Question: please fill out the spread sheet 1. Susan is a farmer and her husband, Edward, works at the local bank. The farm is aligned as

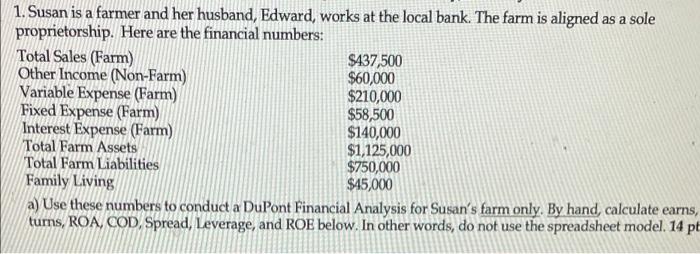

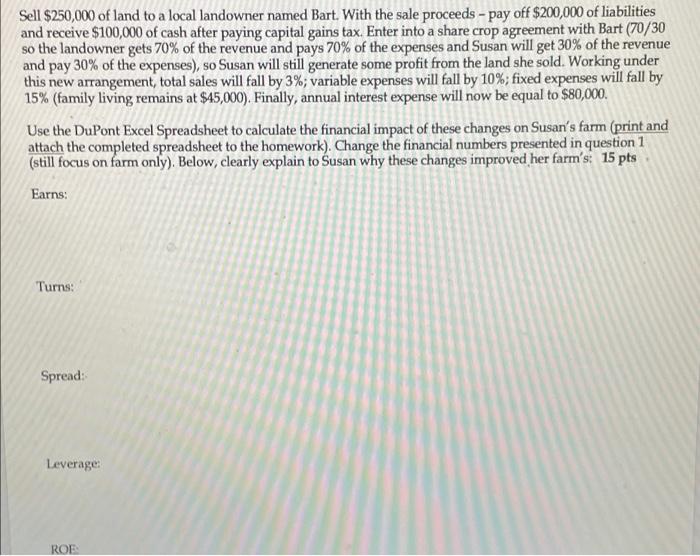

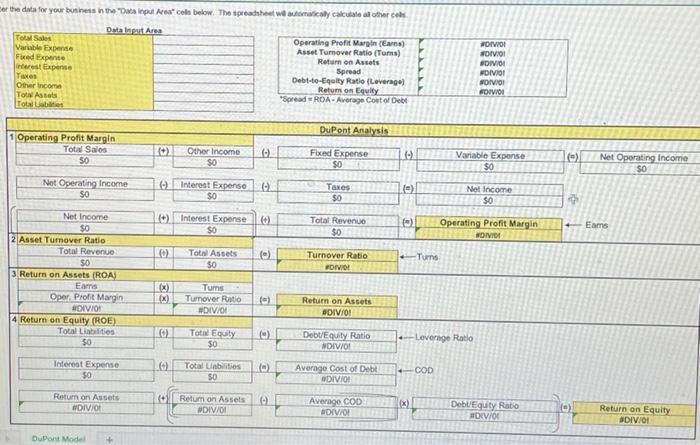

1. Susan is a farmer and her husband, Edward, works at the local bank. The farm is aligned as a sole proprietorship. Here are the financial numbers: Total Sales (Farm) $437,500 Other Income (Non-Farm) $60,000 Variable Expense (Farm) $210,000 Fixed Expense (Farm) $58,500 Interest Expense (Farm) $140,000 Total Farm Assets $1,125,000 Total Farm Liabilities $750,000 Family Living $45,000 a) Use these numbers to conduct a DuPont Financial Analysis for Susan's farm only. By hand, calculate earns, turns, ROA, COD, Spread, Leverage, and ROE below. In other words, do not use the spreadsheet model. 14 pt Sell $250,000 of land to a local landowner named Bart. With the sale proceeds - pay off $200,000 of liabilities and receive $100,000 of cash after paying capital gains tax Enter into a share crop agreement with Bart (70/30 so the landowner gets 70% of the revenue and pays 70% of the expenses and Susan will get 30% of the revenue and pay 30% of the expenses), so Susan will still generate some profit from the land she sold. Working under this new arrangement, total sales will fall by 3%; variable expenses will fall by 10%; fixed expenses will fall by 15% (family living remains at $45,000). Finally, annual interest expense will now be equal to $80,000. Use the DuPont Excel Spreadsheet to calculate the financial impact of these changes on Susan's farm (print and attach the completed spreadsheet to the homework). Change the financial numbers presented in question 1 (still focus on farm only). Below, clearly explain to Susan why these changes improved her farm's: 15 pts Earns: 9. Finally , an Turns: Spread: Leverage ROE er the data for your business in the Data input rea" cols below. The spreadsheet watically calculate all other cele Data ut Area Tot Sales Variable Expense FedExpert rest Expense Yaxes Other income Tot Assets Total Operating Profit Margin (Earna) Asset Turnover Ratio (Tums) Return on Assets Spread Debt-to-Equity Ratio (Leverage) Return on Equity Spread ROA. Average Contor Debt NOIVO WOIVOI DIVO DIVIDI SOIVOI FOIVIOI DuPont Analysis Operating Profit Margin Total Sales 30 Other Income SO Fixed Expense $0 ) Variable Expense $0 ) Net Operating Income SO Net Operating Income $0 Interest Expenso $0 Taxes e) $0 Net Income 50 Interest Expense SO (0) Total Revenue $0 fe) Operating Profit Margin NOVICE Eams 0 Total Assets 50 -) e Turnover Ratio FOIVO! Tums Net Income $0 2 Asset Turnover Ratio Total Revenue $0 3. Return on Assets (ROA) Ens Oper. Profit Margin DIVIO 4 Return on Equity (ROE) Total Liabilities $0 BE Tums Tumover Ratio #DIV/0! ) Return on Assets DIV/0! o Total Equity a $0 Debt Equity Ratio NDIVIOI Leverage Ratio Interest Expense 50 Total Unbilities 50 a Average cost of Debt DIVIO! COD Rotum on Assets DIVO Relum on Assets #DIV/01 Average COD DIV/0! DebuEquity Ratio HIVIO (0) Return on Equity DIV/01 Dupont Model 1. Susan is a farmer and her husband, Edward, works at the local bank. The farm is aligned as a sole proprietorship. Here are the financial numbers: Total Sales (Farm) $437,500 Other Income (Non-Farm) $60,000 Variable Expense (Farm) $210,000 Fixed Expense (Farm) $58,500 Interest Expense (Farm) $140,000 Total Farm Assets $1,125,000 Total Farm Liabilities $750,000 Family Living $45,000 a) Use these numbers to conduct a DuPont Financial Analysis for Susan's farm only. By hand, calculate earns, turns, ROA, COD, Spread, Leverage, and ROE below. In other words, do not use the spreadsheet model. 14 pt Sell $250,000 of land to a local landowner named Bart. With the sale proceeds - pay off $200,000 of liabilities and receive $100,000 of cash after paying capital gains tax Enter into a share crop agreement with Bart (70/30 so the landowner gets 70% of the revenue and pays 70% of the expenses and Susan will get 30% of the revenue and pay 30% of the expenses), so Susan will still generate some profit from the land she sold. Working under this new arrangement, total sales will fall by 3%; variable expenses will fall by 10%; fixed expenses will fall by 15% (family living remains at $45,000). Finally, annual interest expense will now be equal to $80,000. Use the DuPont Excel Spreadsheet to calculate the financial impact of these changes on Susan's farm (print and attach the completed spreadsheet to the homework). Change the financial numbers presented in question 1 (still focus on farm only). Below, clearly explain to Susan why these changes improved her farm's: 15 pts Earns: 9. Finally , an Turns: Spread: Leverage ROE er the data for your business in the Data input rea" cols below. The spreadsheet watically calculate all other cele Data ut Area Tot Sales Variable Expense FedExpert rest Expense Yaxes Other income Tot Assets Total Operating Profit Margin (Earna) Asset Turnover Ratio (Tums) Return on Assets Spread Debt-to-Equity Ratio (Leverage) Return on Equity Spread ROA. Average Contor Debt NOIVO WOIVOI DIVO DIVIDI SOIVOI FOIVIOI DuPont Analysis Operating Profit Margin Total Sales 30 Other Income SO Fixed Expense $0 ) Variable Expense $0 ) Net Operating Income SO Net Operating Income $0 Interest Expenso $0 Taxes e) $0 Net Income 50 Interest Expense SO (0) Total Revenue $0 fe) Operating Profit Margin NOVICE Eams 0 Total Assets 50 -) e Turnover Ratio FOIVO! Tums Net Income $0 2 Asset Turnover Ratio Total Revenue $0 3. Return on Assets (ROA) Ens Oper. Profit Margin DIVIO 4 Return on Equity (ROE) Total Liabilities $0 BE Tums Tumover Ratio #DIV/0! ) Return on Assets DIV/0! o Total Equity a $0 Debt Equity Ratio NDIVIOI Leverage Ratio Interest Expense 50 Total Unbilities 50 a Average cost of Debt DIVIO! COD Rotum on Assets DIVO Relum on Assets #DIV/01 Average COD DIV/0! DebuEquity Ratio HIVIO (0) Return on Equity DIV/01 Dupont Model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts