Question: *****PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET

*****PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED******

*****PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED***********PLEASE FILL IN EXCEL SHEET PROVIDED******

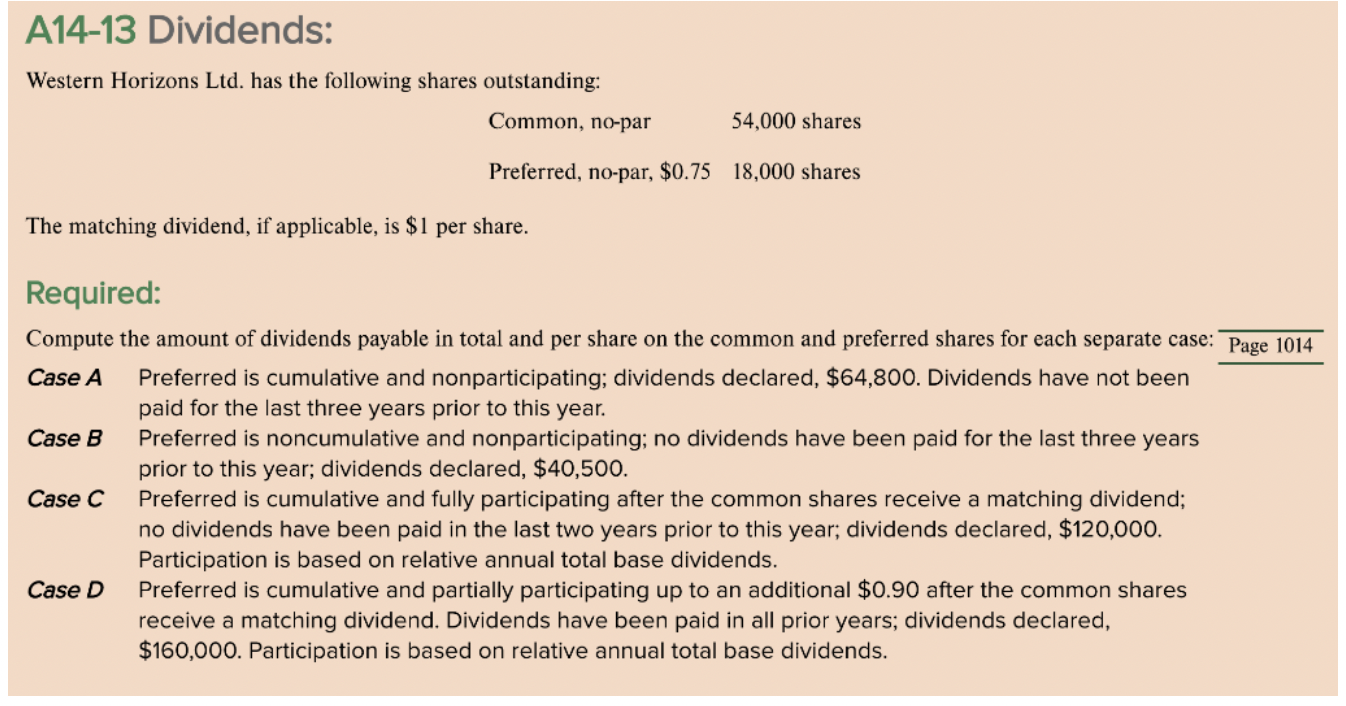

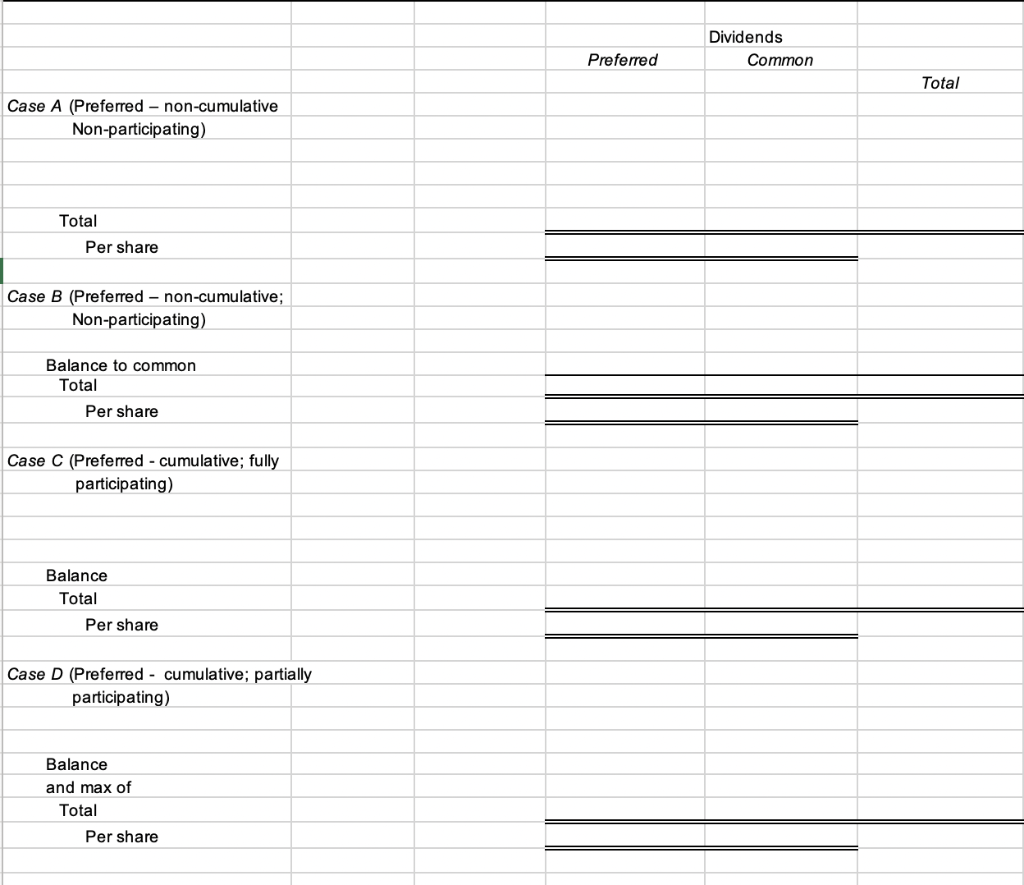

A14-13 Dividends: Western Horizons Ltd. has the following shares outstanding: Common, no-par 54,000 shares Preferred, no-par, $0.75 18,000 shares The matching dividend, if applicable, is $1 per share. Required: Compute the amount of dividends payable in total and per share on the common and preferred shares for each separate case: Page 1014 Case A Preferred is cumulative and nonparticipating; dividends declared, $64,800. Dividends have not been paid for the last three years prior to this year. Case B Preferred is noncumulative and nonparticipating; no dividends have been paid for the last three years prior to this year; dividends declared, $40,500. Case C Preferred is cumulative and fully participating after the common shares receive a matching dividend; no dividends have been paid in the last two years prior to this year; dividends declared, $120,000. Participation is based on relative annual total base dividends. Case D Preferred is cumulative and partially participating up to an additional $0.90 after the common shares receive a matching dividend. Dividends have been paid in all prior years; dividends declared, $160,000. Participation is based on relative annual total base dividends. Dividends Common Preferred Total Case A (Preferred - non-cumulative Non-participating) Total Per share Case B (Preferred non-cumulative; Non-participating) Balance to common Total Per share Case C (Preferred - cumulative; fully participating) Balance Total Per share Case D (Preferred - cumulative; partially participating) Balance and max of Total Per share A14-13 Dividends: Western Horizons Ltd. has the following shares outstanding: Common, no-par 54,000 shares Preferred, no-par, $0.75 18,000 shares The matching dividend, if applicable, is $1 per share. Required: Compute the amount of dividends payable in total and per share on the common and preferred shares for each separate case: Page 1014 Case A Preferred is cumulative and nonparticipating; dividends declared, $64,800. Dividends have not been paid for the last three years prior to this year. Case B Preferred is noncumulative and nonparticipating; no dividends have been paid for the last three years prior to this year; dividends declared, $40,500. Case C Preferred is cumulative and fully participating after the common shares receive a matching dividend; no dividends have been paid in the last two years prior to this year; dividends declared, $120,000. Participation is based on relative annual total base dividends. Case D Preferred is cumulative and partially participating up to an additional $0.90 after the common shares receive a matching dividend. Dividends have been paid in all prior years; dividends declared, $160,000. Participation is based on relative annual total base dividends. Dividends Common Preferred Total Case A (Preferred - non-cumulative Non-participating) Total Per share Case B (Preferred non-cumulative; Non-participating) Balance to common Total Per share Case C (Preferred - cumulative; fully participating) Balance Total Per share Case D (Preferred - cumulative; partially participating) Balance and max of Total Per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts