Question: Please fill out excel sheet with excel formulas showing to see step by step answer please 1. The Clause Solution, Inc., a residential window and

Please fill out excel sheet with excel formulas showing to see step by step answer please

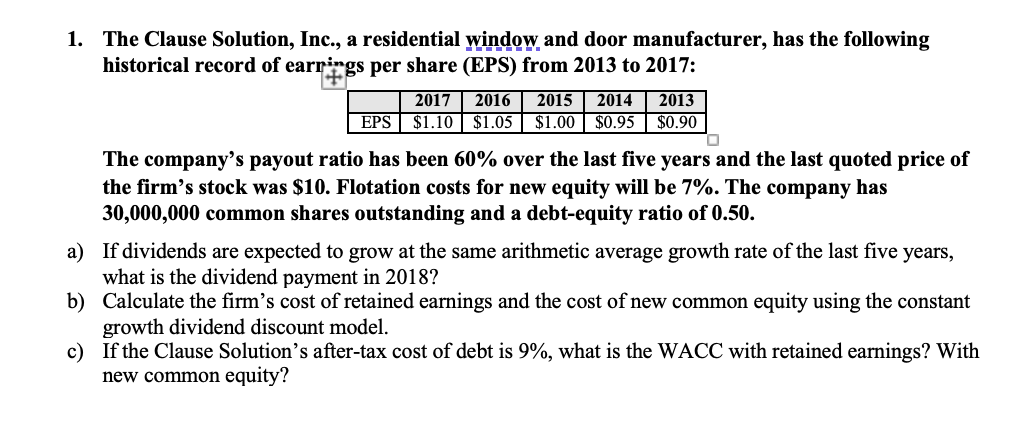

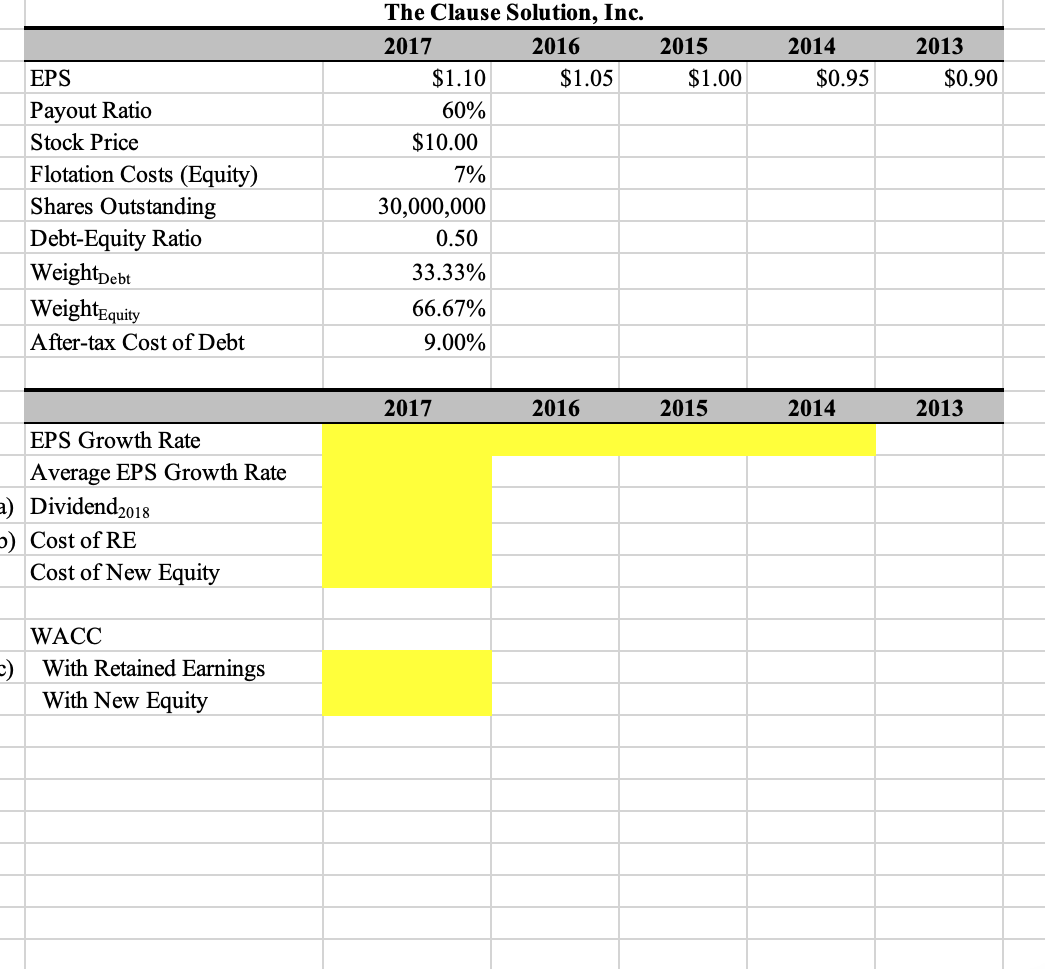

1. The Clause Solution, Inc., a residential window and door manufacturer, has the following historical record of earrings per share (EPS) from 2013 to 2017: 2017 2016 2015 2014 2013 EPS$1.10 $1.05 $1.00 $0.95 $0.90 The company's payout ratio has been 60% over the last five years and the last quoted price of the firm's stock was $10. Flotation costs for new equity will be 7%. The company has 30,000,000 common shares outstanding and a debt-equity ratio of 0.50. a) If dividends are expected to grow at the same arithmetic average growth rate of the last five years, what is the dividend payment in 2018? b) Calculate the firm's cost of retained earnings and the cost of new common equity using the constant growth dividend discount model. c) If the Clause Solution's after-tax cost of debt is 9%, what is the WACC with retained earnings? With new common equity? 2015 $1.00 2014 $0.95 2013 $0.90 EPS Payout Ratio Stock Price Flotation Costs (Equity) Shares Outstanding Debt-Equity Ratio WeightDebt WeightEquity After-tax Cost of Debt The Clause Solution, Inc. 2017 2016 $1.10 $1.05 60% $10.00 7% 30,000,000 0.50 33.33% 66.67% 9.00% 2017 2016 2015 2014 2013 EPS Growth Rate Average EPS Growth Rate a) Dividend2018 5) Cost of RE Cost of New Equity WACC --) With Retained Earnings With New Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts