Question: please fill in blanks and explain how the NPV, A/R, and rank are found such as the NPV of 5,337,768 Project Project Cash Flow Capital

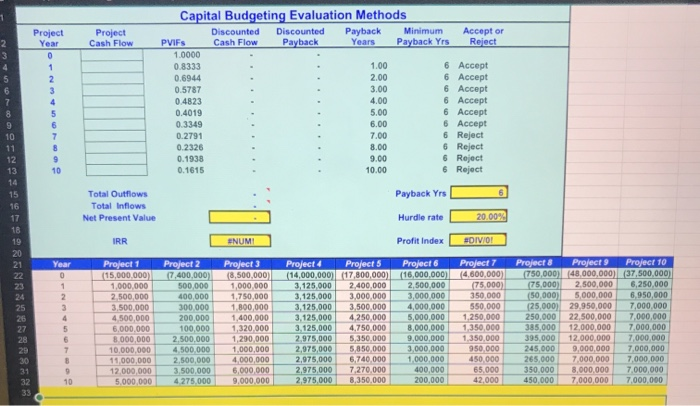

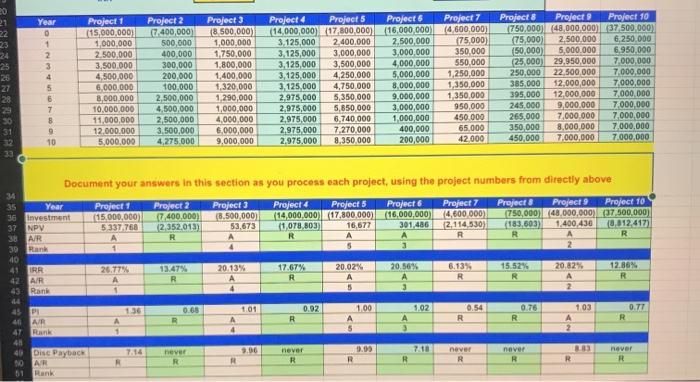

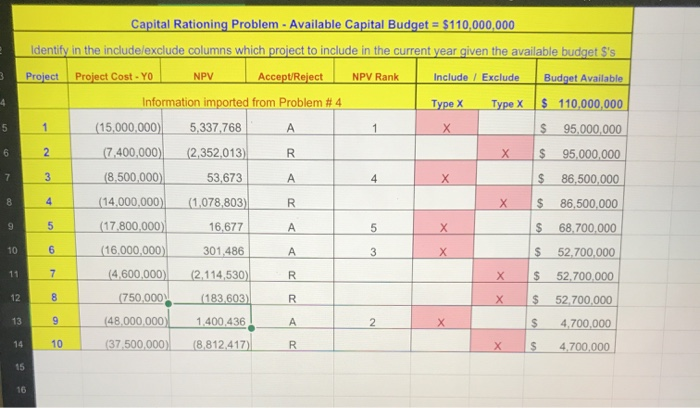

Project Project Cash Flow Capital Budgeting Evaluation Methods Discounted Discounted Payback Minimum Accept or PVIFs Cash Flow Payback Years Payback Yrs Reiect 1.0000 0.8333 1.00 6 Accept 0.6944 2.00 6 Accept 0.5787 3.00 6 Accept 0.4823 4.00 6 Accept 0.4019 5.00 6 Accept 0.3349 6.00 6 Accept 0.2791 7.00 6 Reject 0.2326 8.00 6 Reject 0.1938 9.00 6 Reject 0.1615 10.00 6 Reject Payback Yrs Total Outflows Total Inflows Net Present Value Hurdle rate 20.00% ONDENSORENRENASERS IRR NUMI Profit Index BDIVO! Year Project 1 (15,000.000) 1.000.000 2.500.000 3.500.000 4 500.000 6.000.000 8.000.000 10.000.000 15 000 000 12 000 000 5 000 000 Project 7,400.000) 500,000 400 000 300 000 200.000 100 000 27500.000 4.500.000 2 500 000 3.500.000 4275 000 Project 3 (8,500,000) 1,000,000 1,750,000 1.800.000 1.400.000 1,320,000 1.290.000 1.000.000 4.000.000 5.000.000 9.000.000 Project Projects (14,000,000) (17,800,000) 3,125,000 2,400,000 3,125,000 3.000.000 3,125.000 3.500.000 3.125.000 4.250.000 3.125.000 4.750.000 2.975,000 5.350.000 2.975.000 5.850 000 2.975,000 6,740.000 2.975.000 7270.000 29175000 83501000 Project 6 (16,000,000) 2,500,000 .000.000 4,000,000 5.000.000 8.000.000 9.000.000 3.000.000 1.000.000 400.000 200.000 Project 7 (4,600,000) 75.000) 350 000 550.000 1.250.000 1.350.000 1.350.000 950 000 450.000 65.000 Project & Project Project 10 750,000) 148,000,000) (37,500,000) 75,000) 2.500,000 6.250,000 (50.000 5.000.000 6.950,000 (25.000) 29.950,000 7,000,000 250.000 22.500.000 .000.000 385.000 12.000.000 7.000.000 395.000 12.000.000 7.000.000 245 000 9000.000 7.000.000 265.000 7 000 000 7 000 000 350.000 3.000.000 7 000 000 450.000 7 000 000 7000.000 Project 1 (15.000.000) 1.000.000 2.500.000 3.500 000 4.500.000 6.000.000 8.000.000 10.000.000 11.000.000 12 000 000 5 000 000 Project 2 7,400,000) 500,000 400,000 300,000 200.000 100.000 2.500.000 4.500.000 2.500.000 3.500.000 4.275.000 Project 3 18.500.000) 1.000.000 1,750,000 1,800,000 1.400.000 1,320,000 1,290,000 1,000,000 4.000.000 6.000.000 Project Project (14,000,000) (17.800.000) 3.125.000 2.400.000 3,125,000 3,000 000 3.125.000 3.500.000 3,125,000 4.250.000 3.125,000 4,750,000 2.975,000 5.350.000 2.975,000 5,850.000 2.975,000 6.740 000 2.975.000 7270 000 2,975.000 8350.000 Project (16,000,000) 2.500.000 000 000 4.000.000 5.000.000 8,000,000 9,000,000 3.000.000 1,000,000 400.000 200.000 Project (4.600 000) 75,000) 350.000 550.000 1.250.000 1,350,000 1,350,000 950.000 450 000 65.000 42000 Project Project Project 10 750.000) (48,000,000) (37.500.000) (75.000) 2.500.000 6.250.000 (50.000) 5.000.000 6.950.000 (25000) 29,950.000 7.000.000 250,000 22,500,000 7,000,000 385.000 12,000,000 7,000,000 395,000 12,000,000 7,000,000 245,000 9,000,000 7,000,000 265,000 7.000.000 7,000,000 350.000 8.000.000 7.000.000 450 000 7.000.000 7.000.000 Document your answers in this section as you process each project, using the project numbers from directly above Year 36 Investment 37 NPV Project 1 (15.000.000) 5337. TEB Project 7.400.000) 2352 013) Project (8.500.000) 53.673 Project Projects (14,000,000) (17 800 000) (1,078 803) 16.677 Project (16,000,000) 301.486 Project (4.600.000) 2.114.530) Project & Project Project 10 750,000) (48.000.000) (37.500.000) (183.603) 1.400.436 (8,812,417) R NR 39 Rank 41 20.0296 RR A/R Disc Payback Capital Rationing Problem - Available Capital Budget = $110,000,000 Identify in the include exclude columns which project to include in the current year given the available budget $'s Project Project Cost - Yo NPV Accept/Reject NPV Rank Include / Exclude Budget Available Information imported from Problem #4 Type X Type X $ 110,000,000 (15,000,000) 5,337,768 $ 95,000,000 (7,400,000) (2,352,013) $ 95,000,000 (8,500,000) 53,673 $ 86,500,000 (14,000,000) (1,078,803) $ 86,500,000 (17.800,000) 16,677 $ 68,700,000 (16,000,000) 301,486 $ 52,700,000 (4,600,000) (2,114,530) R $ 52.700.000 (750,000)_ (183,603) $ 52.700.000 (48,000,000 1,400,436 $ 4,700,000 (37,500,000) (8,812,417) $ 4.700.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts