Question: please fast Here is a challenging problem Problem 3 - The American Cancer Society, a not for profit entity, had the following transactions; 1/1/20 Received

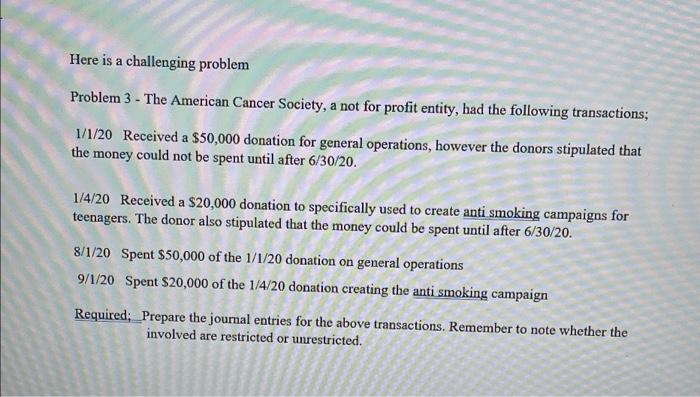

Here is a challenging problem Problem 3 - The American Cancer Society, a not for profit entity, had the following transactions; 1/1/20 Received a $50,000 donation for general operations, however the donors stipulated that the money could not be spent until after 6/30/20. 1/4/20 Received a $20,000 donation to specifically used to create anti smoking campaigns for teenagers. The donor also stipulated that the money could be spent until after 6/30/20. 8/1/20 Spent $50,000 of the 1/1/20 donation on general operations 9/1/20 Spent $20,000 of the 1/4/20 donation creating the anti smoking campaign Required: _Prepare the journal entries for the above transactions. Remember to note whether the involved are restricted or unrestricted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts