Question: Please fill out all the boxes for I. Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $76,000. The equipment falls

Please fill out all the boxes for I.

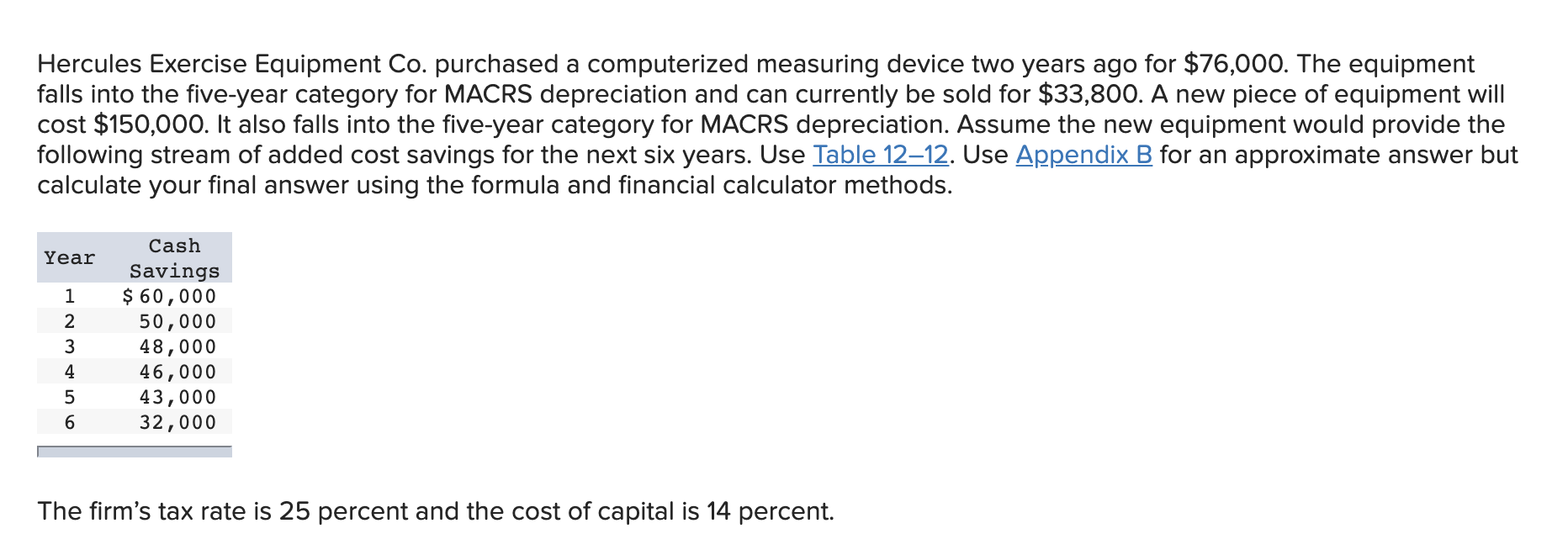

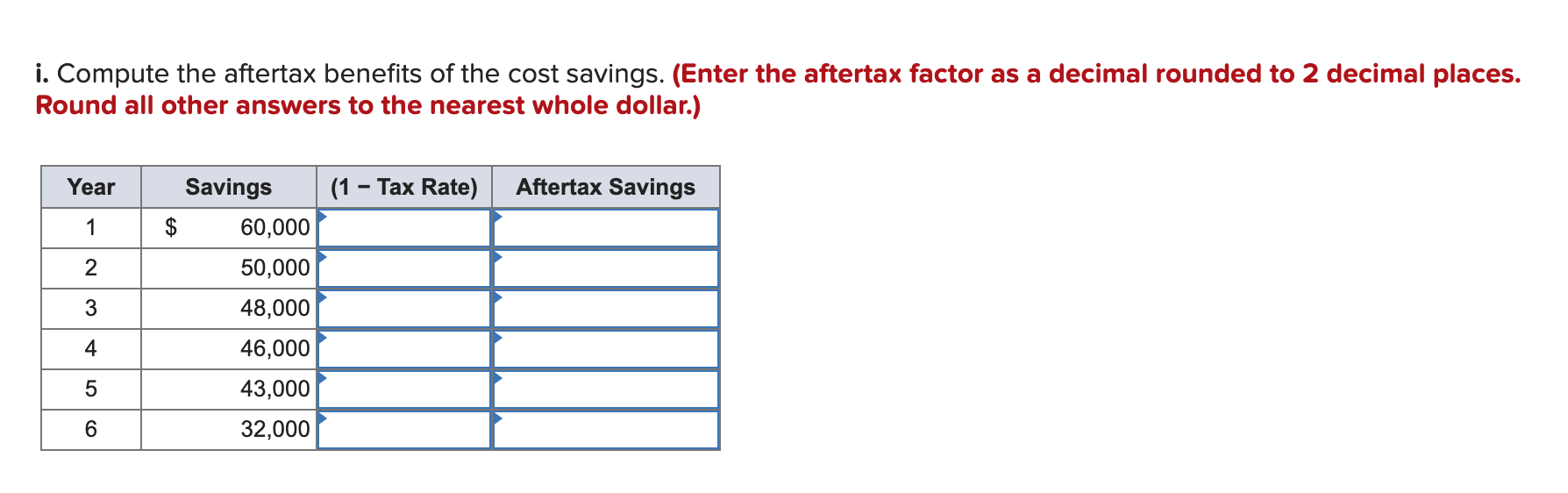

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $76,000. The equipment falls into the ve-year category for MACRS depreciation and can currently be sold for $33,800. A new piece of equipment will cost $150,000. It also falls into the five-year category for MACRS depreciation Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 1212. Use Appendix B for an approximate answer but calculate your nal answer using the formula and financial calculator methods. Cash Savings $60.000 50.000 48.000 46.000 43,000 32,000 r___________ Year mmIP-DJNll The firm's tax rate is 25 percent and the cost of capital is 14 percent. i. Compute the aftertax benefits of the cost savings. (Enter the aftertax factor as a decimal rounded to 2 decimal places. Round all other answers to the nearest whole dollar.) Year Savings (1 - Tax Rate) Aflertax Savings 1 $ 60,000 2 50,000 3 48,000 4 46,000 5 6 43,000 32,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts