Question: Please express answer as excel yield function. use excel functions please! This question has already been posted, but they did not use excel functions. !!!!

Please express answer as excel yield function. use excel functions please! This question has already been posted, but they did not use excel functions. !!!!

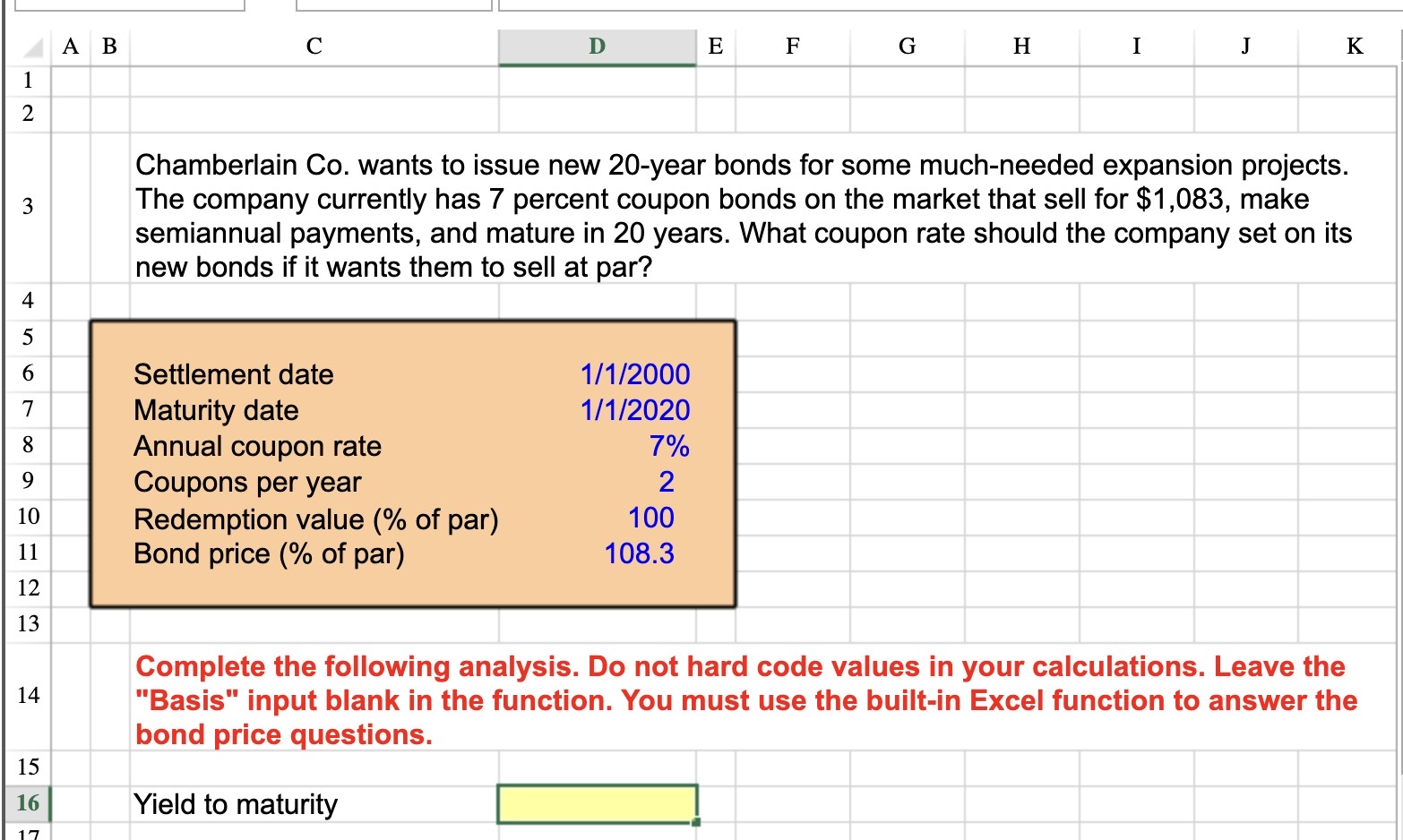

Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? \begin{tabular}{l|l|l|l|l} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline \end{tabular} Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer the bond nrice auestions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts