Question: Please fill in blank with the RIGHT answer after you double check the work. Thanks Problem 3: Peggy's Peaches has developed a new product, the

Please fill in blank with the RIGHT answer after you double check the work. Thanks

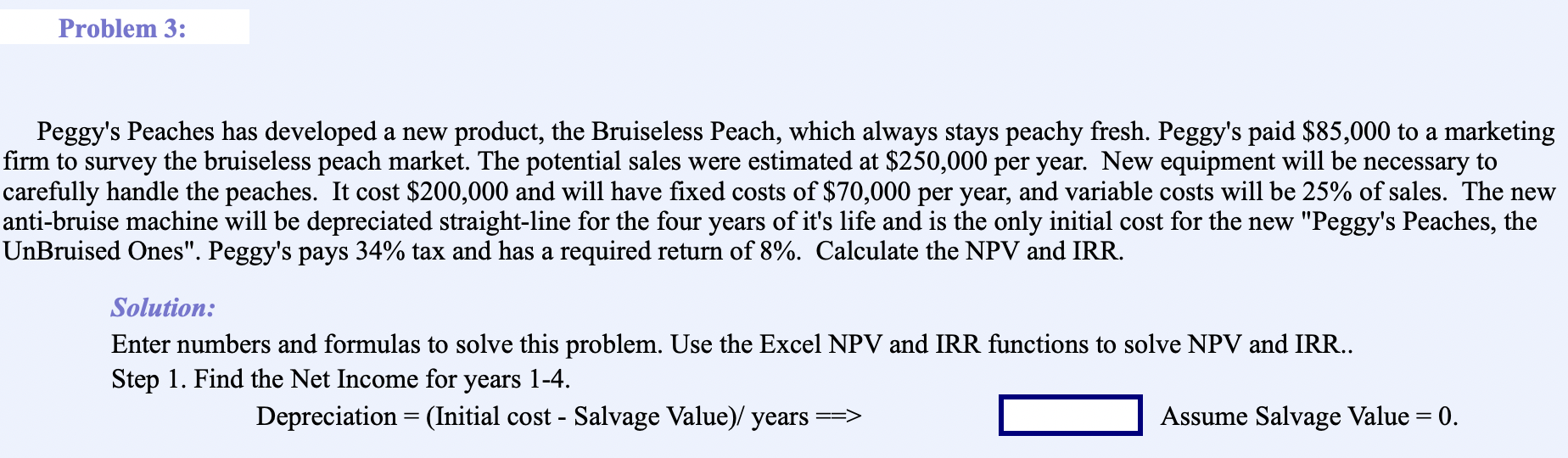

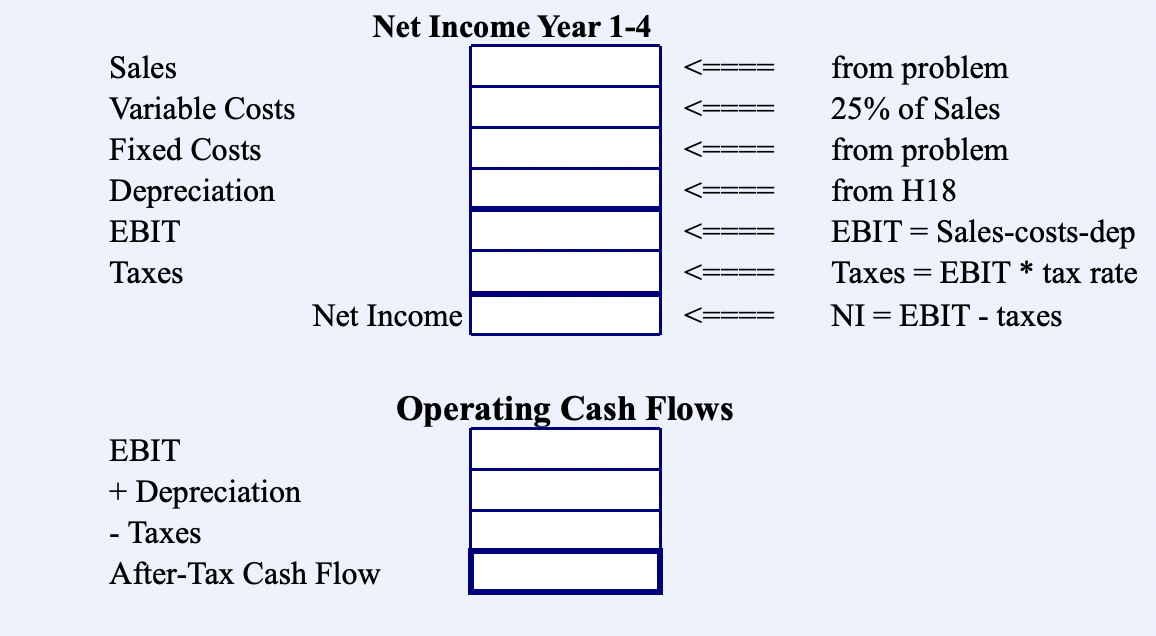

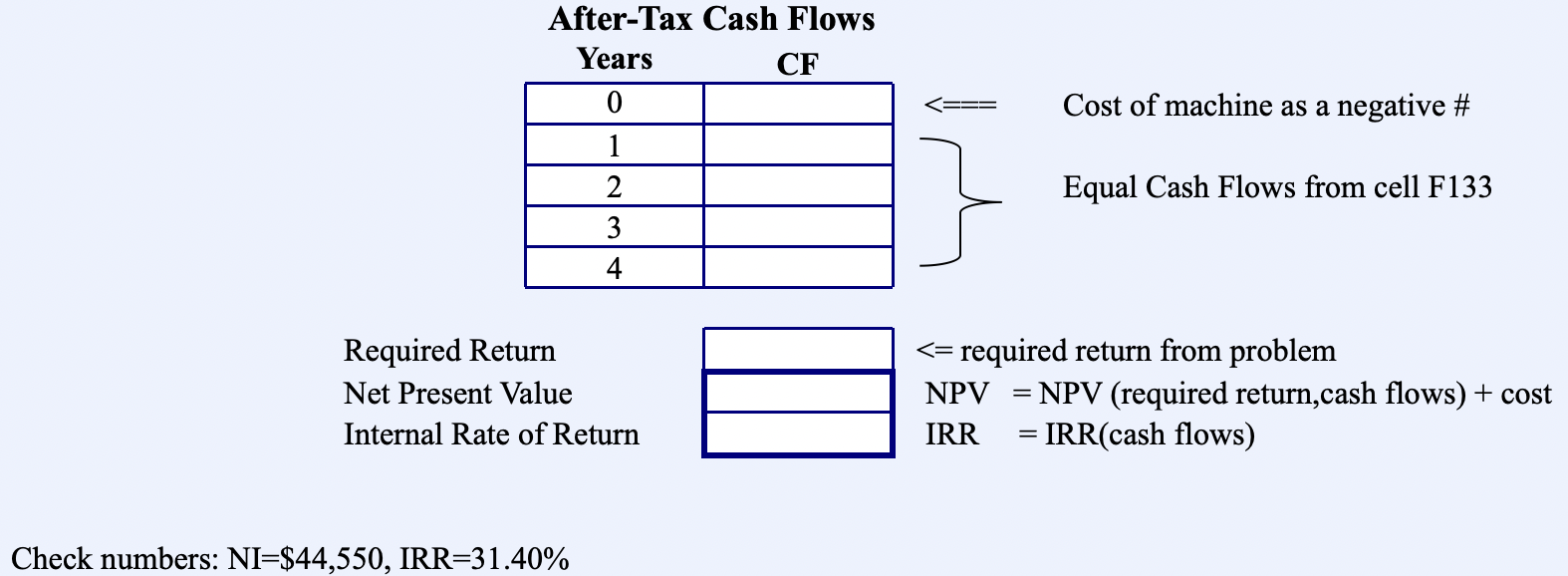

Problem 3: Peggy's Peaches has developed a new product, the Bruiseless Peach, which always stays peachy fresh. Peggy's paid $85,000 to a marketing firm to survey the bruiseless peach market. The potential sales were estimated at $250,000 per year. New equipment will be necessary to carefully handle the peaches. It cost $200,000 and will have fixed costs of $70,000 per year, and variable costs will be 25% of sales. The new anti-bruise machine will be depreciated straight-line for the four years of it's life and is the only initial cost for the new "Peggy's Peaches, the UnBruised Ones". Peggy's pays 34% tax and has a required return of 8%. Calculate the NPV and IRR. Solution: Enter numbers and formulas to solve this problem. Use the Excel NPV and IRR functions to solve NPV and IRR.. Step 1. Find the Net Income for years 1-4. Depreciation = (Initial cost - Salvage Value)/ years Assume Salvage Value = 0. ==> Net Income Year 1-4 Sales Variable Costs Fixed Costs Depreciation EBIT Taxes Net Income from problem 25% of Sales from problem from H18 EBIT = Sales-costs-dep Taxes = EBIT * tax rate NI = EBIT - taxes = Operating Cash Flows EBIT + Depreciation - Taxes After-Tax Cash Flow After-Tax Cash Flows Years CF 0 Cost of machine as a negative # Equal Cash Flows from cell F133 1 2 3 4 Required Return Net Present Value Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts