Question: Please fill in the Excel sheet for the answer!!! Stock info: 8. Use the Corporate Valuation model is the most appropriate model to value Nvidia.

Please fill in the Excel sheet for the answer!!!

Stock info:

Stock info:

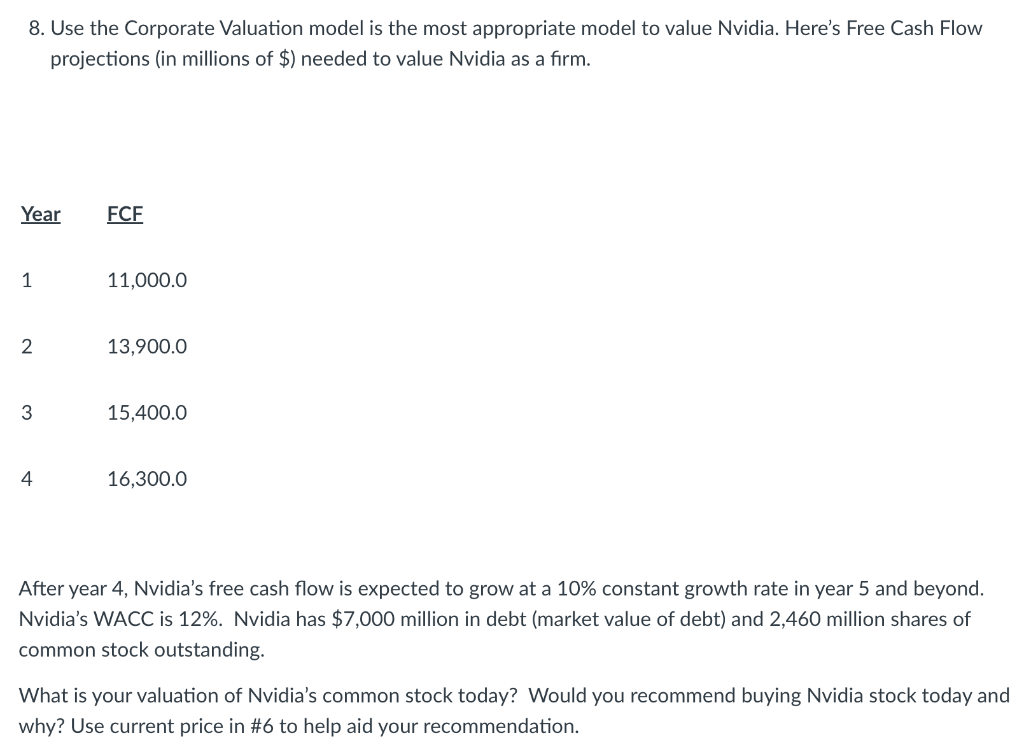

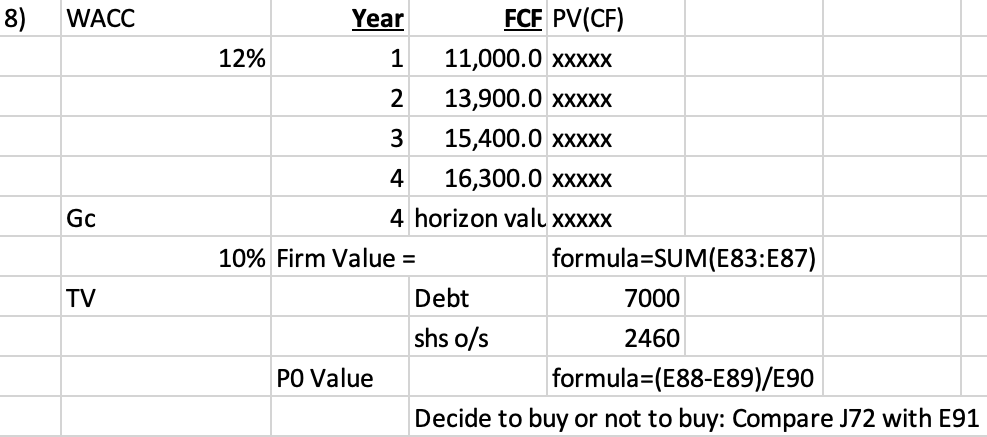

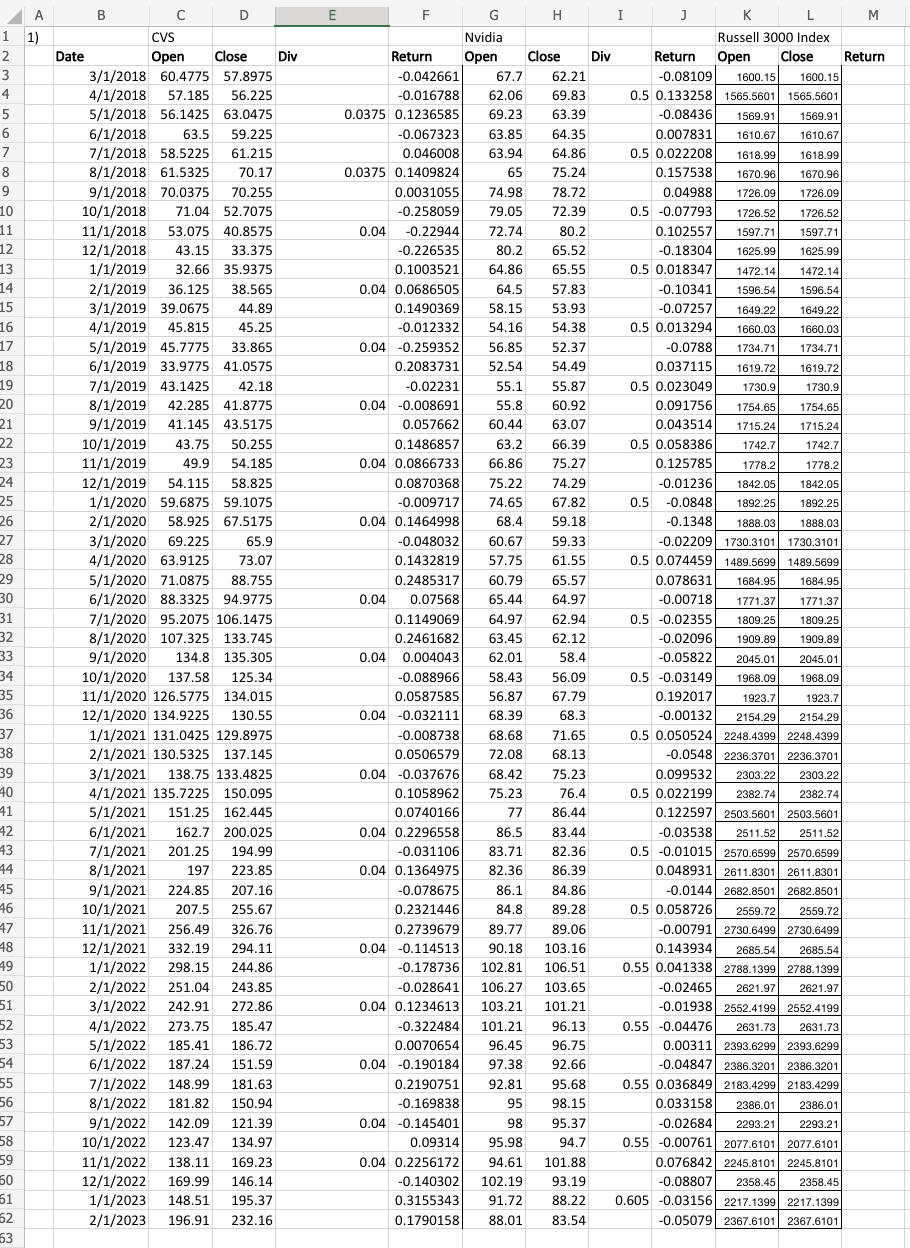

8. Use the Corporate Valuation model is the most appropriate model to value Nvidia. Here's Free Cash Flow projections (in millions of $ ) needed to value Nvidia as a firm. After year 4, Nvidia's free cash flow is expected to grow at a 10% constant growth rate in year 5 and beyond. Nvidia's WACC is 12%. Nvidia has $7,000 million in debt (market value of debt) and 2,460 million shares of common stock outstanding. What is your valuation of Nvidia's common stock today? Would you recommend buying Nvidia stock today and why? Use current price in \#6 to help aid your recommendation. 8) Decide to buy or not to buy: Compare J72 with E91 8. Use the Corporate Valuation model is the most appropriate model to value Nvidia. Here's Free Cash Flow projections (in millions of $ ) needed to value Nvidia as a firm. After year 4, Nvidia's free cash flow is expected to grow at a 10% constant growth rate in year 5 and beyond. Nvidia's WACC is 12%. Nvidia has $7,000 million in debt (market value of debt) and 2,460 million shares of common stock outstanding. What is your valuation of Nvidia's common stock today? Would you recommend buying Nvidia stock today and why? Use current price in \#6 to help aid your recommendation. 8) Decide to buy or not to buy: Compare J72 with E91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts