Question: please fill out the balance sheet using the provided events. Required information [The following information applies to the questions displayed below.] The following transactions apply

![[The following information applies to the questions displayed below.] The following transactions](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e98e334d9d8_32266e98e32bdee0.jpg)

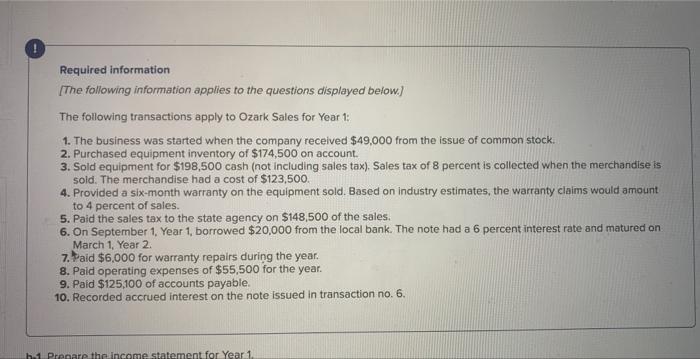

Required information [The following information applies to the questions displayed below.] The following transactions apply to Ozark Sales for Year 1: 1. The business was started when the company received $49,000 from the issue of common stock. 2. Purchased equipment inventory of $174,500 on account. 3. Sold equipment for $198,500 cash (not including sales tax). Sales tax of 8 percent is collected when the merchandise is sold. The merchandise had a cost of $123,500. 4. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 4 percent of sales. 5. Paid the sales tax to the state agency on $148,500 of the sales. 6. On September 1, Year 1, borrowed $20,000 from the local bank. The note had a 6 percent interest rate and matured on March 1, Year 2. 7. Haid $6,000 for warranty repairs during the year. 8. Paid operating expenses of $55,500 for the year. 9. Paid $125,100 of accounts payable. 10. Recorded accrued interest on the note issued in transaction no. 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts