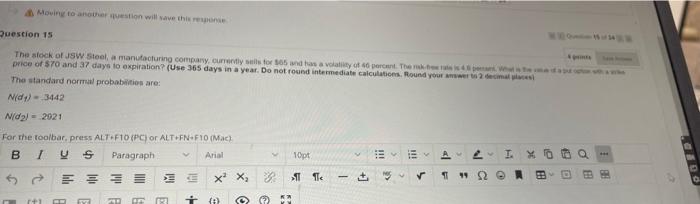

Question: please faaaaaassst Moving to another question will save this response Question 15 The stock of JSW Steel, a manufacturing company, currently sells for $65 and

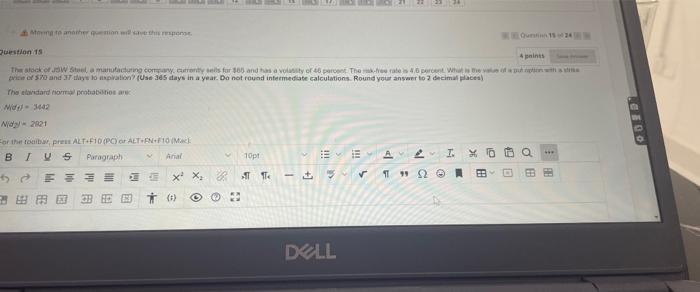

Moving to another question will save this response Question 15 The stock of JSW Steel, a manufacturing company, currently sells for $65 and has a volatility of 46 percent. The risk bee ras is 4 pers. What the price of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places The standard normal probabilities are: N(d) - 3442 N(0) - 2921 For the toolbar, press ALT+F10 (PC) or ALT+FN-F10 (Mac) B I Arial Y 10pt A 2 V I. Paragraph = xx 11 1122E r+1 D FY M D 1 M +{} - prints *** B FB 000 LA MALA BY Moving to another question will save this response Question 15 4 points The stock of JSW Steel, a manufacturing company currently sells for $60 and has a volassity of 46 percent. The risk-free rate is 4/6 percent. What is the value of a put ption with a price of $70 and 37 days to expiration? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places) The elavdard normal probabilities are Nidel- 3442 Nidal 2021 For the toolbar, press ALT+F10 (PC) or ALT-EN-F10 (Mac) B IVS Paragraph 1 Arial V 10pt I. X EEA 2 -5r 19 1x X 33 * () DELL Te EB 8.8 LCEDO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts