Question: Please explain your answer. Thank you. QUESTION 6 10 points Save Answer Consider a loan of $1 million that is paid off monthly over a

Please explain your answer.

Thank you.

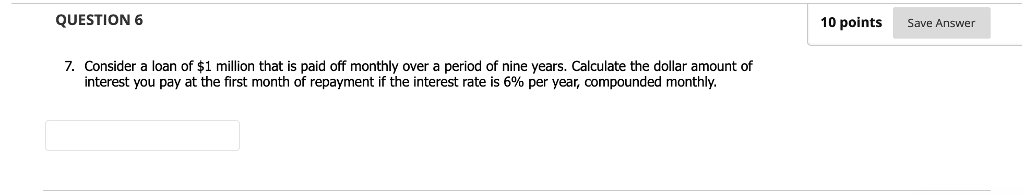

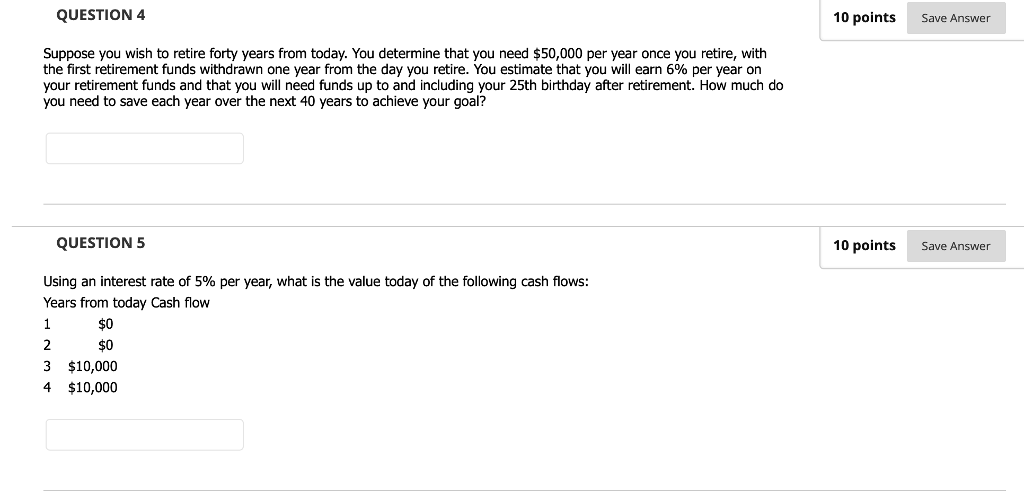

QUESTION 6 10 points Save Answer Consider a loan of $1 million that is paid off monthly over a period of nine years. Calculate the dollar amount of interest you pay at the first month of repayment if the interest rate is 6% per year compounded monthly. 7. QUESTION4 10 points Save Answer Suppose you wish to retire forty years from today. You determine that you need $50,000 per year once you retire, with the first retirement funds withdrawn one year from the day you retire. You estimate that you will earn 6% per year on your retirement funds and that you will need funds up to and including your 25th birthday after retirement. How much do you need to save each year over the next 40 years to achieve your goal? QUESTION 5 10 points Save Answer Using an interest rate of 5% per year, what is the value today of the following cash flows Years from today Cash flow 1 $0 2 $0 3 $10,000 4 $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts