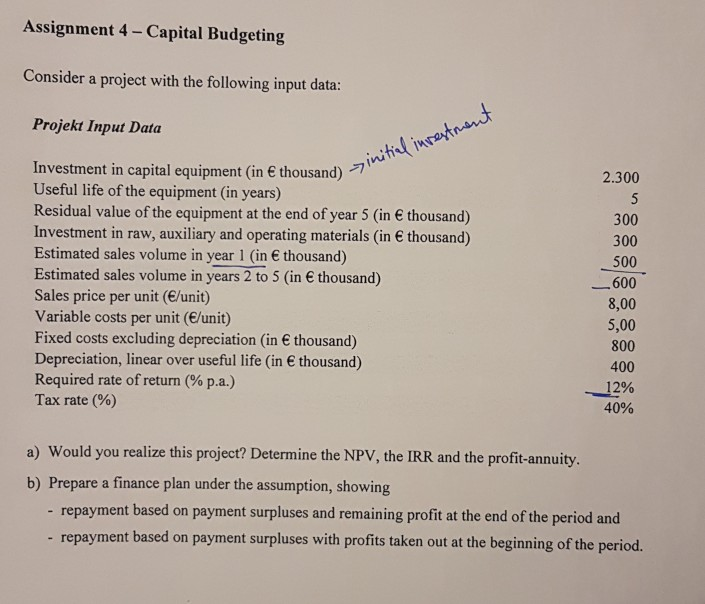

Consider a project with the following input data: Projekt Input Data Investment in capital equipment (in thousand)initi inratnant 2.300 Useful life of the equipment (in years) Residual value of the equipment at the end of year 5 (in thousand) Investment in raw, auxiliary and operating materials (in thousand) Estimated sales volume in year 1 (in thousand) Estimated sales volume in years 2 to 5 (in thousand) Sales price per unit (E/unit) Variable costs per unit (E/unit) Fixed costs excluding depreciation (in thousand) Depreciation, linear over useful life (in thousand) Required rate of return (% p.a.) Tax rate (%) 5 300 300 500 600 8,00 5,00 800 400 12% 40% a) Would you realize this project? Determine the NPV, the IRR and the profit-annuity. b) Prepare a finance plan under the assumption, showing repayment based on payment surpluses and remaining profit at the end of the period and repayment based on payment surpluses with profits taken out at the beginning of the period. Assignment 4-Capital Budgeting Consider a project with the following input data: Projekt Input Data Investment in capital equipment (in thousand) initicl inretnant 2.300 Useful life of the equipment (in years) Residual value of the equipment at the end of year 5 (in thousand) Investment in raw, auxiliary and operating materials (in thousand) Estimated sales volume in year 1 (in thousand) Estimated sales volume in years 2 to 5 (in thousand) Sales price per unit (E/unit) Variable costs per unit (E/unit) Fixed costs excluding depreciation (in thousand) Depreciation, linear over useful life (in thousand) Required rate of return (% p.a.) Tax rate (%) 5 300 300 500 600 8,00 5,00 800 400 12% 40% a) Would you realize this project? Determine the NPV, the IRR and the profit-annuity. b) Prepare a finance plan under the assumption, showing repayment based on payment surpluses and remaining profit at the end of the period and repayment based on payment surpluses with profits taken out at the beginning of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts