Question: please explain with steps A machine that produces cellphone components is purchased on January 1, 2020, for $103,000. It is expected to have a useful

please explain with steps

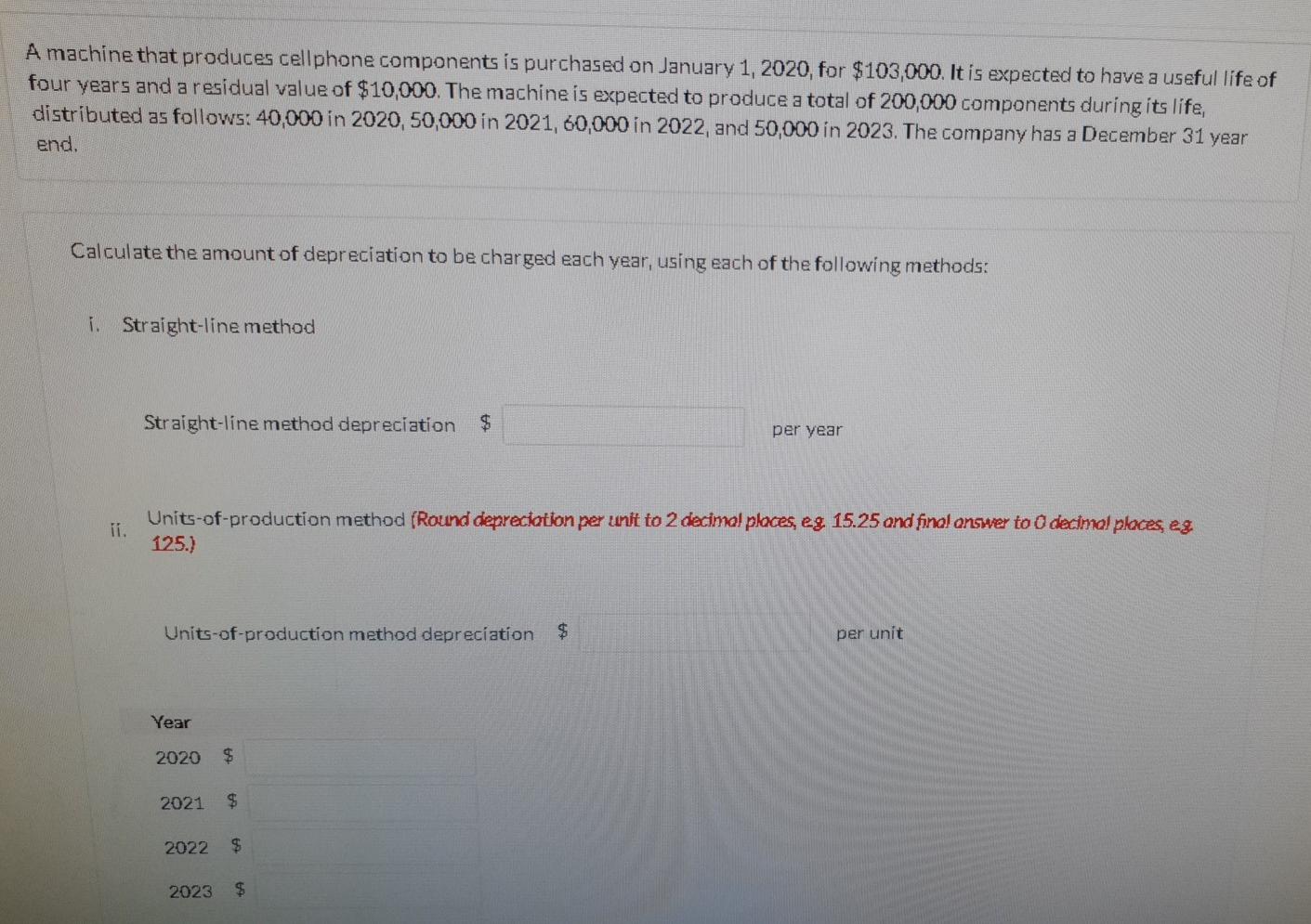

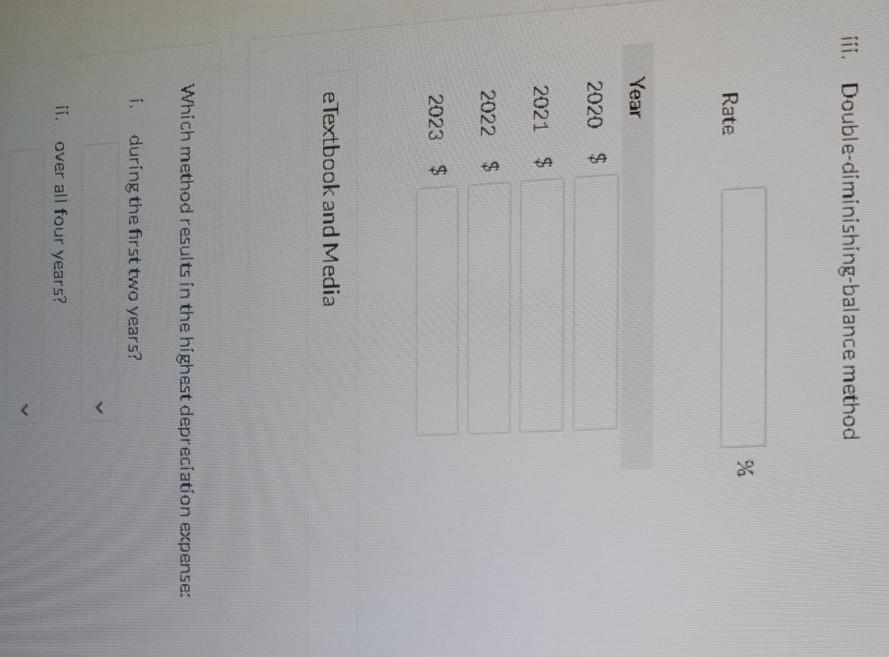

A machine that produces cellphone components is purchased on January 1, 2020, for $103,000. It is expected to have a useful life of four years and a residual value of $10,000. The machine is expected to produce a total of 200,000 components during its life, distributed as follows: 40,000 in 2020, 50,000 in 2021, 60,000 in 2022, and 50,000 in 2023. The company has a December 31 year end. Calculate the amount of depreciation to be charged each year, using each of the following methods: 1. Straight-line method Straight-line method depreciation $ per year Units-of-production method (Round depreciation per unit to 2 decimal places, eg 15.25 ond final answer to O decimal places, eg 125.) Units-of-production method depreciation $ per unit Year 2020 $ 2021 $ 2022 $ 2023 $ iii. Double-diminishing-balance method % Rate Year 2020 $ 2021 $ 2022 $ 2023 $ e Textbook and Media Which method results in the highest depreciation expense: i. during the first two years? ii. over all four years?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts