Question: Please fill in the blanks and please also explain how you found the cash and fees earned totals. Thank you! Transactions related to revenue and

Please fill in the blanks and please also explain how you found the cash and fees earned totals. Thank you!

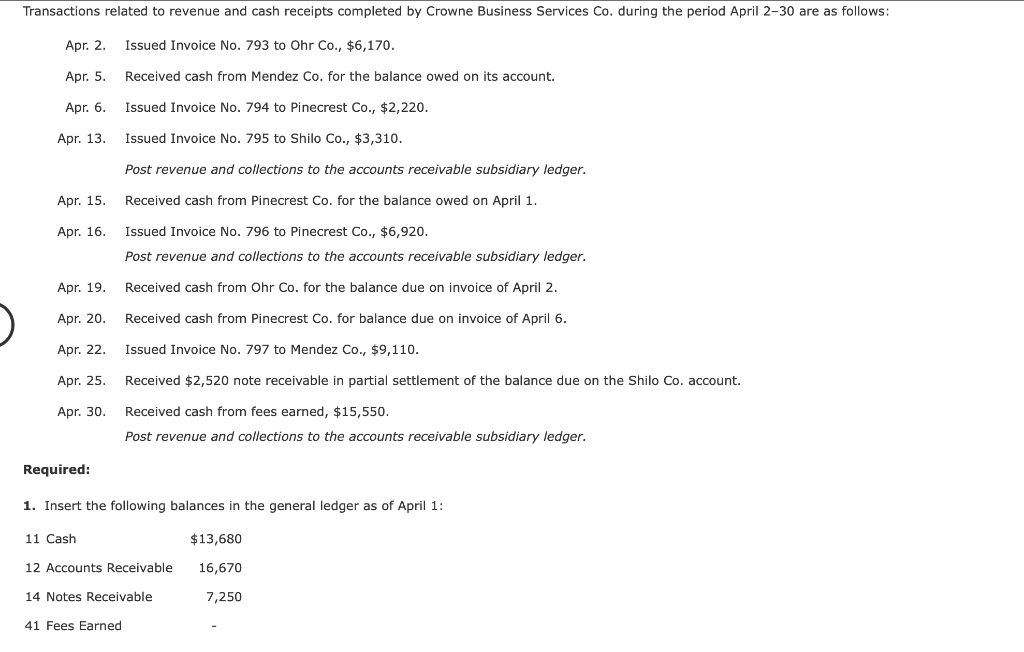

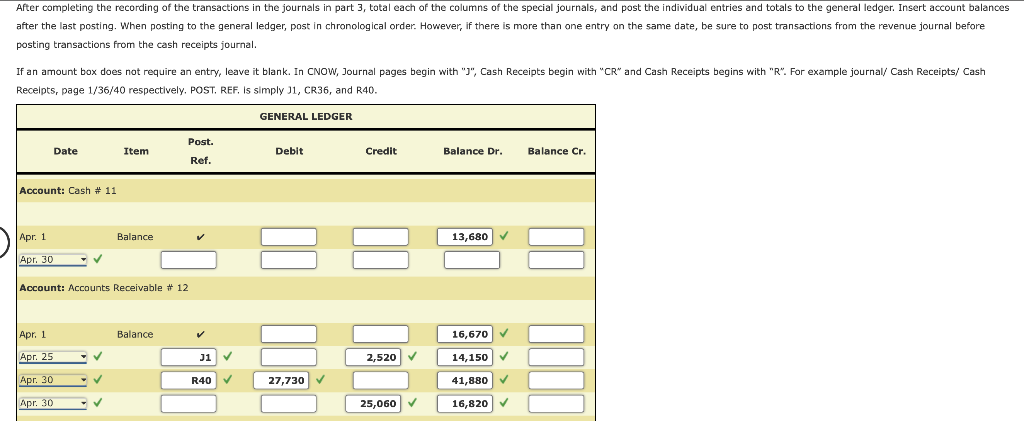

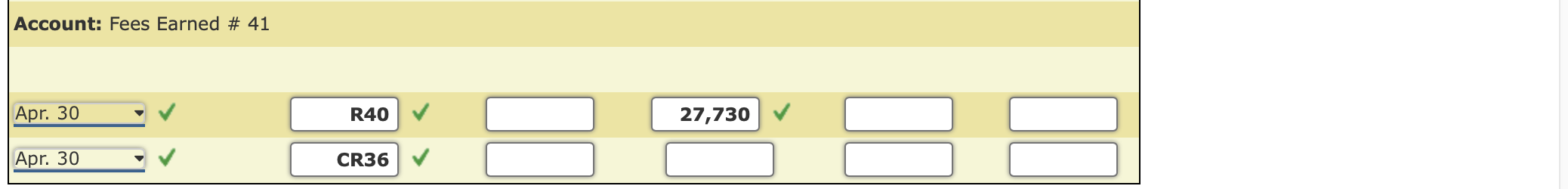

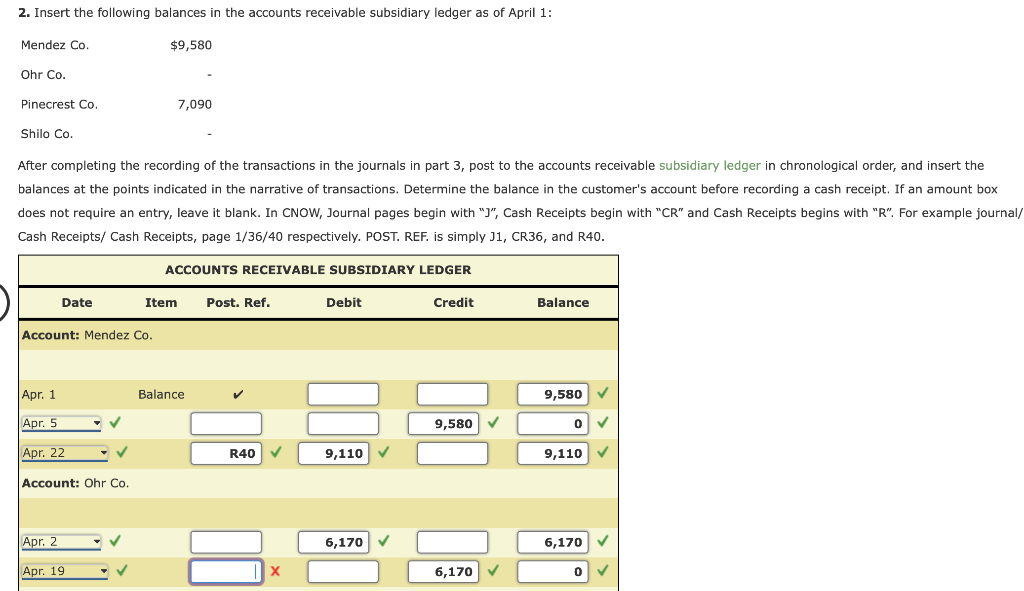

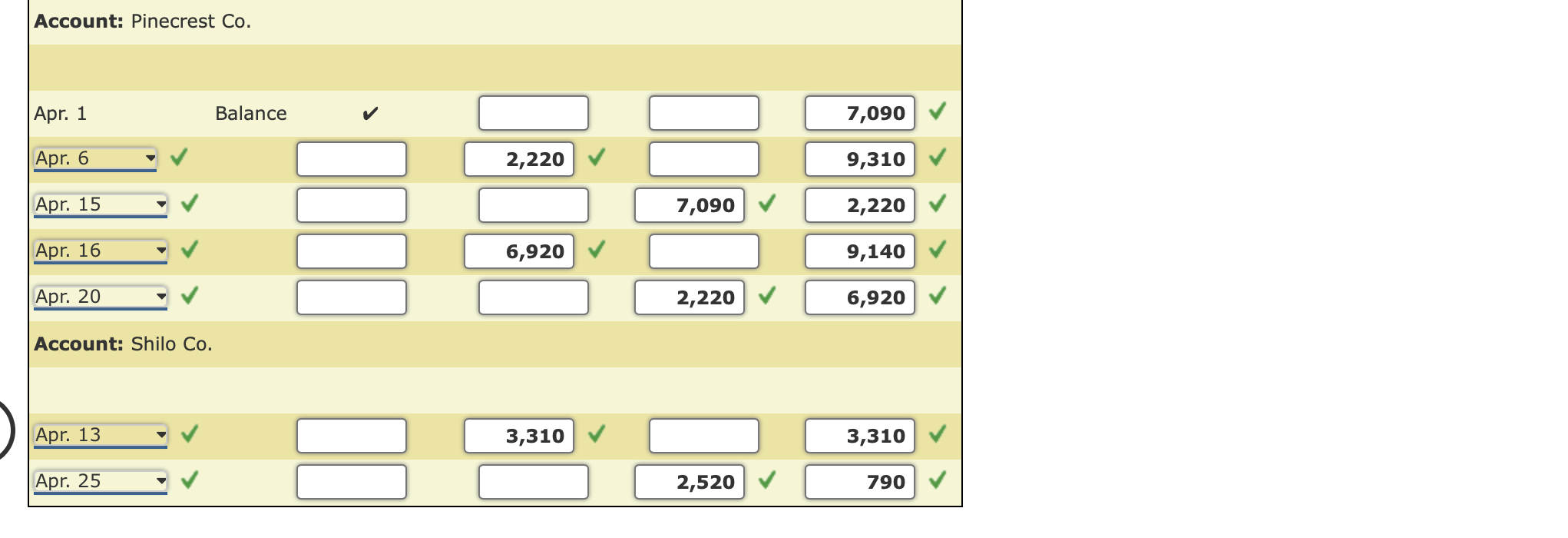

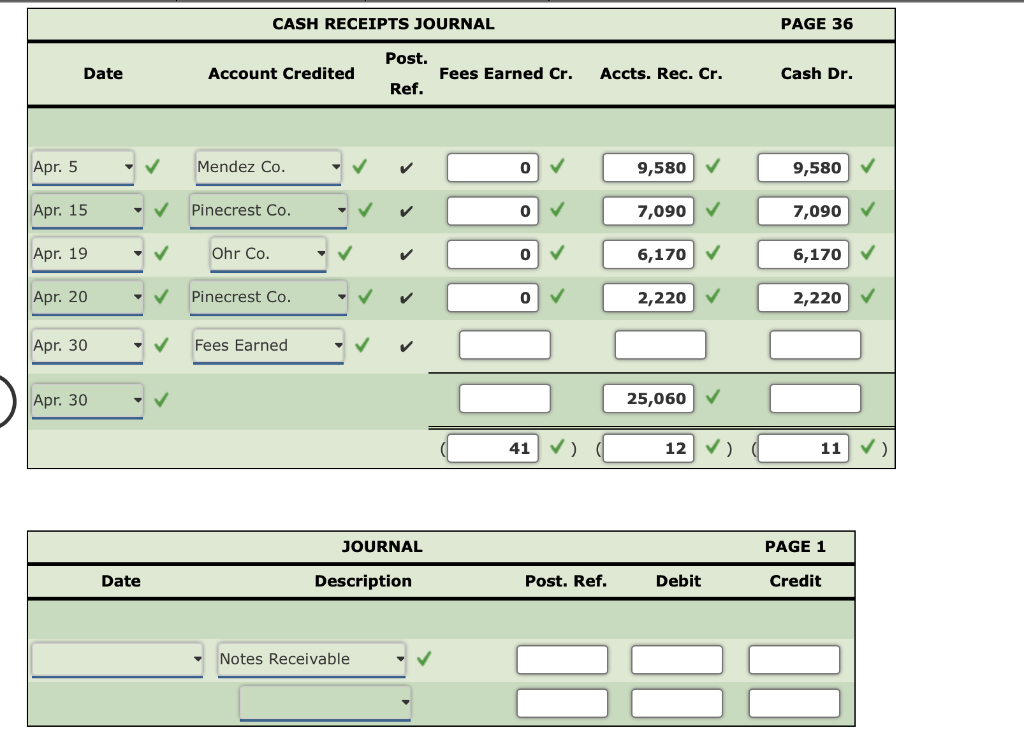

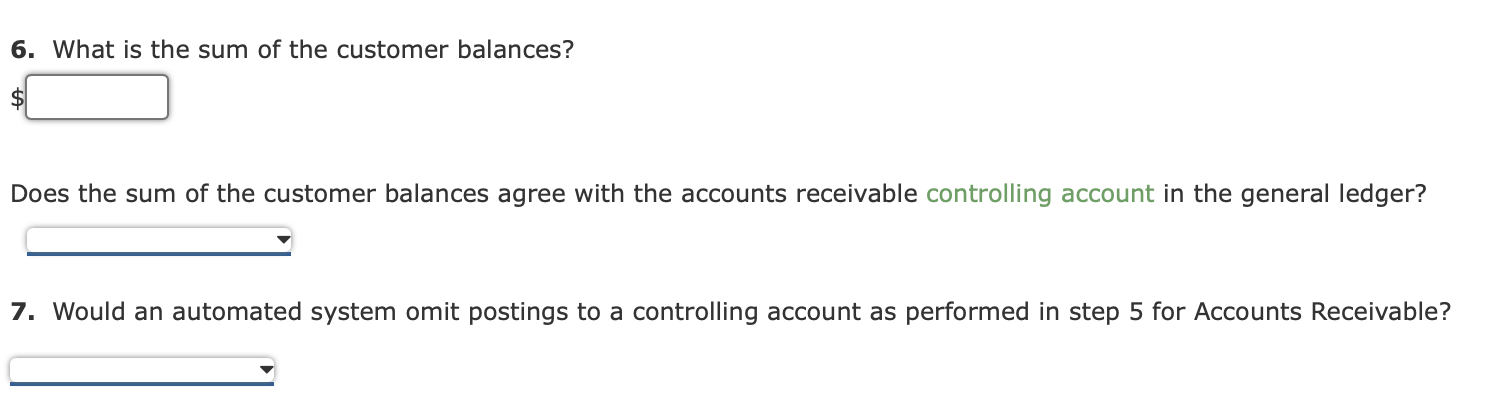

Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period April 2-30 are as follows: Apr. 2. Issued Invoice No. 793 to Ohr Co., $6,170. Apr. 5. Received cash from Mendez Co. for the balance owed on its account. Apr. 6. Issued Invoice No. 794 to Pinecrest Co., $2,220. Apr. 13. Issued Invoice No. 795 to Shilo Co., $3,310. Post revenue and collections to the accounts receivable subsidiary ledger. Apr. 15. Received cash from Pinecrest Co. for the balance owed on April 1. Apr. 16. Issued Invoice No. 796 to Pinecrest Co., $6,920. Post revenue and collections to the accounts receivable subsidiary ledger. Apr. 19. Received cash from Ohr Co. for the balance due on invoice of April 2. Apr. 20. Received cash from Pinecrest Co. for balance due on invoice of April 6. Apr. 22. Issued Invoice No. 797 to Mendez Co., $9,110. Apr. 25. Received $2,520 note receivable in partial settlement of the balance due on the Shilo Co. account. Apr. 30. Received cash from fees earned, $15,550. Post revenue and collections to the accounts receivable subsidiary ledger. Required: 1. Insert the following balances in the general ledger as of April 1: 11 Cash $13,680 12 Accounts Receivable 16,670 14 Notes Receivable 7,250 41 Fees Earned After completing the recording of the transactions in the journals in part 3, total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. When posting to the general ledger, post in chronological order. However, there is more than one entry on the same date, be sure to post transactions from the revenue journal before posting transactions from the cash receipts journal. If an amount box does not require an entry, leave it blank. In CNOW, Journal pages begin with ")", Cash Receipts begin with "CR" and Cash Receipts begins with "R". For example journal/ Cash Receipts/ Cash Receipts, page 1/36/40 respectively. POST. REF. is simply J1, CR36, and R40. GENERAL LEDGER Date Item Post. Ref. Deblt Credit Balance Dr. Balance Cr. Account: Cash # 11 Apr. 1 Balance 13,680 Apr. 30 Account: Accounts Receivable # 12 Apr. 1 Balance 16,670 Apr. 25 J1 2,520 14,150 Apr. 30 R40 27,730 41,880 Apr. 30 25,060 16,820 Account: Fees Earned # 41 Apr. 30 R40 27,730 Apr. 30 CR36 2. Insert the following balances in the accounts receivable subsidiary ledger as of April 1: Mendez Co. $9,580 Ohr Co. Pinecrest Co. 7,090 Shilo Co. After completing the recording of the transactions in the journals in part 3, post to the accounts receivable subsidiary ledger in chronological order, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customer's account before recording a cash receipt. If an amount box does not require an entry, leave it blank. In CNOW, Journal pages begin with "]", Cash Receipts begin with "CR" and Cash Receipts begins with "R". For example journal/ Cash Receipts/ Cash Receipts, page 1/36/40 respectively. POST. REF. is simply J1, CR36, and R40. ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Date Item Post. Ref. Debit Credit Balance Account: Mendez Co. Apr. 1 Balance 9,580 Apr. 5 9,580 0 Apr. 22 R40 9,110 9,110 Account: Ohr Co. Apr. 2 6,170 6,170 Apr. 19 X 6,170 Account: Pinecrest Co. Apr. 1 Balance 7,090 Apr. 6 2,220 9,310 Apr. 15 7,090 2,220 Apr. 16 6,920 9,140 Apr. 20 2,220 6,920 Account: Shilo Co. Apr. 13 3,310 3,310 Apr. 25 2,520 790 CASH RECEIPTS JOURNAL PAGE 36 Post. Date Account Credited Fees Earned Cr. Accts. Rec. Cr. Cash Dr. Ref. Apr. 5 Mendez Co. 0 9,580 9,580 Apr. 15 Pinecrest Co. 0 7,090 7,090 Apr. 19 Ohr Co. 0 6,170 6,170 Apr. 20 Pinecrest Co. 0 2,220 2,220 Apr. 30 Fees Earned Apr. 30 25,060 41 12 11 JOURNAL PAGE 1 Date Description Post. Ref. Debit Credit Notes Receivable 6. What is the sum of the customer balances? Does the sum of the customer balances agree with the accounts receivable controlling account in the general ledger? 7. Would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts