Question: Please fill in all the requirements. Save Homework: Chapter 7 part B homework Score: 0.18 of 1 pt 5 of 7 (7 complete) %E7-22 (similar

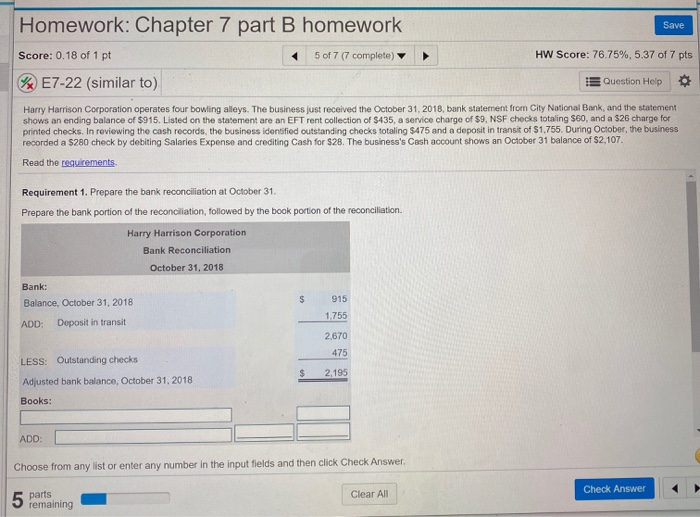

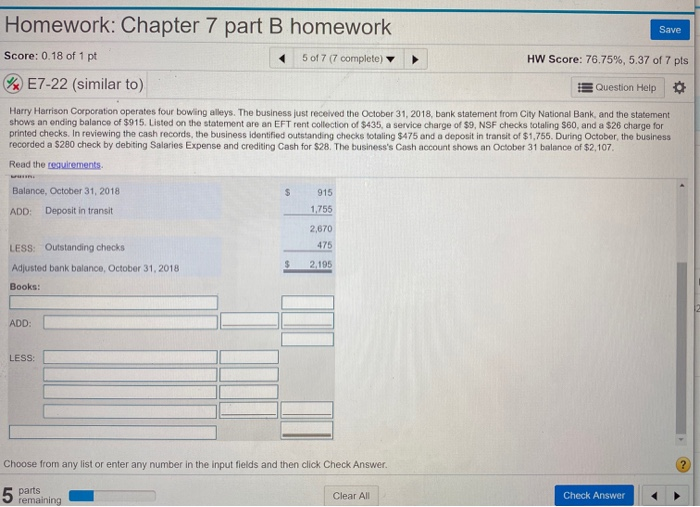

Save Homework: Chapter 7 part B homework Score: 0.18 of 1 pt 5 of 7 (7 complete) %E7-22 (similar to) HW Score: 76.75%, 5.37 of 7 pts Question Help Harry Harrison Corporation operates four bowling alleys. The business just received the October 31, 2018, bank statement from City National Bank, and the statement shows an ending balance of $915. Listed on the statement are an EFT rent collection of $435, a service charge of $9, NSF checks totaling 560, and a $26 charge for printed checks. In reviewing the cash records, the business identified outstanding checks totaling $475 and a deposit in transit of $1.755. During October, the business recorded a $280 check by debiting Salaries Expense and crediting Cash for $28. The business's Cash account shows an October 31 balance of $2,107. Read the requirements Requirement 1. Prepare the bank reconciliation at October 31 Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation Harry Harrison Corporation Bank Reconciliation October 31, 2018 Bank: Balance, October 31, 2018 ADD: Deposit in transit 915 1.755 2.670 475 $ 2.195 LESS: Outstanding checks Adjusted bank balance, October 31, 2018 Books: ADD: Choose from any list or enter any number in the input fields and then click Check Answer 5 parts Clear All Check Answer 5 remaining Save Homework: Chapter 7 part B homework Score: 0.18 of 1 pt 5 of 7 (7 complete) %E7-22 (similar to) HW Score: 76.75%, 5.37 of 7 pts Question Help Harry Harrison Corporation operates four bowing alleys. The business just received the October 31, 2018, bank statement from City National Bank, and the statement shows an ending balance of $915. Listed on the statement are an EFT rent collection of $435, a service charge of $9, NSF checks totaling $60, and a $26 charge for printed checks. In reviewing the cash records, the business identified outstanding checks totaling $475 and a deposit in transit of $1,755. During October, the business recorded a $280 check by debiting Salaries Expense and crediting Cash for $28. The business's Cash account shows an October 31 balance of $2,107 Read the requirements Balance, October 31, 2018 ADD: Deposit in transit 915 1.755 2,670 475 LESS: Outstanding checks Adjusted bank balance, October 31, 2018 2,195 Books: ADD: LESS Choose from any list or enter any number in the input fields and then click Check Answer. 5 parts 5 remaining Clear All Check Answer A Requirements - X 1. Prepare the bank reconciliation at October 31. 2. Journalize any transactions required from the bank reconciliation. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts