Question: Please explain your answers Also, I know this question may not be for many points but I really need this, please I pay for a

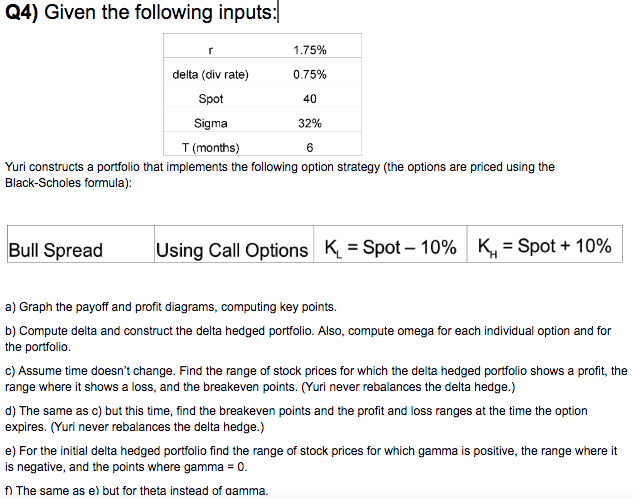

Q4) Given the following inputs: 1.75% delta (div rate) 0.75% Spot 40 Sigma 32% T (months) Yuri constructs a portfolio that implements the following option strategy (the options are priced using the Black-Scholes formula): Bull Spread Using Call Options K = Spot - 10% K7 = Spot + 10% a) Graph the payoff and profit diagrams, computing key points. b) Compute delta and construct the delta hedged portfolio. Also, compute omega for each individual option and for the portfolio c) Assume time doesn't change. Find the range of stock prices for which the delta hedged portfolio shows a profit, the range where it shows a loss, and the breakeven points. (Yuri never rebalances the delta hedge.) d) The same as c) but this time, find the breakeven points and the profit and loss ranges at the time the option expires. (Yuri never rebalances the delta hedge.) e) For the initial delta hedged portfolio find the range of stock prices for which gamma is positive, the range where it is negative, and the points where gamma=0. The same as e) but for theta instead of aamma. Q4) Given the following inputs: 1.75% delta (div rate) 0.75% Spot 40 Sigma 32% T (months) Yuri constructs a portfolio that implements the following option strategy (the options are priced using the Black-Scholes formula): Bull Spread Using Call Options K = Spot - 10% K7 = Spot + 10% a) Graph the payoff and profit diagrams, computing key points. b) Compute delta and construct the delta hedged portfolio. Also, compute omega for each individual option and for the portfolio c) Assume time doesn't change. Find the range of stock prices for which the delta hedged portfolio shows a profit, the range where it shows a loss, and the breakeven points. (Yuri never rebalances the delta hedge.) d) The same as c) but this time, find the breakeven points and the profit and loss ranges at the time the option expires. (Yuri never rebalances the delta hedge.) e) For the initial delta hedged portfolio find the range of stock prices for which gamma is positive, the range where it is negative, and the points where gamma=0. The same as e) but for theta instead of aamma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts