Question: Please explain with supporting calculations why it is a good decision or why it is not a good decision. Do not write the paper. Thanks!

Please explain with supporting calculations why it is a good decision or why it is not a good decision. Do not write the paper. Thanks!

Please explain with supporting calculations why it is a good decision or why it is not a good decision. Do not write the paper. Thanks!

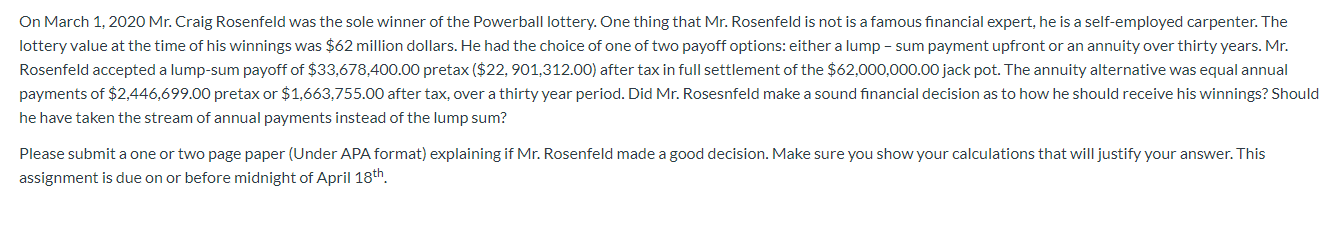

On March 1, 2020 Mr. Craig Rosenfeld was the sole winner of the Powerball lottery. One thing that Mr. Rosenfeld is not is a famous financial expert, he is a self-employed carpenter. The lottery value at the time of his winnings was $62 million dollars. He had the choice of one of two payoff options: either a lump - sum payment upfront or an annuity over thirty years. Mr. Rosenfeld accepted a lump-sum payoff of $33,678,400.00 pretax ($22, 901,312.00) after tax in full settlement of the $62,000,000.00 jack pot. The annuity alternative was equal annual payments of $2,446,699.00 pretax or $1,663,755.00 after tax, over a thirty year period. Did Mr. Rosesnfeld make a sound financial decision as to how he should receive his winnings? Should he have taken the stream of annual payments instead of the lump sum? Please submit a one or two page paper (Under APA format) explaining if Mr. Rosenfeld made a good decision. Make sure you show your calculations that will justify your answer. This assignment is due on or before midnight of April 18th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts