Question: please fill in all empty green spaces COMPLETE THE PROJECT CASH FLOW: (50 Points) Show your work for atleast two columns and where ever it

please fill in all empty green spaces

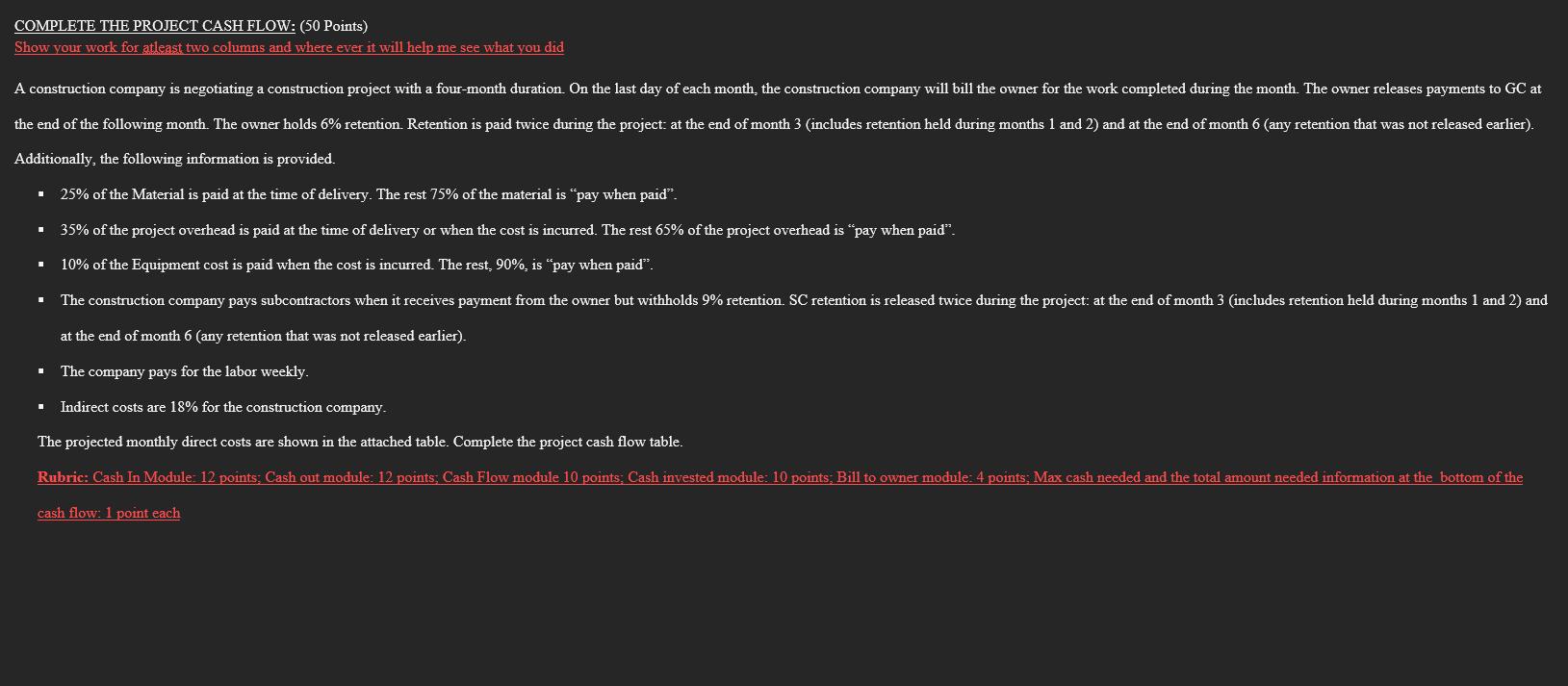

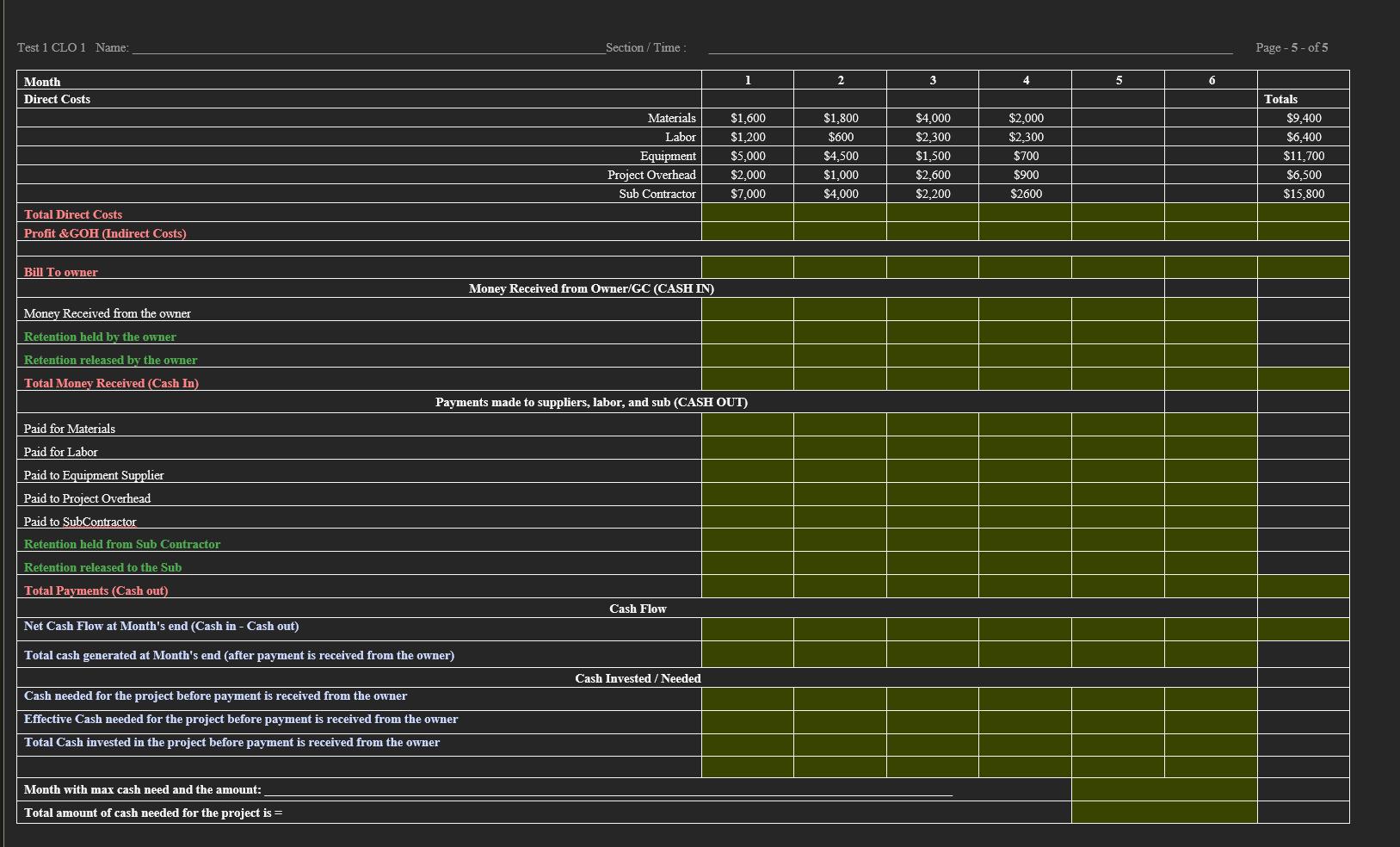

COMPLETE THE PROJECT CASH FLOW: (50 Points) Show your work for atleast two columns and where ever it will help me see what you did A construction company is negotiating a construction project with a four-month duration. On the last day of each month, the construction company will bill the owner for the work completed during the month. The owner releases payments to GC at the end of the following month. The owner holds 6% retention. Retention is paid twice during the project: at the end of month 3 (includes retention held during months 1 and 2) and at the end of month 6 (any retention that was not released earlier). Additionally, the following information is provided. 25% of the Material is paid at the time of delivery. The rest 75% of the material is "pay when paid. 35% of the project overhead is paid at the time of delivery or when the cost is incurred. The rest 65% of the project overhead is "pay when paid. 10% of the Equipment cost is paid when the cost is incurred. The rest, 90%, is "pay when paid". The construction company pays subcontractors when it receives payment from the owner but withholds 9% retention. SC retention is released twice during the project: at the end of month 3 (includes retention held during months 1 and 2) and at the end of month 6 (any retention that was not released earlier). The company pays for the labor weekly. Indirect costs are 18% for the construction company. The projected monthly direct costs are shown in the attached table. Complete the project cash flow table. Rubric: Cash In Module: 12 points; Cash out module: 12 points; Cash Flow module 10 points; Cash invested module: 10 points; Bill to owner module: 4 points; Max cash needed and the total amount needed information at the bottom of the cash flow: 1 point each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts