Question: Please explain(elaborate) accounts receivable / notes receivable in this topic Thanks Item 7A. Quantitative and Qualitative Disclosures About Market Risk. We are exposed to market

Please explain(elaborate) accounts receivable / notes receivable in this topic

Please explain(elaborate) accounts receivable / notes receivable in this topic

Thanks

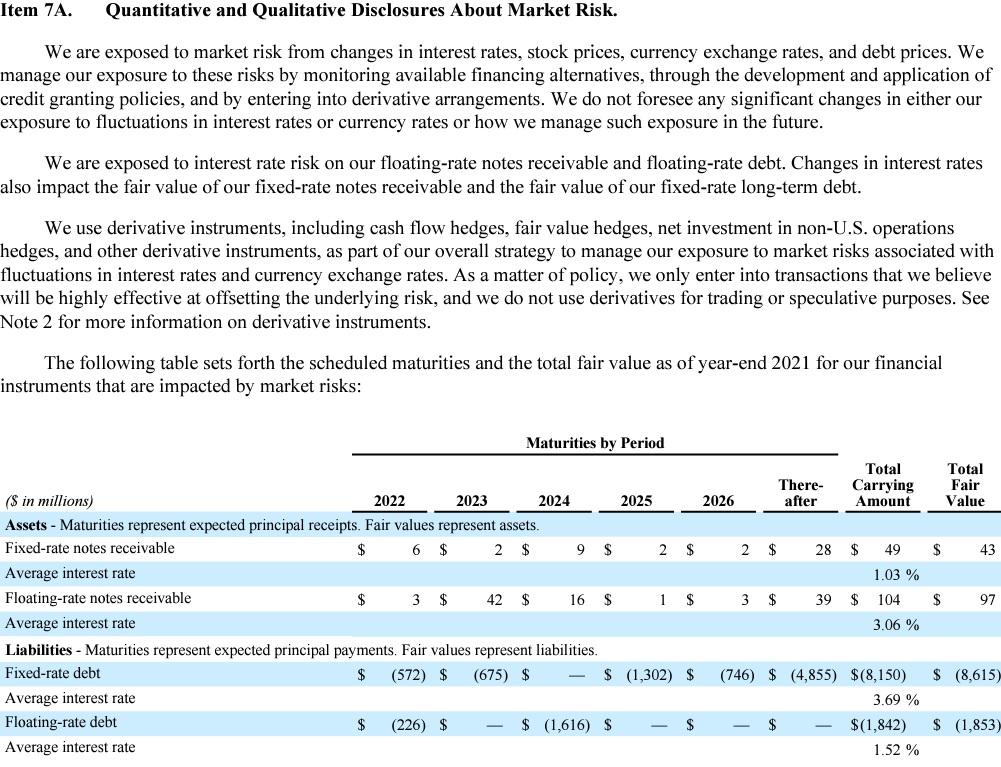

Item 7A. Quantitative and Qualitative Disclosures About Market Risk. We are exposed to market risk from changes in interest rates, stock prices, currency exchange rates, and debt prices. We manage our exposure to these risks by monitoring available financing alternatives, through the development and application of credit granting policies, and by entering into derivative arrangements. We do not foresee any significant changes in either our exposure to fluctuations in interest rates or currency rates or how we manage such exposure in the future. We are exposed to interest rate risk on our floating-rate notes receivable and floating-rate debt. Changes in interest rates impact the fair value of our fixed-rate notes receivable and the fair value of our fixed-rate long-term debt. We use derivative instruments, including cash flow hedges, fair value hedges, net investment in non-U.S. operations hedges, and other derivative instruments, as part of our overall strategy to manage our exposure to market risks associated with fluctuations in interest rates and currency exchange rates. As a matter of policy, we only enter into transactions that we believe will be highly effective at offsetting the underlying risk, and we do not use derivatives for trading or speculative purposes. See Note 2 for more information on derivative instruments. The following table sets forth the scheduled maturities and the total fair value as of year-end 2021 for our financial instruments that are impacted by market risks: Item 7A. Quantitative and Qualitative Disclosures About Market Risk. We are exposed to market risk from changes in interest rates, stock prices, currency exchange rates, and debt prices. We manage our exposure to these risks by monitoring available financing alternatives, through the development and application of credit granting policies, and by entering into derivative arrangements. We do not foresee any significant changes in either our exposure to fluctuations in interest rates or currency rates or how we manage such exposure in the future. We are exposed to interest rate risk on our floating-rate notes receivable and floating-rate debt. Changes in interest rates impact the fair value of our fixed-rate notes receivable and the fair value of our fixed-rate long-term debt. We use derivative instruments, including cash flow hedges, fair value hedges, net investment in non-U.S. operations hedges, and other derivative instruments, as part of our overall strategy to manage our exposure to market risks associated with fluctuations in interest rates and currency exchange rates. As a matter of policy, we only enter into transactions that we believe will be highly effective at offsetting the underlying risk, and we do not use derivatives for trading or speculative purposes. See Note 2 for more information on derivative instruments. The following table sets forth the scheduled maturities and the total fair value as of year-end 2021 for our financial instruments that are impacted by market risks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts