Question: Please fill in blanks Oct 2 Johnson Services received $62,000 cash and issued common stock to the stockholders. Oct 3 Purchased supplies, $400, and equipment,

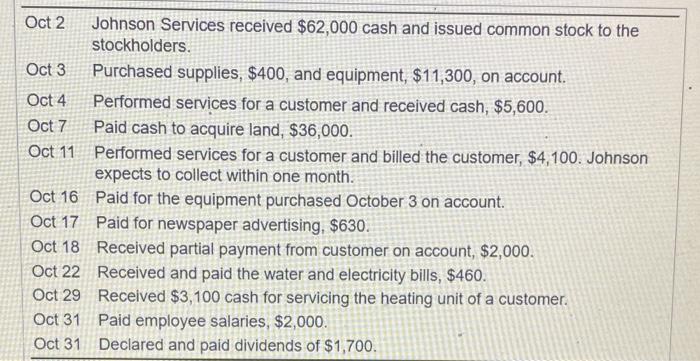

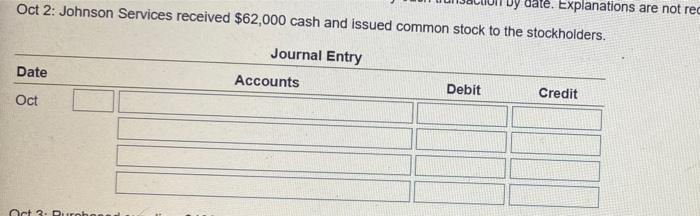

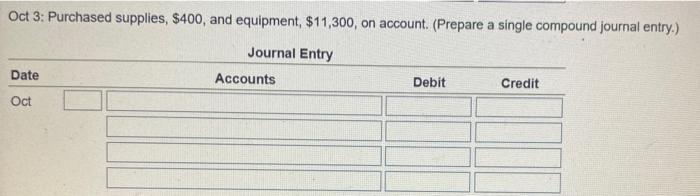

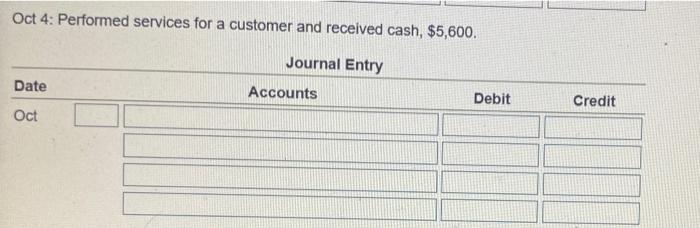

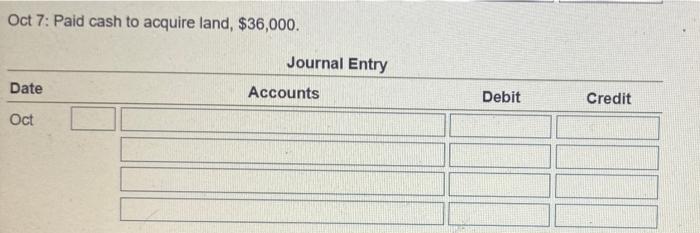

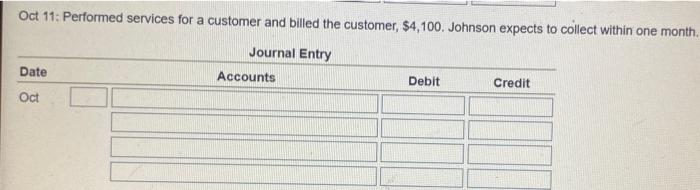

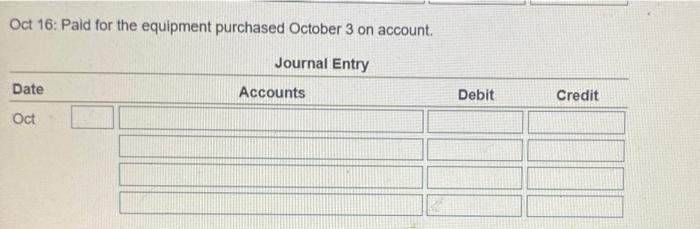

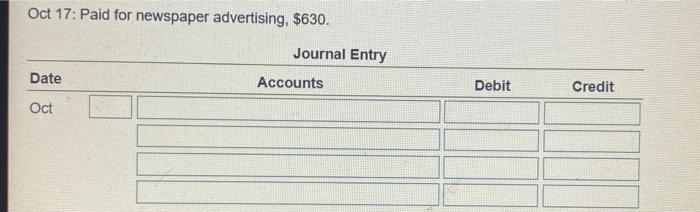

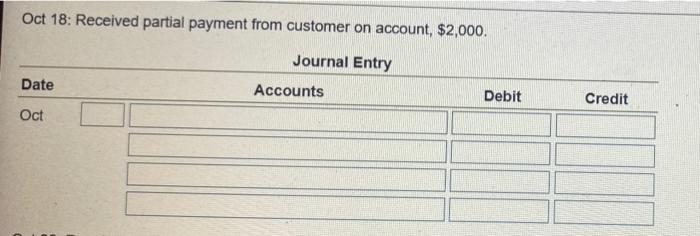

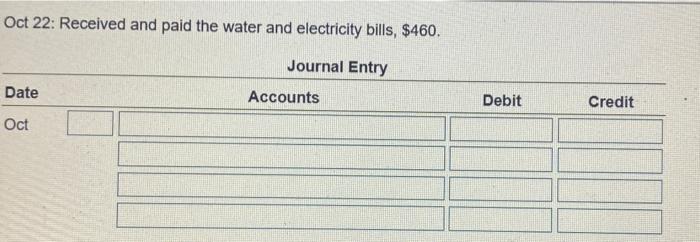

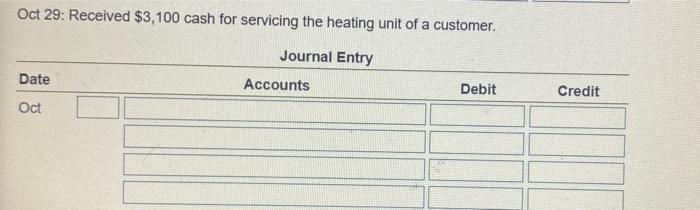

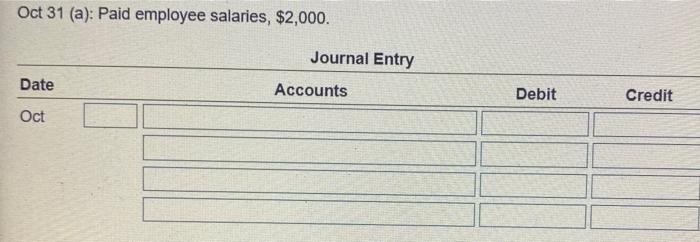

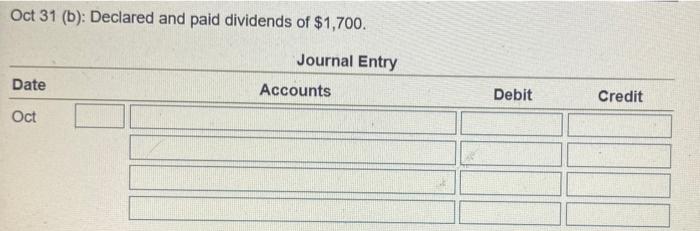

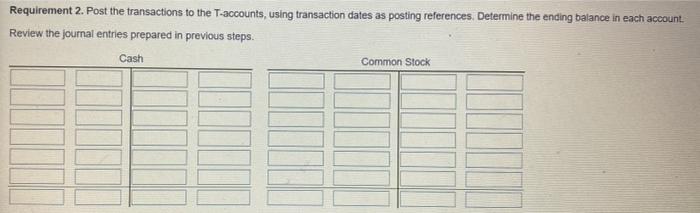

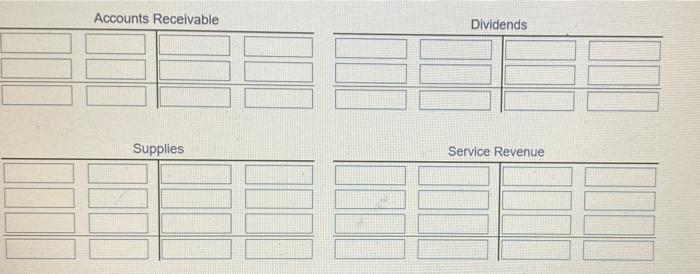

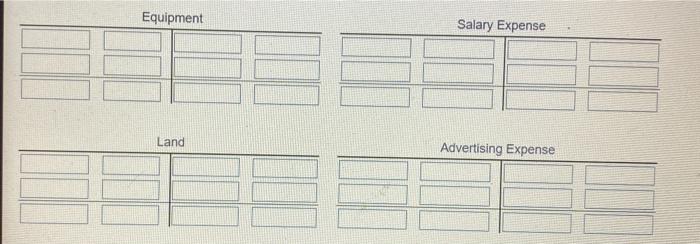

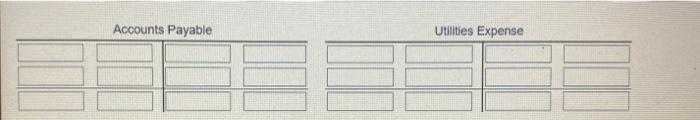

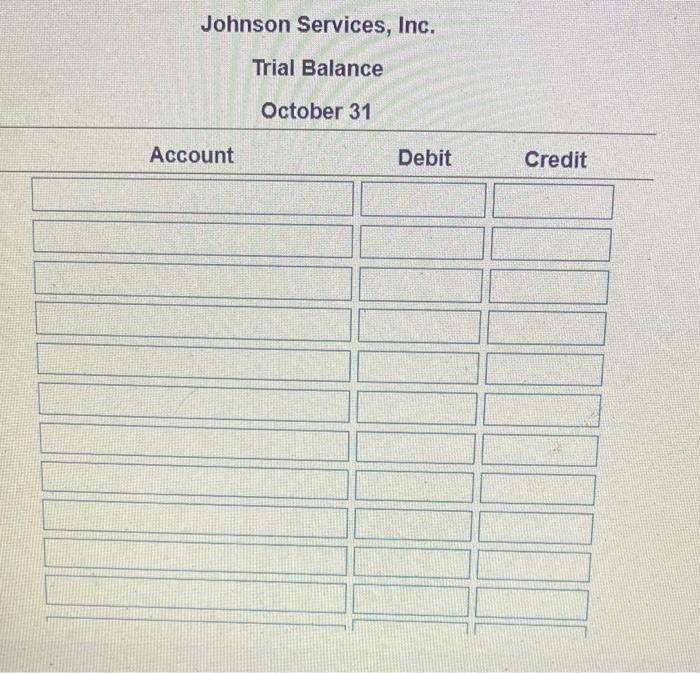

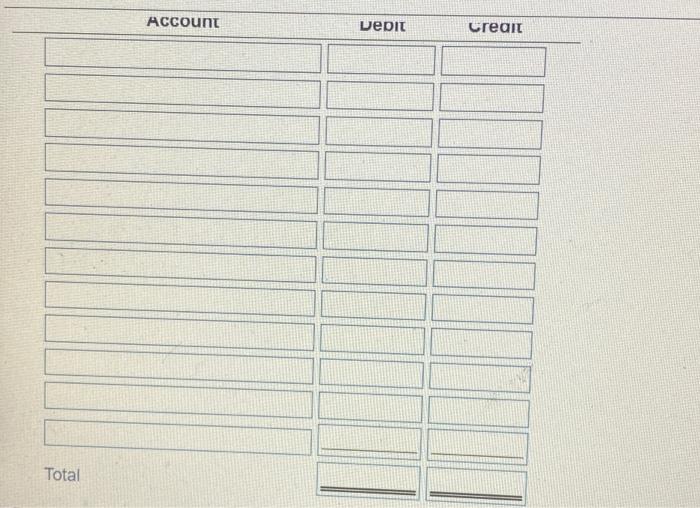

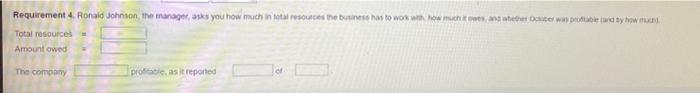

Oct 2 Johnson Services received $62,000 cash and issued common stock to the stockholders. Oct 3 Purchased supplies, $400, and equipment, $11,300, on account. Oct 4 Performed services for a customer and received cash, $5,600. Oct 7 Paid cash to acquire land, $36,000. Oct 11 Performed services for a customer and billed the customer, $4,100. Johnson expects to collect within one month. Oct 16 Paid for the equipment purchased October 3 on account. Oct 17 Paid for newspaper advertising, $630. Oct 18 Received partial payment from customer on account, $2,000. Oct 22 Received and paid the water and electricity bills, $460. Oct 29 Received $3,100 cash for servicing the heating unit of a customer. Oct 31 Paid employee salaries, $2,000. Oct 31 Declared and paid dividends of $1,700. date. Explanations are not rec Oct 2: Johnson Services received $62,000 cash and issued common stock to the stockholders. Journal Entry Date Accounts Debit Oct Credit Oct 3: Purchased supplies, $400, and equipment, $11,300, on account. (Prepare a single compound journal entry.) Journal Entry Accounts Date Debit Credit Oct Oct 4: Performed services for a customer and received cash, $5,600. Journal Entry Date Accounts Debit Credit Oct Oct 7: Paid cash to acquire land, $36,000. Journal Entry Date Accounts Debit Credit Oct Oct 11: Performed services for a customer and billed the customer, $4,100. Johnson expects to collect within one month. Journal Entry Accounts Date Debit Credit Oct Oct 16: Paid for the equipment purchased October 3 on account. Journal Entry Accounts Date Debit Credit Oct Oct 17: Paid for newspaper advertising, $630. Journal Entry Date Accounts Debit Credit Oct Oct 18: Received partial payment from customer on account, $2,000. Journal Entry Date Accounts Debit Credit Oct Oct 22: Received and paid the water and electricity bills, $460. Journal Entry Date Accounts Debit Credit Oct Oct 29: Received $3,100 cash for servicing the heating unit of a customer. Journal Entry Date Accounts Debit Credit Oct Oct 31 (a): Paid employee salaries, $2,000. Journal Entry Date Accounts Debit Credit Oct Oct 31 (b): Declared and paid dividends of $1,700. Journal Entry Date Accounts Debit Credit Oct Requirement 2. Post the transactions to the T-accounts, using transaction dates as posting references. Determine the ending balance in each account Review the journal entries prepared in previous steps. Cash Common Stock Accounts Receivable Dividends Supplies Service Revenue Equipment Salary Expense Land Advertising Expense Accounts Payable Utilities Expense Johnson Services, Inc. Trial Balance October 31 Account Debit Credit ACCOUnt Depit Credit Total Requirement 4. Ronald Johnson, the manager asks you how much in to the beas to wo how much weiter was prototyw Total resources Amount owed The company protease reported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts