Question: please fast please 6-Forward contract is....... A) is a customized contract between two parties to buy or sell an asset at a specified price on

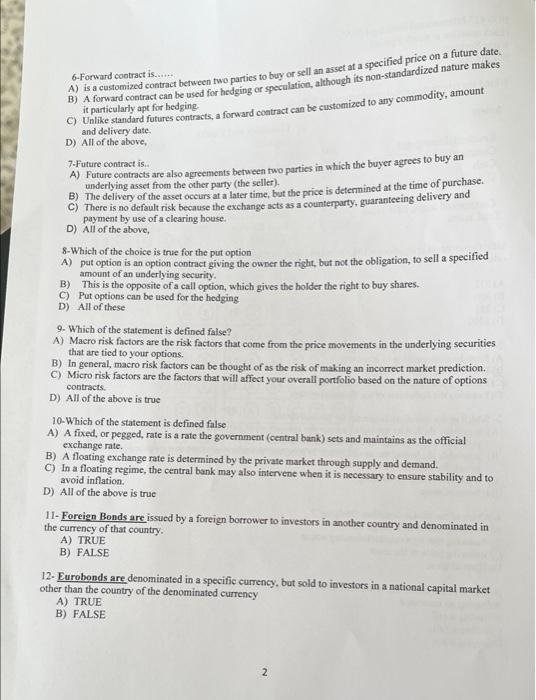

6-Forward contract is....... A) is a customized contract between two parties to buy or sell an asset at a specified price on a future date. B) A forward contract can be used for hedging or speculation, although its non-standardized nature makes it particularly apt for hedging. C) Unlike standard futures contracts, a forward contract can be customized to any commodity, amount and delivery date. D) All of the above, 7-Future contract is... A) Future contracts are also agreements between two parties in which the buyer agrees to buy an underlying asset from the other party (the seller). B) The delivery of the asset occurs at a later time, but the price is determined at the time of purchase. C) There is no default risk because the exchange acts as a counterparty, guaranteeing delivery and payment by use of a clearing house. D) All of the above, 8-Which of the choice is true for the put option A) put option is an option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security. B) This is the opposite of a call option, which gives the holder the right to buy shares. C) Put options can be used for the hedging D) All of these 9. Which of the statement is defined false? A) Macro risk factors are the risk factors that come from the price movements in the underlying securities that are tied to your options. B) In general, macro risk factors can be thought of as the risk of making an incorrect market prediction. C) Micro risk factors are the factors that will affect your overall portfolio based on the nature of options contracts. D) All of the above is true 10-Which of the statement is defined false A) A fixed, or pegged, rate is a rate the government (central bank) sets and maintains as the official exchange rate. B) A floating exchange rate is determined by the private market through supply and demand. C) In a floating regime, the central bank may also intervene when it is necessary to ensure stability and to avoid inflation. D) All of the above is true 11- Foreign Bonds are issued by a foreign borrower to investors in another country and denominated in the currency of that country. A) TRUE B) FALSE 12- Eurobonds are denominated in a specific currency, but sold to investors in a national capital market other than the country of the denominated currency A) TRUE B) FALSE 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts