Question: Please fill out the table attached according to the given information. Also, give your opinion on which alternative is preferable (The companys management wants to

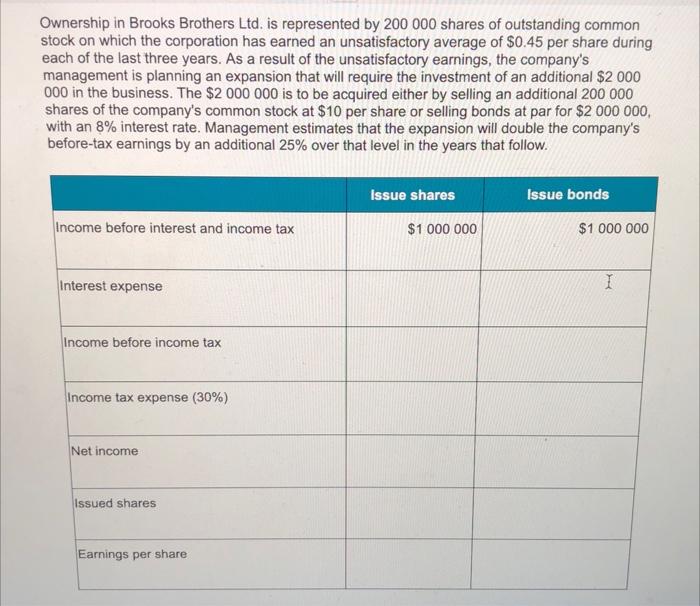

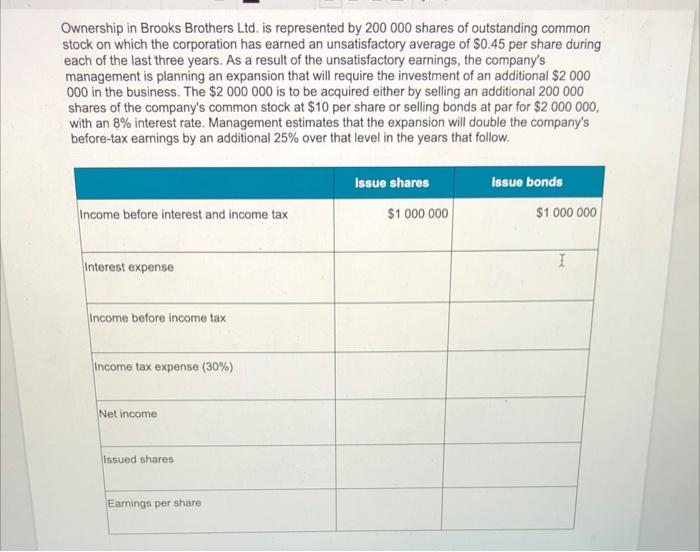

Ownership in Brooks Brothers Ltd. is represented by 200 000 shares of outstanding common stock on which the corporation has earned an unsatisfactory average of $0.45 per share during each of the last three years. As a result of the unsatisfactory earnings, the company's management is planning an expansion that will require the investment of an additional $2 000 000 in the business. The $2 000 000 is to be acquired either by selling an additional 200 000 shares of the company's common stock at $10 per share or selling bonds at par for $2 000 000, with an 8% interest rate. Management estimates that the expansion will double the company's before-tax earnings by an additional 25% over that level in the years that follow. Issue shares Issue bonds Income before interest and income tax $1 000 000 $ 1 000 000 Interest expense Income before income tax Income tax expense (30%) Net income Issued shares Earnings per share Ownership in Brooks Brothers Ltd. is represented by 200 000 shares of outstanding common stock on which the corporation has earned an unsatisfactory average of $0.45 per share during each of the last three years. As a result of the unsatisfactory earnings, the company's management is planning an expansion that will require the investment of an additional $2 000 000 in the business. The $2 000 000 is to be acquired either by selling an additional 200 000 shares of the company's common stock at $10 per share or selling bonds at par for $2 000 000, with an 8% interest rate. Management estimates that the expansion will double the company's before-tax earnings by an additional 25% over that level in the years that follow. Issue shares $1 000 000 Issue bonds $1 000 000 Income before interest and income tax Interest expense 1 Income before income tax Income tax expense (30%) Net income Issued shares Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts