Question: Please fill in the blanks please! thanks! Data is at the end. Data: Requirement 1. Prepare the closing entries for Mark's Bowling Alley. (Record debits

Please fill in the blanks please! thanks! Data is at the end.

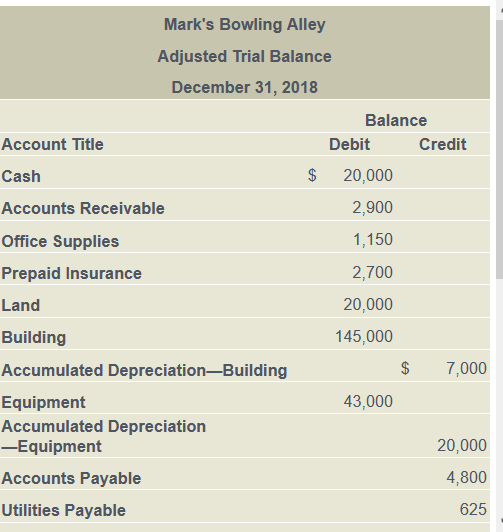

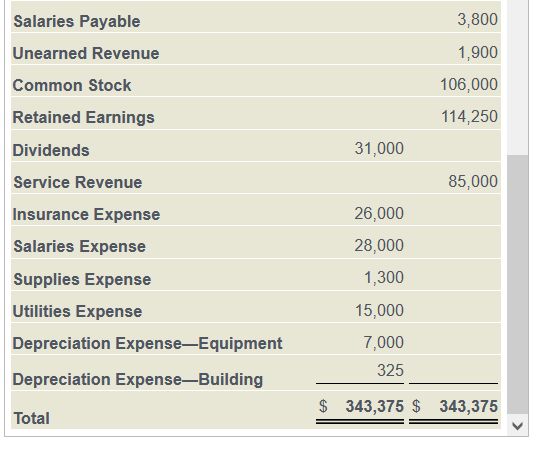

Data:

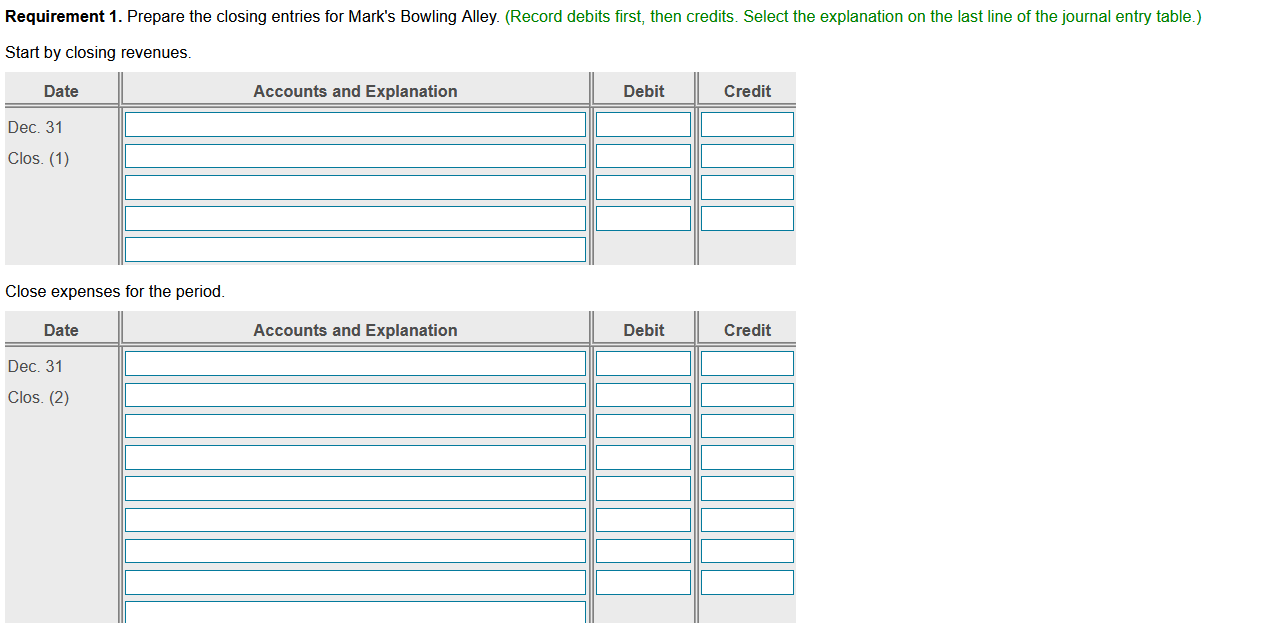

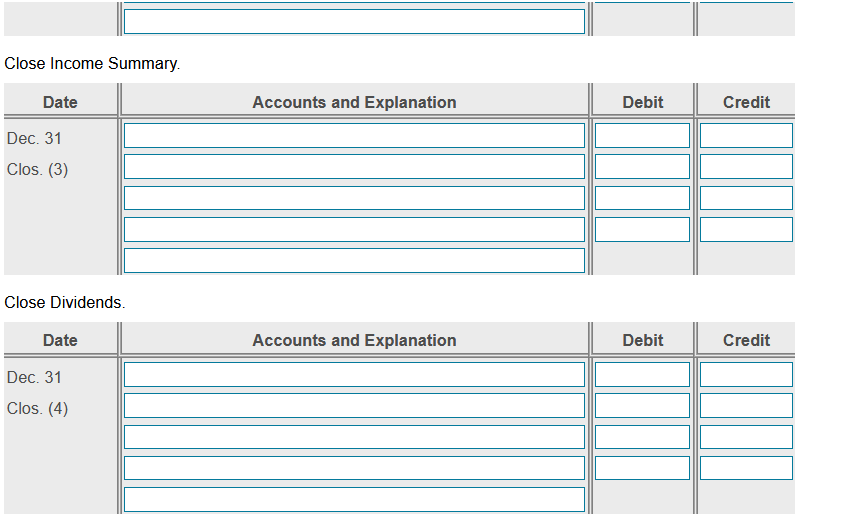

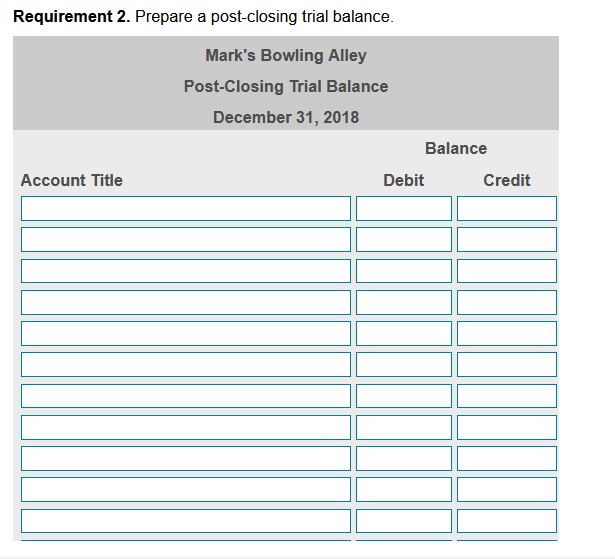

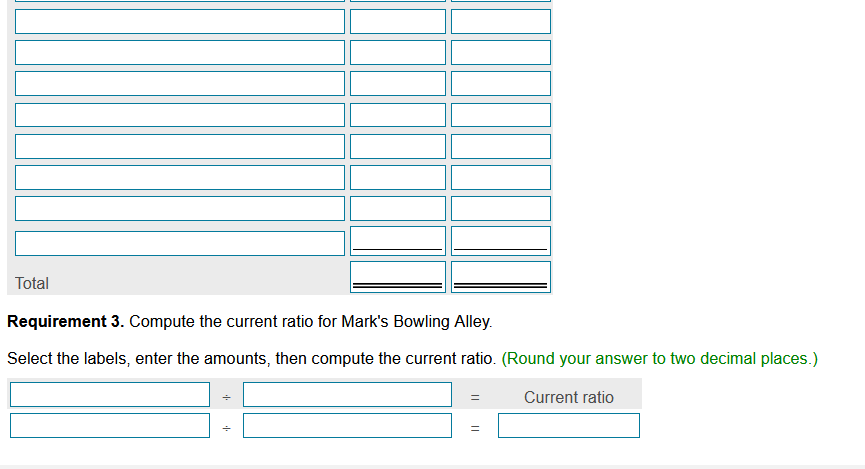

Requirement 1. Prepare the closing entries for Mark's Bowling Alley. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Start by closing revenues. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (1) Close expenses for the period. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (2) Close Income Summary Date Accounts and Explanation Debit Credit Dec. 31 Clos. (3) Close Dividends. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (4) Requirement 2. Prepare a post-closing trial balance. Mark's Bowling Alley Post-Closing Trial Balance December 31, 2018 Balance Debit Credit Account Title Total Requirement 3. Compute the current ratio for Mark's Bowling Alley. Select the labels, enter the amounts, then compute the current ratio. (Round your answer to two decimal places.) Current ratio Mark's Bowling Alley Adjusted Trial Balance December 31, 2018 Balance Account Title Debit Credit Cash $ 20,000 Accounts Receivable 2,900 Office Supplies 1,150 Prepaid Insurance 2,700 Land 20,000 Building 145,000 Accumulated DepreciationBuilding $ 7,000 Equipment 43,000 Accumulated Depreciation -Equipment 20,000 Accounts Payable 4,800 Utilities Payable 625 3,800 1,900 106,000 114,250 Salaries Payable Unearned Revenue Common Stock Retained Earnings Dividends Service Revenue Insurance Expense Salaries Expense 31,000 85,000 26,000 28,000 1,300 Supplies Expense Utilities Expense 15,000 Depreciation ExpenseEquipment 7,000 325 Depreciation ExpenseBuilding $ 343,375 $ 343,375 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts