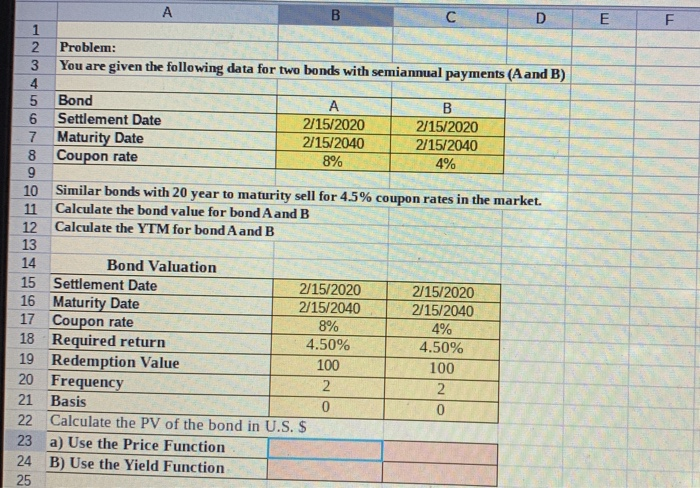

Question: Please fill in FORMULAS in the red boxes. BCDE Problem: You are given the following data for two bonds with semiannual payments (A and B)

BCDE Problem: You are given the following data for two bonds with semiannual payments (A and B) 3 I 5 Bond 6 Settlement Date 7 Maturity Date 8 Coupon rate A DA B 2/15/2020 2/15/2040 8 % 2/15/2020 2/15/2040 4% REBOCO 14 10 Similar bonds with 20 year to maturity sell for 4.5% coupon rates in the market. 11 Calculate the bond value for bond A and B 12 Calculate the YTM for bond A and B 13 Bond Valuation 15 Settlement Date 2/15/2020 2/15/2020 16 Maturity Date 2/15/2040 2/15/2040 17 Coupon rate 8% 4% 18 Required return 4.50% 4.50% 19 Redemption Value 100 20 Frequency 2 2 21 Basis 0 0 22 Calculate the PV of the bond in U.S. $ 23 a) Use the Price Function 24 B) Use the Yield Function 100 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts