Question: please explain/answer number 4 thanks! 4. An analyst needs to assign a value to an illiquid four-year, 6.5% annual coupon payment corporate bond. The analyst

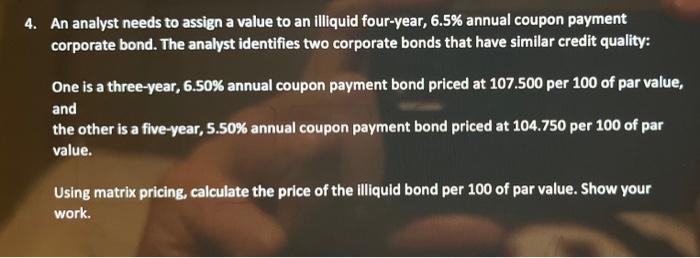

4. An analyst needs to assign a value to an illiquid four-year, 6.5% annual coupon payment corporate bond. The analyst identifies two corporate bonds that have similar credit quality: One is a three-year, 6.50% annual coupon payment bond priced at 107.500 per 100 of par value, and the other is a five-year, 5.50% annual coupon payment bond priced at 104.750 per 100 of par value. Using matrix pricing, calculate the price of the illiquid bond per 100 of par value. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts