Question: Please fill in the answer on above sheet in Blue cell PART B - Practical Activities You are currently employed as a Tax Agent for

Please fill in the answer on above sheet in Blue cell

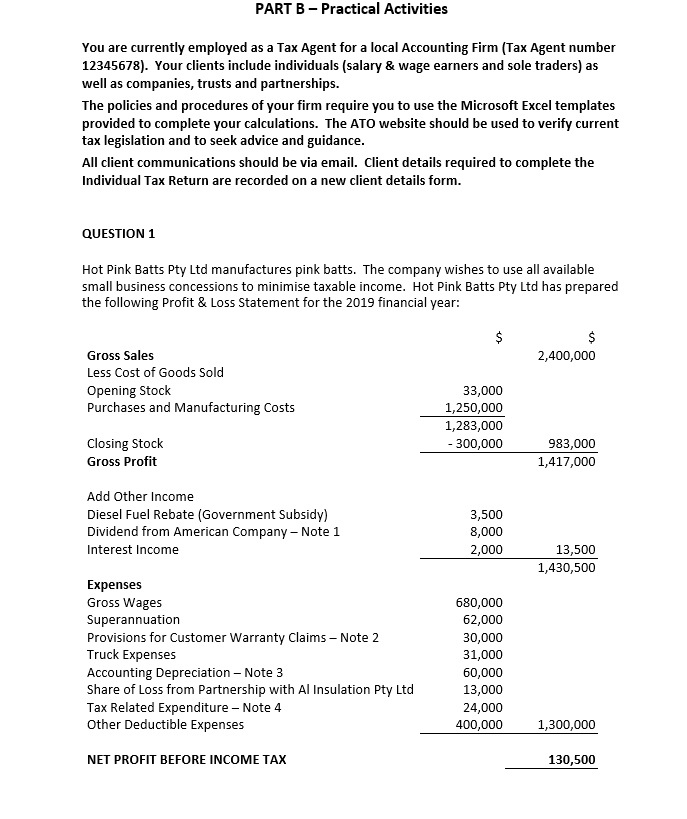

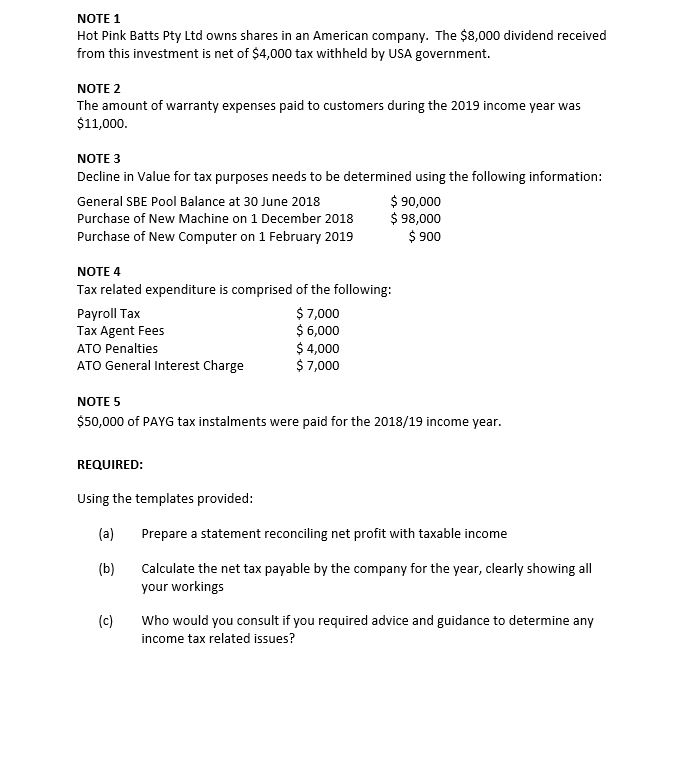

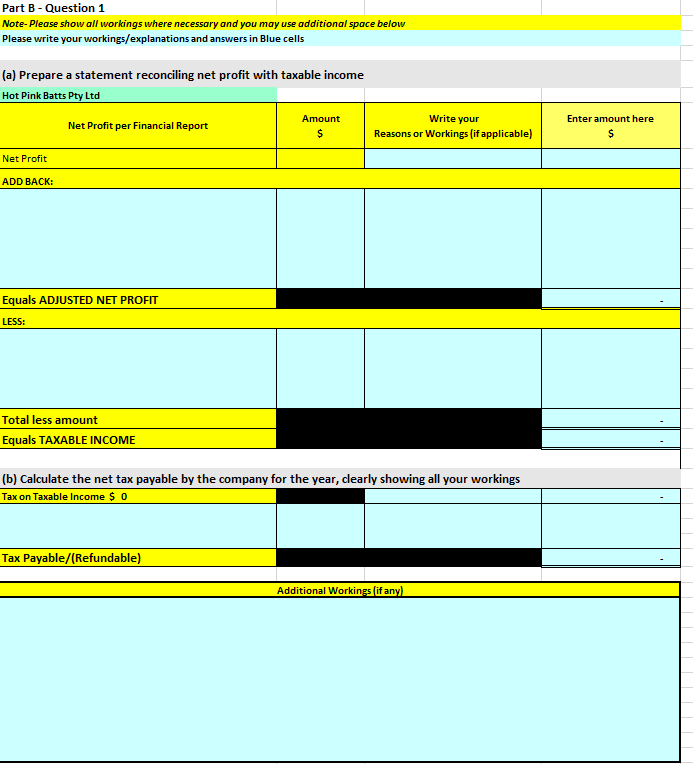

PART B - Practical Activities You are currently employed as a Tax Agent for a local Accounting Firm (Tax Agent number 12345678). Your clients include individuals (salary & wage earners and sole traders) as well as companies, trusts and partnerships. The policies and procedures of your firm require you to use the Microsoft Excel templates provided to complete your calculations. The ATO website should be used to verify current tax legislation and to seek advice and guidance. All client communications should be via email. Client details required to complete the Individual Tax Return are recorded on a new client details form. QUESTION 1 Hot Pink Batts Pty Ltd manufactures pink batts. The company wishes to use all available small business concessions to minimise taxable income. Hot Pink Batts Pty Ltd has prepared the following Profit & Loss Statement for the 2019 financial year: $ $ 2,400,000 Gross Sales Less Cost of Goods Sold Opening Stock Purchases and Manufacturing Costs 33,000 1,250,000 1,283,000 - 300,000 Closing Stock Gross Profit 983,000 1,417,000 Add Other Income Diesel Fuel Rebate (Government Subsidy) Dividend from American Company - Note 1 Interest Income 3,500 8,000 2,000 13,500 1,430,500 Expenses Gross Wages Superannuation Provisions for Customer Warranty Claims - Note 2 Truck Expenses Accounting Depreciation - Note 3 Share of Loss from Partnership with Al Insulation Pty Ltd Tax Related Expenditure - Note 4 Other Deductible Expenses 680,000 62,000 30,000 31,000 60,000 13,000 24,000 400,000 1,300,000 NET PROFIT BEFORE INCOME TAX 130,500 NOTE 1 Hot Pink Batts Pty Ltd owns shares in an American company. The $8,000 dividend received from this investment is net of $4,000 tax withheld by USA government. NOTE 2 The amount of warranty expenses paid to customers during the 2019 income year was $11,000. NOTE 3 Decline in Value for tax purposes needs to be determined using the following information: General SBE Pool Balance at 30 June 2018 $ 90,000 Purchase of New Machine on 1 December 2018 $ 98,000 Purchase of New Computer on 1 February 2019 $ 900 NOTE 4 Tax related expenditure is comprised of the following: Payroll Tax $ 7,000 Tax Agent Fees $ 6,000 ATO Penalties $ 4,000 ATO General Interest Charge $ 7,000 NOTE 5 $50,000 of PAYG tax instalments were paid for the 2018/19 income year. REQUIRED: Using the templates provided: (a) Prepare a statement reconciling net profit with taxable income (b) Calculate the net tax payable by the company for the year, clearly showing all your workings Who would you consult if you required advice and guidance to determine any income tax related issues? (c) Part B - Question 1 Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells (a) Prepare a statement reconciling net profit with taxable income Hot Pink Batts Pty Ltd Net Profit per Financial Report Amount $ Write your Reasons or Workings (if applicable) Enter amount here $ Net Profit ADD BACK: Equals ADJUSTED NET PROFIT LESS: Total less amount Equals TAXABLE INCOME (b) Calculate the net tax payable by the company for the year, clearly showing all your workings Tax on Taxable income $ 0 Tax Payable/Refundable) Additional Workings (if any) PART B - Practical Activities You are currently employed as a Tax Agent for a local Accounting Firm (Tax Agent number 12345678). Your clients include individuals (salary & wage earners and sole traders) as well as companies, trusts and partnerships. The policies and procedures of your firm require you to use the Microsoft Excel templates provided to complete your calculations. The ATO website should be used to verify current tax legislation and to seek advice and guidance. All client communications should be via email. Client details required to complete the Individual Tax Return are recorded on a new client details form. QUESTION 1 Hot Pink Batts Pty Ltd manufactures pink batts. The company wishes to use all available small business concessions to minimise taxable income. Hot Pink Batts Pty Ltd has prepared the following Profit & Loss Statement for the 2019 financial year: $ $ 2,400,000 Gross Sales Less Cost of Goods Sold Opening Stock Purchases and Manufacturing Costs 33,000 1,250,000 1,283,000 - 300,000 Closing Stock Gross Profit 983,000 1,417,000 Add Other Income Diesel Fuel Rebate (Government Subsidy) Dividend from American Company - Note 1 Interest Income 3,500 8,000 2,000 13,500 1,430,500 Expenses Gross Wages Superannuation Provisions for Customer Warranty Claims - Note 2 Truck Expenses Accounting Depreciation - Note 3 Share of Loss from Partnership with Al Insulation Pty Ltd Tax Related Expenditure - Note 4 Other Deductible Expenses 680,000 62,000 30,000 31,000 60,000 13,000 24,000 400,000 1,300,000 NET PROFIT BEFORE INCOME TAX 130,500 NOTE 1 Hot Pink Batts Pty Ltd owns shares in an American company. The $8,000 dividend received from this investment is net of $4,000 tax withheld by USA government. NOTE 2 The amount of warranty expenses paid to customers during the 2019 income year was $11,000. NOTE 3 Decline in Value for tax purposes needs to be determined using the following information: General SBE Pool Balance at 30 June 2018 $ 90,000 Purchase of New Machine on 1 December 2018 $ 98,000 Purchase of New Computer on 1 February 2019 $ 900 NOTE 4 Tax related expenditure is comprised of the following: Payroll Tax $ 7,000 Tax Agent Fees $ 6,000 ATO Penalties $ 4,000 ATO General Interest Charge $ 7,000 NOTE 5 $50,000 of PAYG tax instalments were paid for the 2018/19 income year. REQUIRED: Using the templates provided: (a) Prepare a statement reconciling net profit with taxable income (b) Calculate the net tax payable by the company for the year, clearly showing all your workings Who would you consult if you required advice and guidance to determine any income tax related issues? (c) Part B - Question 1 Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells (a) Prepare a statement reconciling net profit with taxable income Hot Pink Batts Pty Ltd Net Profit per Financial Report Amount $ Write your Reasons or Workings (if applicable) Enter amount here $ Net Profit ADD BACK: Equals ADJUSTED NET PROFIT LESS: Total less amount Equals TAXABLE INCOME (b) Calculate the net tax payable by the company for the year, clearly showing all your workings Tax on Taxable income $ 0 Tax Payable/Refundable) Additional Workings (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts