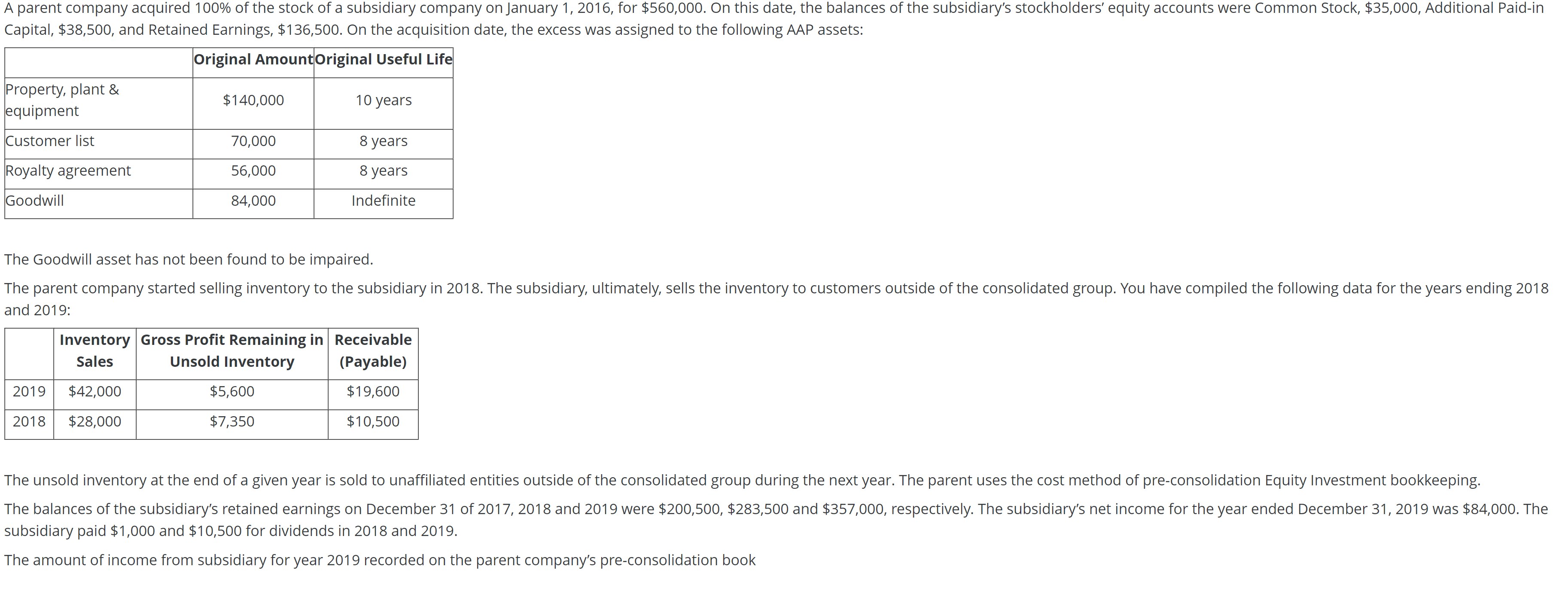

Question: Please explain your reasoning for finding the solution! Zooming in helps to see the information! Thanks in advance! :) Capital, $38,500, and Retained Earnings, $136,500.

Please explain your reasoning for finding the solution! Zooming in helps to see the information! Thanks in advance! :)

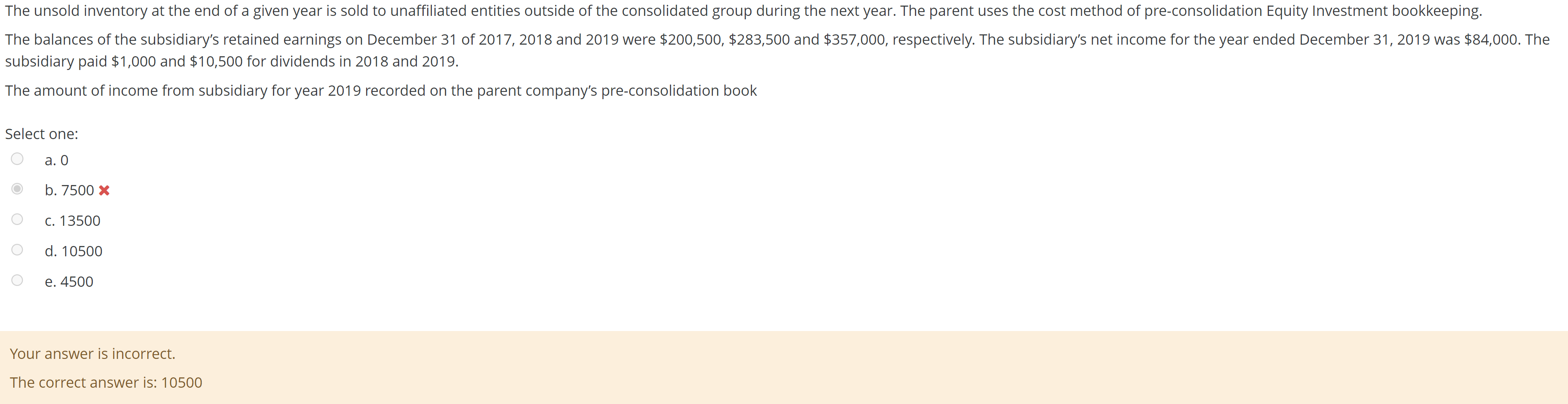

Capital, $38,500, and Retained Earnings, $136,500. On the acquisition date, the excess was assigned to the following AAP assets: The Goodwill asset has not been found to be impaired. and 2019: subsidiary paid $1,000 and $10,500 for dividends in 2018 and 2019 . The amount of income from subsidiary for year 2019 recorded on the parent company's pre-consolidation book subsidiary paid $1,000 and $10,500 for dividends in 2018 and 2019 . The amount of income from subsidiary for year 2019 recorded on the parent company's pre-consolidation book Select one: a. 0 b. 7500 c. 13500 d. 10500 e. 4500 Your answer is incorrect. The correct answer is: 10500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts