Question: Please explain your steps!! Casplan Sea Drinks is considering the purchase of a plum juicer - the PJX5. There is no planned increase in production.

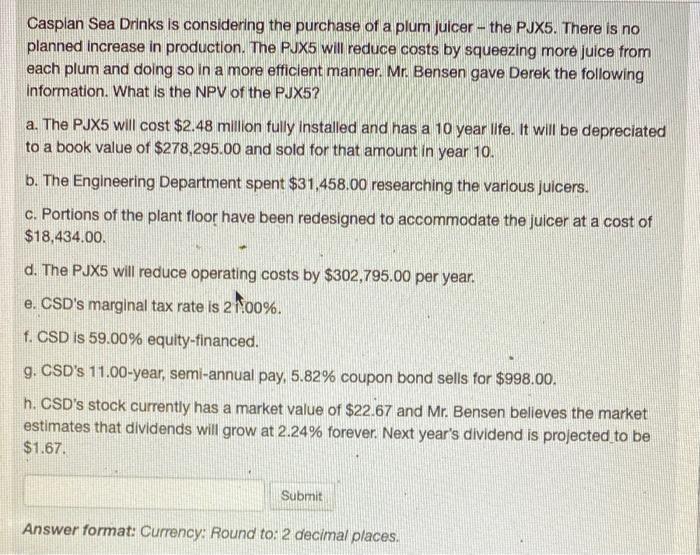

Casplan Sea Drinks is considering the purchase of a plum juicer - the PJX5. There is no planned increase in production. The PJX5 will reduce costs by squeezing more juice from each plum and doing so in a more efficient manner. Mr. Bensen gave Derek the following information. What is the NPV of the PJX5? a. The PJX5 will cost $2.48 million fully installed and has a 10 year life. It will be depreciated to a book value of $278,295.00 and sold for that amount in year 10. b. The Engineering Department spent $31,458.00 researching the various juicers. c. Portions of the plant floor have been redesigned to accommodate the juicer at a cost of $18,434.00. d. The PJX5 will reduce operating costs by $302,795.00 per year. e. CSD's marginal tax rate is 2 100%. f. CSD is 59.00% equity-financed. g. CSD's 11.00-year, semi-annual pay, 5.82% coupon bond sells for $998.00. h. CSD's stock currently has a market value of $22.67 and Mr. Bensen believes the market estimates that dividends will grow at 2.24% forever. Next year's dividend is projected to be $1.67. Submit Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts