Question: PLEASE FILL OUT ALL FORMS THAT ARE ASKED FOR THIS PROBLEM. Form 1065: page 1 and Schedule K page Form 4562 Schedule K-1 for Chewi

PLEASE FILL OUT ALL FORMS THAT ARE ASKED FOR THIS PROBLEM.

Form 1065: page 1 and Schedule K page

Form 4562

Schedule K-1 for Chewi

- Prepare any necessary supporting calculations in Excel

- Reconcile Chewi's beginning and ending tax basis using Excel

- Reconcile Chewi's beginning and ending capital account balance using Excel

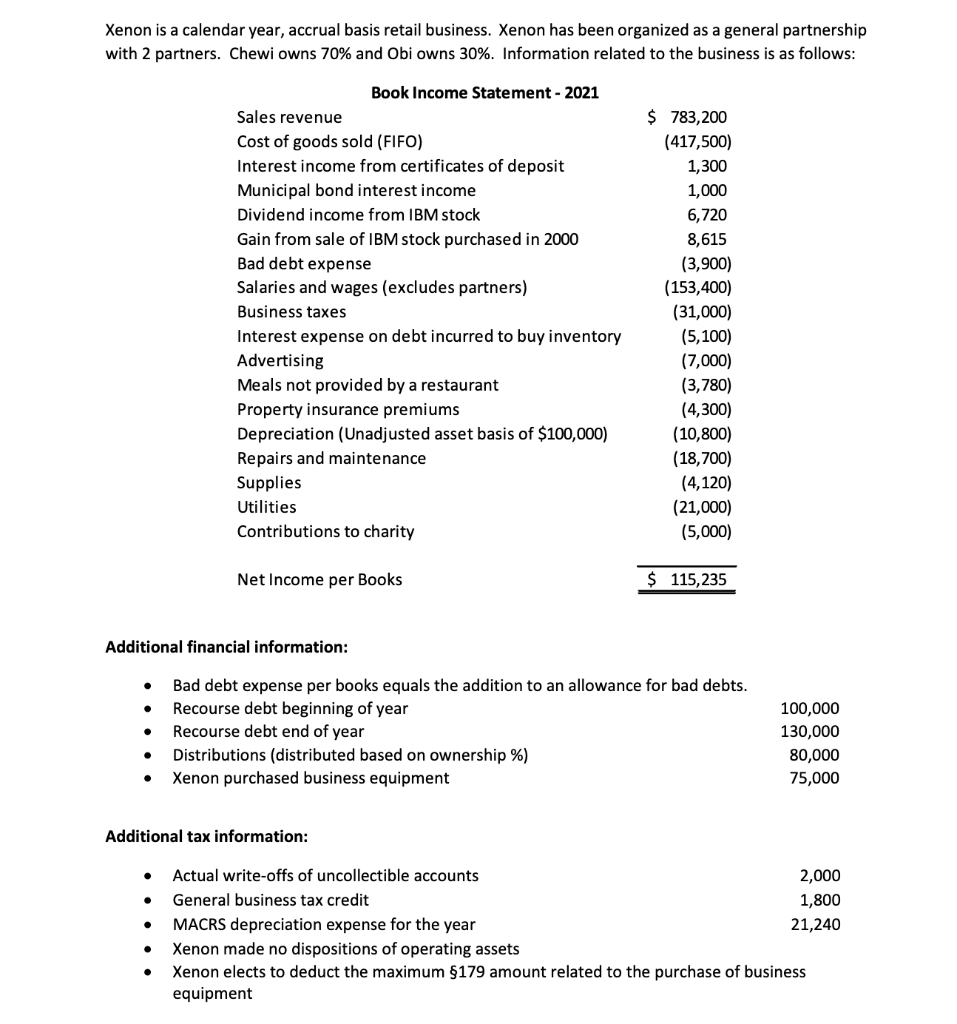

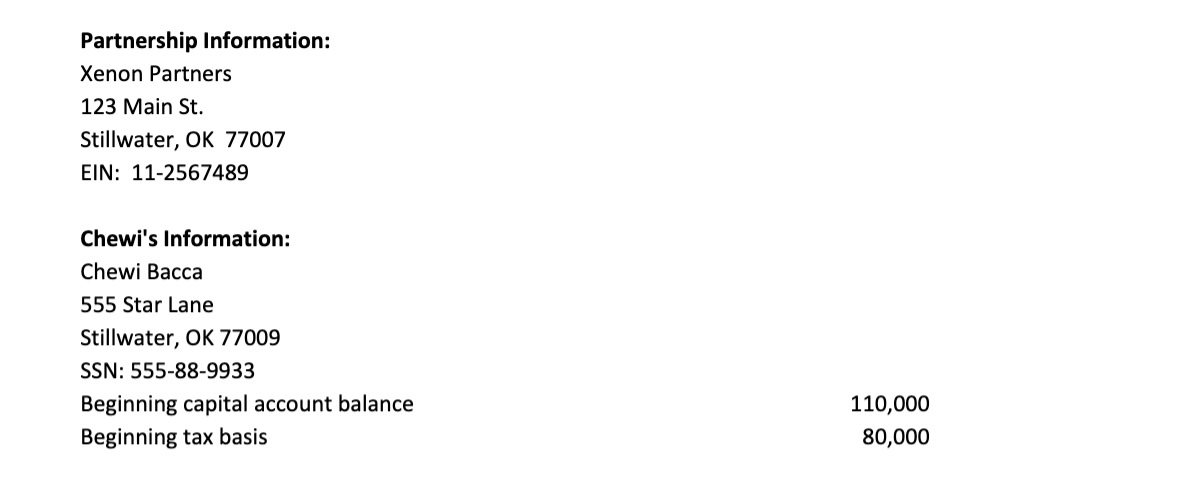

Xenon is a calendar year, accrual basis retail business. Xenon has been organized as a general partnership with 2 partners. Chewi owns 70% and Obi owns 30%. Information related to the business is as follows: Book Income Statement - 2021 Sales revenue Cost of goods sold (FIFO) Interest income from certificates of deposit Municipal bond interest income Dividend income from IBM stock Gain from sale of IBM stock purchased in 2000 Bad debt expense Salaries and wages (excludes partners) Business taxes Interest expense on debt incurred to buy inventory Advertising Meals not provided by a restaurant Property insurance premiums Depreciation (Unadjusted asset basis of $100,000) Repairs and maintenance Supplies Utilities Contributions to charity $ 783,200 (417,500) 1,300 1,000 6,720 8,615 (3,900) (153,400) (31,000) (5,100) (7,000) (3,780) (4,300) (10,800) (18,700) (4,120) (21,000) (5,000) Net Income per Books $ 115,235 Additional financial information: . . . Bad debt expense per books equals the addition to an allowance for bad debts. Recourse debt beginning of year Recourse debt end of year Distributions (distributed based on ownership %) Xenon purchased business equipment 100,000 130,000 80,000 75,000 . Additional tax information: . . Actual write-offs of uncollectible accounts 2,000 General business tax credit 1,800 MACRS depreciation expense for the year 21,240 Xenon made no dispositions of operating assets Xenon elects to deduct the maximum $179 amount related to the purchase of business equipment . . Partnership Information: Xenon Partners 123 Main St. Stillwater, OK 77007 EIN: 11-2567489 Chewi's Information: Chewi Bacca 555 Star Lane Stillwater, OK 77009 SSN: 555-88-9933 Beginning capital account balance Beginning tax basis 110,000 80,000 Xenon is a calendar year, accrual basis retail business. Xenon has been organized as a general partnership with 2 partners. Chewi owns 70% and Obi owns 30%. Information related to the business is as follows: Book Income Statement - 2021 Sales revenue Cost of goods sold (FIFO) Interest income from certificates of deposit Municipal bond interest income Dividend income from IBM stock Gain from sale of IBM stock purchased in 2000 Bad debt expense Salaries and wages (excludes partners) Business taxes Interest expense on debt incurred to buy inventory Advertising Meals not provided by a restaurant Property insurance premiums Depreciation (Unadjusted asset basis of $100,000) Repairs and maintenance Supplies Utilities Contributions to charity $ 783,200 (417,500) 1,300 1,000 6,720 8,615 (3,900) (153,400) (31,000) (5,100) (7,000) (3,780) (4,300) (10,800) (18,700) (4,120) (21,000) (5,000) Net Income per Books $ 115,235 Additional financial information: . . . Bad debt expense per books equals the addition to an allowance for bad debts. Recourse debt beginning of year Recourse debt end of year Distributions (distributed based on ownership %) Xenon purchased business equipment 100,000 130,000 80,000 75,000 . Additional tax information: . . Actual write-offs of uncollectible accounts 2,000 General business tax credit 1,800 MACRS depreciation expense for the year 21,240 Xenon made no dispositions of operating assets Xenon elects to deduct the maximum $179 amount related to the purchase of business equipment . . Partnership Information: Xenon Partners 123 Main St. Stillwater, OK 77007 EIN: 11-2567489 Chewi's Information: Chewi Bacca 555 Star Lane Stillwater, OK 77009 SSN: 555-88-9933 Beginning capital account balance Beginning tax basis 110,000 80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts