Question: please fast this is the way I need it solved The comparative balance sheet of Amelia Enterprises, Inc. at December 31, 2010 and. 2009, is

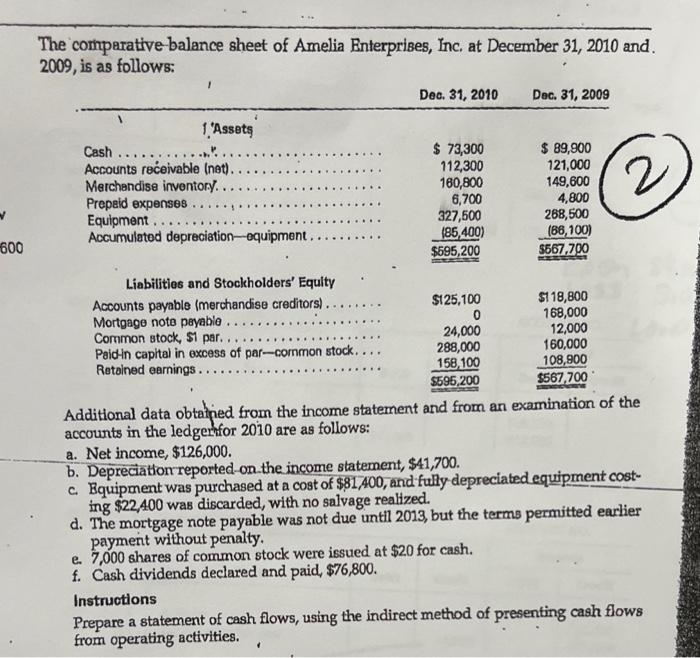

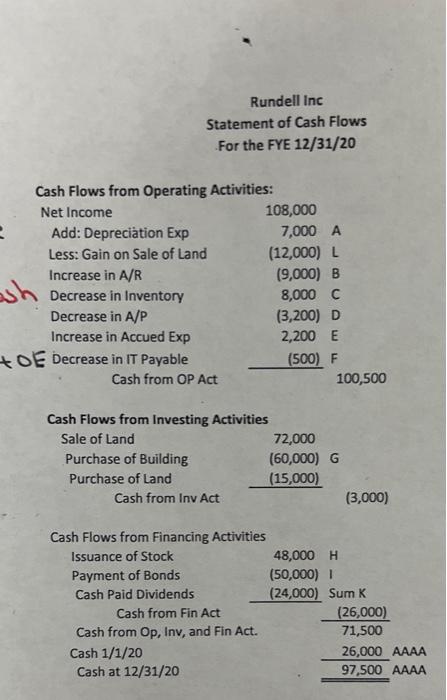

The comparative balance sheet of Amelia Enterprises, Inc. at December 31, 2010 and. 2009, is as follows: 1 Dec. 31, 2010 Dec. 31, 2009 2 600 1 'Assets Cash ... $ 73,300 $ 89,900 Accounts receivable (net). 112,300 121,000 Merchandise inventory.. 160,800 149,600 Prepaid expenses 6,700 4,800 Equipment .. 327,500 268,500 Accumulated depreciation-equipment... (86,400) (66,100) $595,200 $567.700 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors). $125,100 $118,800 Mortgage noto payable .. 0 168,000 Common stock, $1 par.. 24,000 12,000 Paid in capital in excess of par--common stock. 288,000 160,000 Retained earnings.. 158,100 108,900 $595,200 $567,700 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 2010 are as follows: a. Net income, $126,000. b. Depreciation reported on the income statement, $41,700. c Equipment was purchased at a cost of $81,400, and fully depreciated equipment cost- ing $22,400 was discarded, with no salvage realized. d. The mortgage note payable was not due until 2013, but the terms permitted earlier payment without penalty. e 7,000 shares of common stock were issued at $20 for cash. f. Cash dividends declared and paid $76,800. Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Rundell Inc Statement of Cash Flows For the FYE 12/31/20 esh Decrease in Inventory Cash Flows from Operating Activities: Net Income 108,000 2 Add: Depreciation Exp 7,000 A Less: Gain on Sale of Land (12,000) L Increase in A/R (9,000) B 8,000 C Decrease in A/P (3,200) D Increase in Accued Exp 2,200 E HOE Decrease in IT Payable (500) F Cash from OP Act 100,500 Cash Flows from Investing Activities Sale of Land 72,000 Purchase of Building (60,000) G Purchase of Land (15,000) Cash from Inv Act (3,000) Cash Flows from Financing Activities Issuance of Stock 48,000 H Payment of Bonds (50,000) Cash Paid Dividends (24,000) Sum K Cash from Fin Act (26,000) Cash from Op, Inv, and Fin Act. 71,500 Cash 1/1/20 26,000 AAAA Cash at 12/31/20 97,500 AAAA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts