Question: please fill out every single box with the right information please ! Sheridan Corporation's capital structure consists of 50,000 shares of common stock. At December

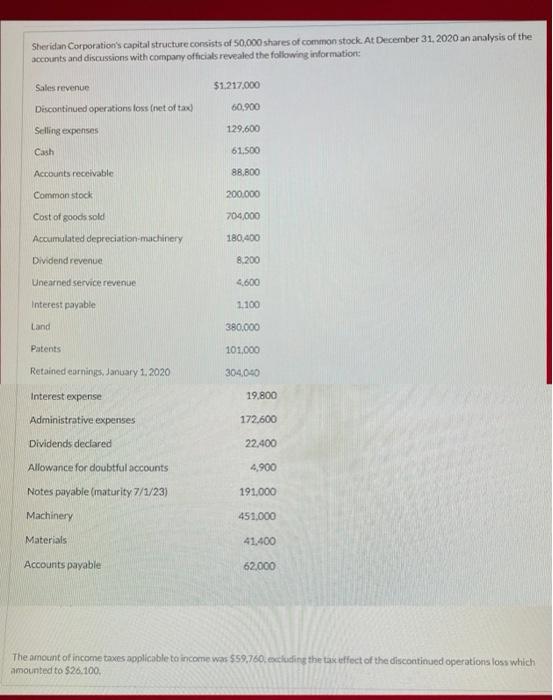

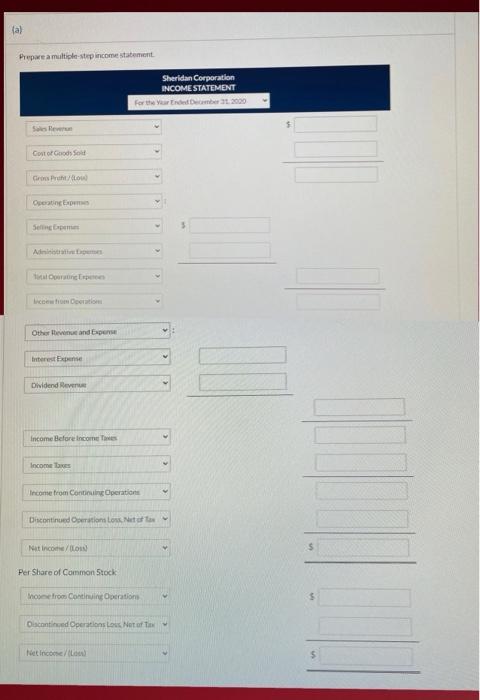

Sheridan Corporation's capital structure consists of 50,000 shares of common stock. At December 31, 2020 an analysis of the accounts and discussions with company officials revealed the following information: Sales revenue $1.217.000 Descontinued operations foss (net of tax) 60.900 Selling expenses 129.600 Cash 61.500 Accounts receivable 88.800 Common stock 200.000 704,000 Cost of goods sold Accumulated depreciation machinery 180,400 Dividend revenue 8.200 Unearned service revenue 4,600 Interest payable 2100 Land 380,000 Patents 101,000 Retained earnings, January 1, 2020 304,040 Interest expense 19.800 Administrative expenses 172.600 Dividends declared 22.400 Allowance for doubtful accounts 4,900 Notes payable (maturity 7/1/23) 191.000 Machinery 451,000 Materials 41.400 Accounts payable 62000 The amount of income taxes applicable to income was $59,760, occluding the tax effect of the discontinued operations loss which amounted to $26.100, (a) Prepare a multiple step income statement Sheridan Corporation INCOME STATEMENT For the Year Ended. 2000 Sew Gosto Grosso Pro Orating Sering Liceo Com Othew and per terest Expense Dividend Reven Income Before Income Income Income from Continuing Operations Discontinued Operations to Netto Net Inco/LOIN Per Share of Common Stock More from Continuing Operation Discounted Operations Low Not of Notice/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts