Question: Please explain your answer and preferably show your work in Excel spreadsheet format. Thank you! Your firm has an average - risk project under consideration.

Please explain your answer and preferably show your work in Excel spreadsheet format. Thank you!

Please explain your answer and preferably show your work in Excel spreadsheet format. Thank you!

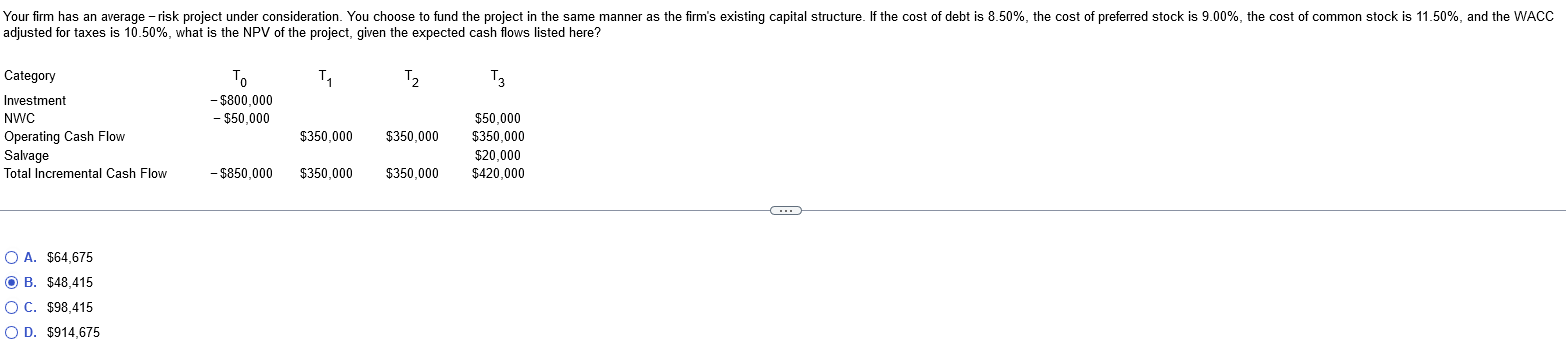

Your firm has an average - risk project under consideration. You choose to fund the project in the same manner as the firm's existing capital structure. If the cost of debt is 8.50%, the cost of preferred stock is 9.00%, the cost of common stock is 11.50%, and the WACC adjusted for taxes is 10.50%, what is the NPV of the project, given the expected cash flows listed here? Category To T T T3 Investment - $800,000 NWC - $50,000 Operating Cash Flow $350,000 $350,000 $50,000 $350,000 $20,000 Salvage Total Incremental Cash Flow - $850,000 $350,000 $350,000 $420,000 C O A. $64,675 O B. $48,415 OC. $98,415 O D. $914,675

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts