Question: Please fill in all the blanks, dont send incorrect or incomplete answers, Thank You! Problem 11-6 Depreciation methods; partial-year depreciation; sale of assets [LO11-2] On

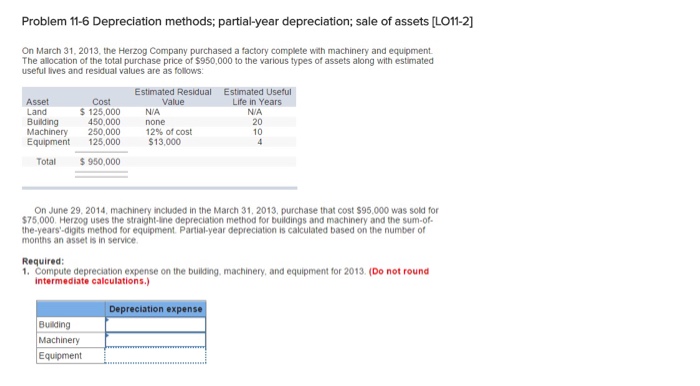

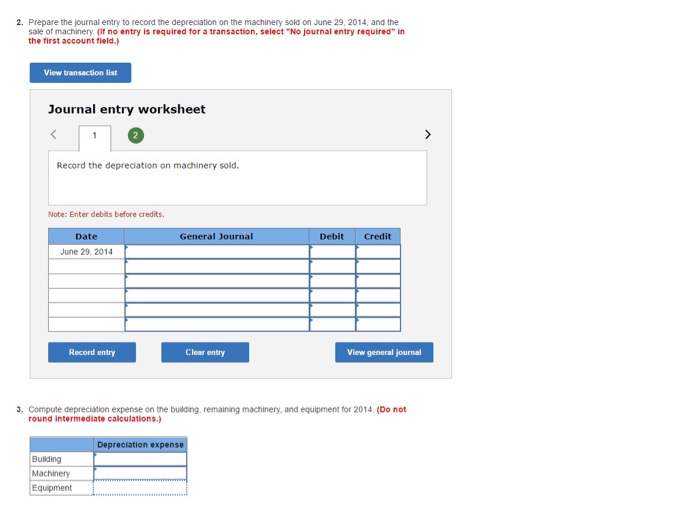

Problem 11-6 Depreciation methods; partial-year depreciation; sale of assets [LO11-2] On March 31, 2013, the Herzog Company purchased a factory complete with machinery and equipment The allocation of the total purchase price of $950,000 to the various types of assets along with estimated useful lves and residual values are as folows Estimated Residual Value Estimated Usetul Life in Years NIA 20 10 Cost $ 125,000 N/A Asset Land Buiding 450,000 Machinery 250,000 Equipment 125,000 12% of cost $13,000 Total$ 950,000 On June 29, 2014, machinery included in the March 31, 2013, purchase that cost $95,000 was sold for $75,000. Herzog uses the straight-line depreciation method for buildings and machinery and the sum-of the-years-digits method for equipment. Partial-year depreciation is calculated based on the number of months an asset is in service Required 1. Compute depreciation expense on the building, machinery, and equipment for 2013. (Do not round Depreciation expense Buiding Machinery Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts