Question: please fill in empty boxes and show work. thank you Fairmount Travel Gear produces backpacks and sells them to vendors who sell them under their

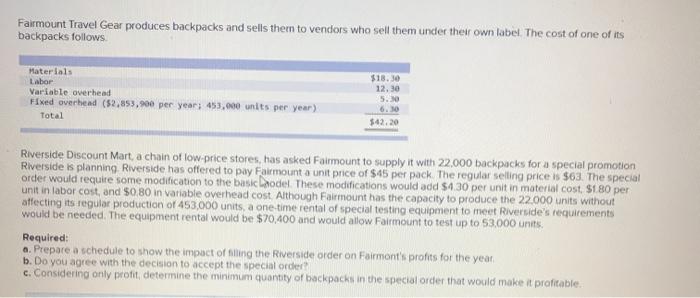

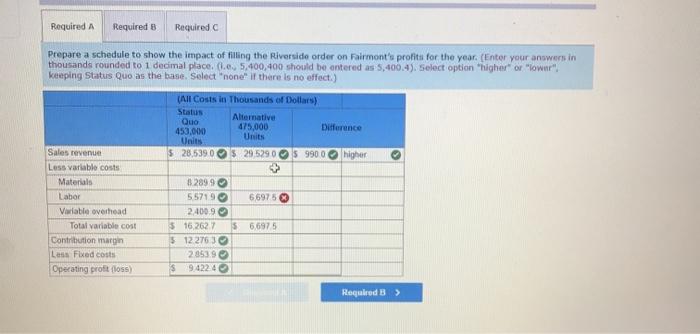

Fairmount Travel Gear produces backpacks and sells them to vendors who sell them under their own label. The cost of one of its backpacks follows Materials Labor Variable overhead Fixed overhead (52,853,900 per year: 453,000 units per year) Total $18.30 12.30 5.30 $42:20 Riverside Discount Mart, a chain of low price stores, has asked Fairmount to supply it with 22,000 backpacks for a special promotion Riverside is planning Riverside has offered to pay Fairmount a unit price of $45 per pack. The regular selling price is $63. The special order would require some modification to the basicodelThese modifications would add $4.30 per unit in material cost $180 per unit in labor cost and $0.80 in variable overhead cost Although Fairmount has the capacity to produce the 22000 units without affecting its regular production of 453,000 units a one-time rental of special testing equipment to meet Riverside's requirements would be needed. The equipment rental would be $70,400 and would allow Fairmount to test up to 53.000 units Required: a. Prepare a schedule to show the impact of filing the Riverside order on Fairmont's profits for the year b. Do you agree with the decision to accept the special order c. Considering only profit, determine the minimum quantity of backpacks in the special order that would make it profitable. Required A Required B Required o Prepare a schedule to show the impact of filling the Riverside order on Fairmont's profits for the year. (Enter your answers in thousands rounded to 1 decimal place... 5.400,400 should be entered as 5,400.4). Select option higher" or "lower". keeping Status Quo as the base Select "none" if there is no effect.) (All Costs in Thousands of Dollars Status Quo Alternative 453,00 475,000 Difference Units Units Sales revenue $28.539 05 29 52905 9900 higher Less variable costs Materials 02899 Labor 55719 66975 Variable overhead 2.400.9 Total variable cost $ 16,2627 $6,6975 Contribution margin 5 12 276 3 Las Fixed costs 28539 Operating profit (loss) $ 94224 Required B >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts