Question: please fill in blanks exactly how it would be shown on excel document The bicycle manufacturer has another opportunity presented to expand their current factory

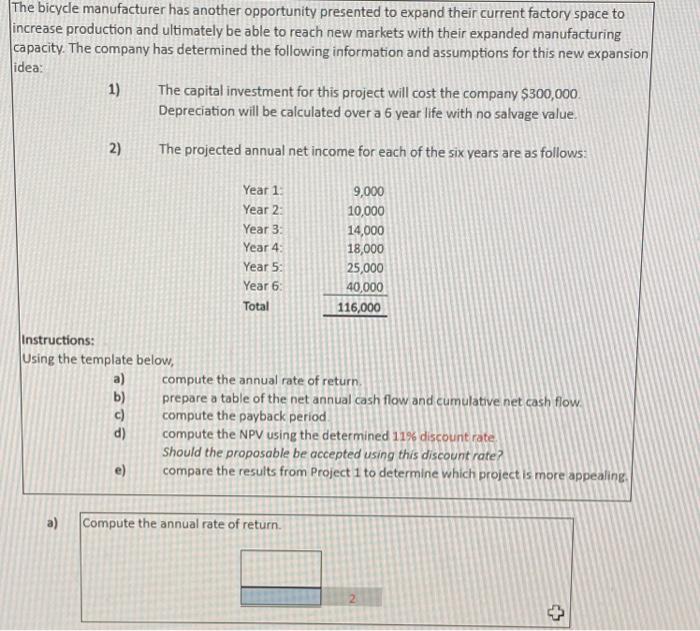

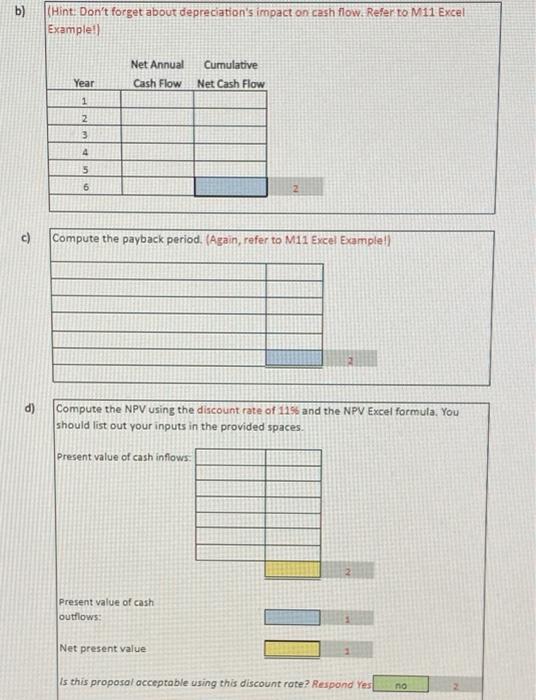

The bicycle manufacturer has another opportunity presented to expand their current factory space to increase production and ultimately be able to reach new markets with their expanded manufacturing capacity. The company has determined the following information and assumptions for this new expansion idea: 1) The capital investment for this project will cost the company $300,000 Depreciation will be calculated over a 6 year life with no salvage value 2) The projected annual net income for each of the six years are as follows: Year 1 Year 2: Year 3: Year 4: Year 5 Year 6 Total 9,000 10,000 14,000 18,000 25,000 40,000 116,000 Instructions: Using the template below, a) compute the annual rate of return b) prepare a table of the net annual cash flow and cumulative net cash flow. c) compute the payback period d) compute the NPV using the determined 11% discount rate Should the proposable be accepted using this discount rate? e) compare the results from Project 1 to determine which project is more appealing a a) Compute the annual rate of return. + b) (Hint: Don't forget about depreciation's impact on cash flow. Refer to M11 Excel Example!) Net Annual Cash Flow Cumulative Net Cash Flow Year 1 2 3 4 5 6 Compute the payback period. (Again, refer to M11 Excel Example!) d) Compute the NPV using the discount rate of 11% and the NPV Excel formula, You should list out your inputs in the provided spaces Present value of cash inflows. Present value of cash outflows: Net present value Is this proposal acceptable using this discount rate? Respond Yes no

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts