Question: Please explain your work For the stocks A and B you observe the following relationship to the market portfolio: A B Beta (B) 0.3001 0.3001

Please explain your work

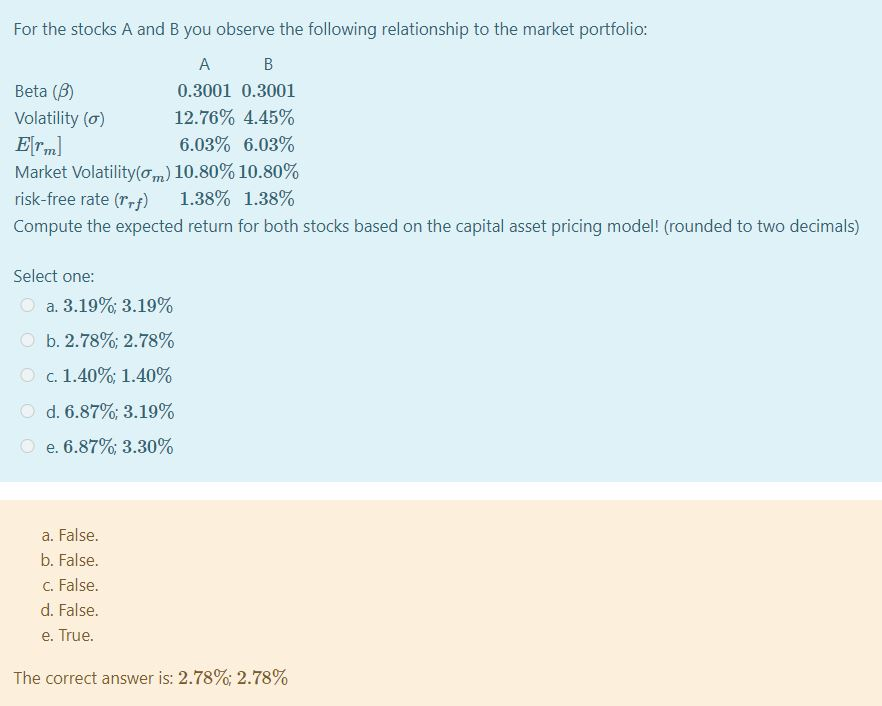

For the stocks A and B you observe the following relationship to the market portfolio: A B Beta (B) 0.3001 0.3001 Volatility (0) 12.76% 4.45% E[rm] 6.03% 6.03% Market Volatility(om) 10.80% 10.80% risk-free rate (ref) 1.38% 1.38% Compute the expected return for both stocks based on the capital asset pricing model! (rounded to two decimals) Select one: a. 3.19%; 3.19% O b. 2.78%; 2.78% c. 1.40%; 1.40% O d. 6.87% 3.19% e. 6.87%; 3.30% a. False. b. False. c. False. d. False. e. True. The correct answer is: 2.78%; 2.78%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts