Question: please fill out in the excel below and provide formula if it need. Suppose that the S&P 500, with a beta of 1.0, has an

please fill out in the excel below and provide formula if it need.

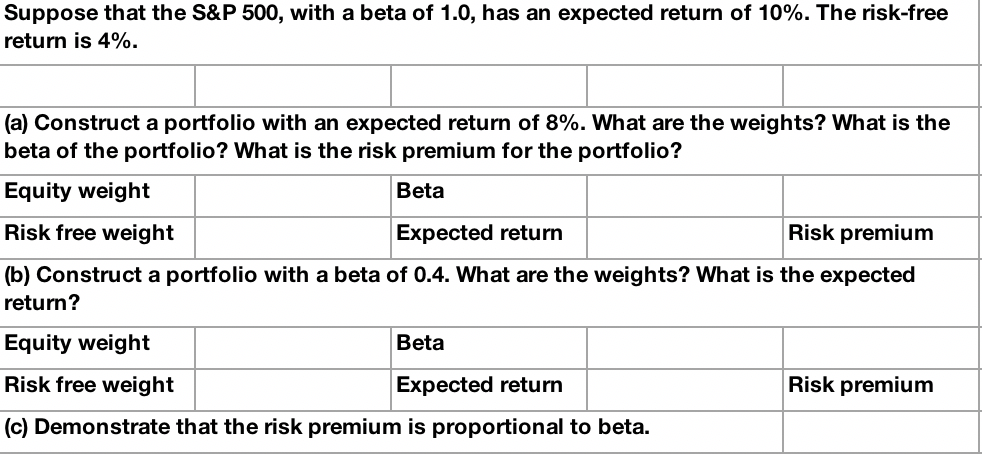

Suppose that the S&P 500, with a beta of 1.0, has an expected retum of 10%. The risk-free return is 4%. (a) Construct a portfolio with an expected return of 8%. what are the weights? what is the beta of the portfolio? What is the risk premium for the portfolio? Equity weight Risk free weight (b) Construct a portfolio with a beta of 0.4. What are the weights? What is the expected return? Equity weight Risk free weight (c) Demonstrate that the risk premium is proportional to beta. Beta Expected return Risk premium Beta Expected return Risk premium

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock