Question: Please fill in the missing information Thank you! Mastery Problem: Statement of Cash Flows Championship Boxing, Inc. Championship Boxing, Inc. is a small manufacturer of

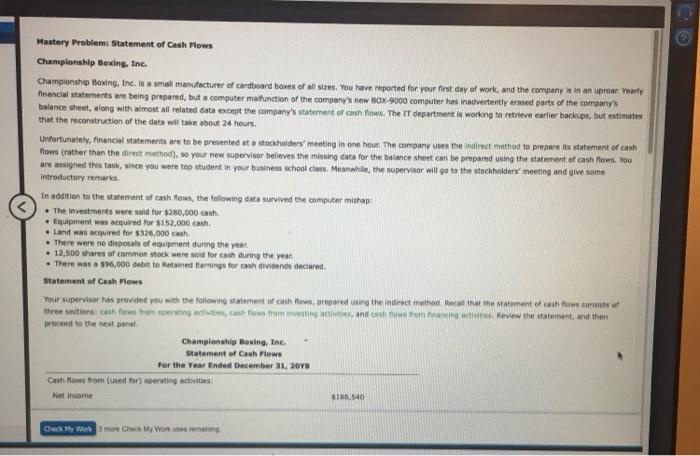

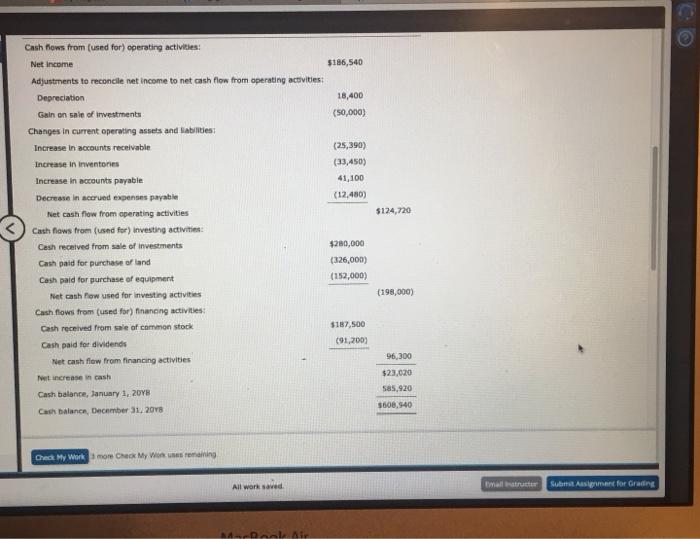

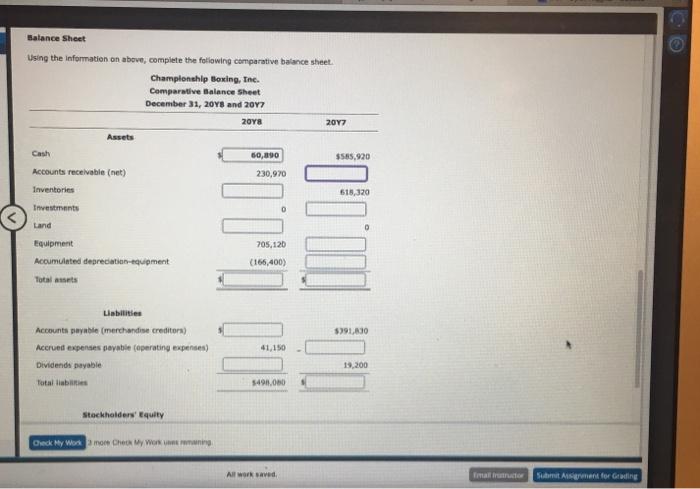

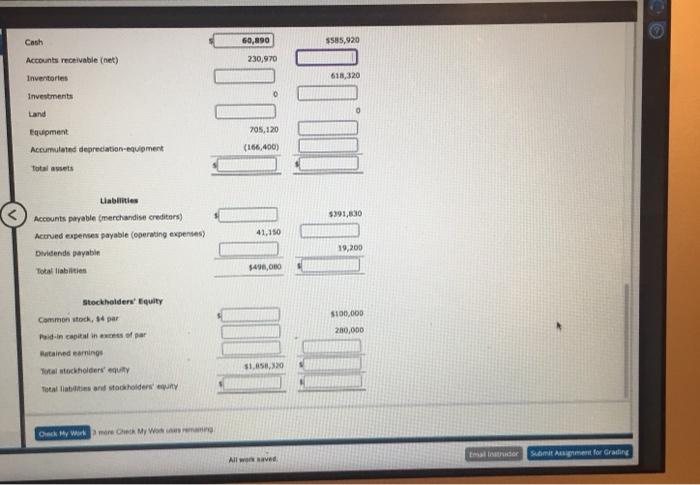

Mastery Problem: Statement of Cash Flows Championship Boxing, Inc. Championship Boxing, Inc. is a small manufacturer of cardboard boxes of all sizes. You have reported for your first day of work, and the company is in an uproar. Yearly financial statements are being prepared, but a computer malfunction of the company's new BOX-9000 computer has inadvertently erased parts of the company's balance sheet, along with almost all related data except the company's statement of cash flows. The IT department is working to retrieve earlier backups, but estimates that the reconstruction of the data will take about 24 hours. Unfortunately, financial statements are to be presented at a stockholders' meeting in one hour. The company uses the indirect method to prepare its statement of cash flows (rather than the direct method), so your new supervisor believes the missing data for the balance sheet can be prepared using the statement of cash flows. You are assigned this task, since you were top student in your business school class. Meanwhile, the supervisor will go to the stockholders' meeting and give some Introductory remarks. In addition to the statement of cash flows, the following data survived the computer mishap The investments were sold for $280,000 cash. Equipment was acquired for $152,000 cash. Land was acquired for $326,000 cash. There were no disposals of equipment during the year. 12,500 shares of common stock were sold for cash during the year There was a $96,000 debit to Retained Earnings for cash dividends declared. Statement of Cash Flows Your supervisor has provided you with the following statement of cash flows, prepared using the indirect method. Recall that the statement of cash flows consists of three sections: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Review the statement, and then proceed to the next panel Championship Boxing, Inc. Statement of Cash Flows For the Year Ended December 31, 2018 Cash flows from (used for) operating activities: Net income $185,540 Check My Work 3 more Check My Work uses remaning Cash flows from (used for) operating activities: Net Income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Gain on sale of investments Changes in current operating assets and liabilities: Increase in accounts receivable Increase in Inventories Increase in accounts payable Decrease in accrued expenses payable Net cash flow from operating activities Cash flows from (used for) investing activities: Cash received from sale of investments Cash paid for purchase of land Cash paid for purchase of equipment Net cash flow used for investing activities Cash flows from (used for) financing activities: Cash received from sale of common stock Cash paid for dividends Net cash flow from financing activities Net increase in cash Cash balance, January 1, 2018 Cash balance, December 31, 2018 Check My Work 3 more Check My Work uses remaining All work saved. MacBook Air $186,540 18,400 (50,000) (25,390) (33,450) 41,100 (12,480) $280,000 (326,000) (152,000) $187,500 (91,200) $124,720 (198,000) 96,300 $23,020 585,920 $608,940 Emall structur Submit Assignment for Grading Balance Sheet Using the information on above, complete the following comparative balance sheet. Championship Boxing, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Cash Accounts receivable (net) Inventories Investments Land Equipment Accumulated depreciation-equipment Total assets Liabilities Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable Total liabilities Stockholders' Equity Check My Work 3 more Check My Work unremaining 60,890 230,970 705,120 (166,400) 001 41,150 $498,080 All work saved, 000.0.0: $585,920 618,320 $391,830 19,200 Email Instructor Submit Assignment for Grading Cash Accounts receivable (net) Inventories Investments Land Equipment Accumulated depreciation-equipment Total assets Liabilities Accounts payable (merchandise creditors) Accrued expenses payable (operating expenses) Dividends payable Total liabilities Stockholders' Equity Common stock, 14 par Paid-in capital in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Check My Work more Check My Wos unes remang 60,890 230,970 705,120 (166,400) 41,150 $498,000 $1,858,320 All work saved $585,920 618,320 $391,830 19,200 $100,000 280,000 Email Instrutor Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts