Question: please fill out the table using the 1-4 prompts During the current year, Rayon Corporation disposed of two different assets. On January 1, prior to

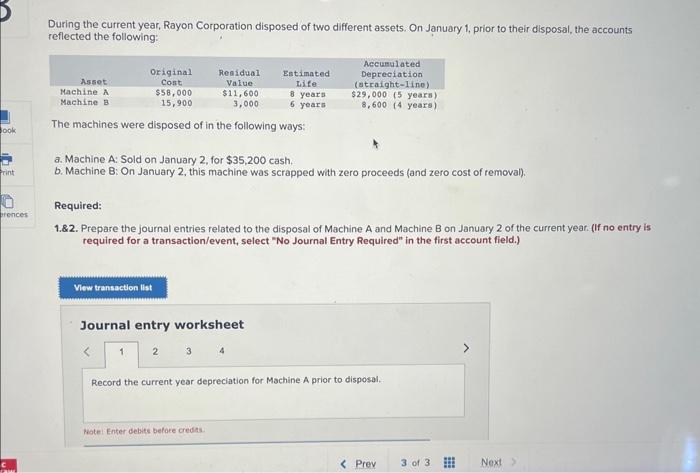

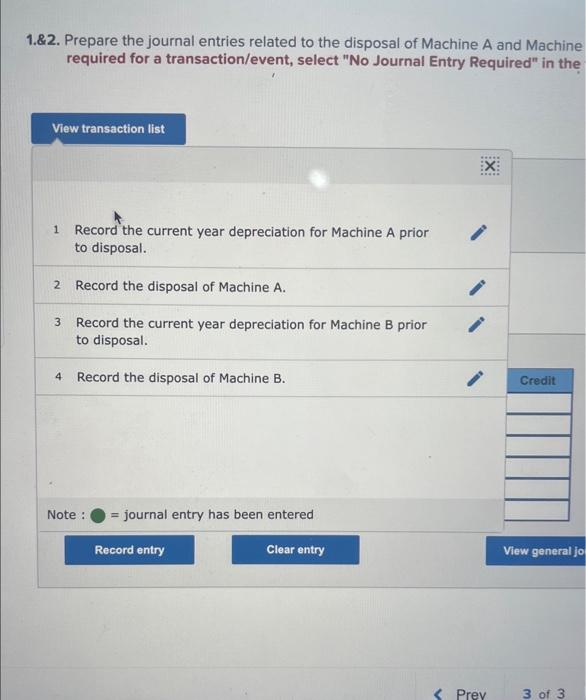

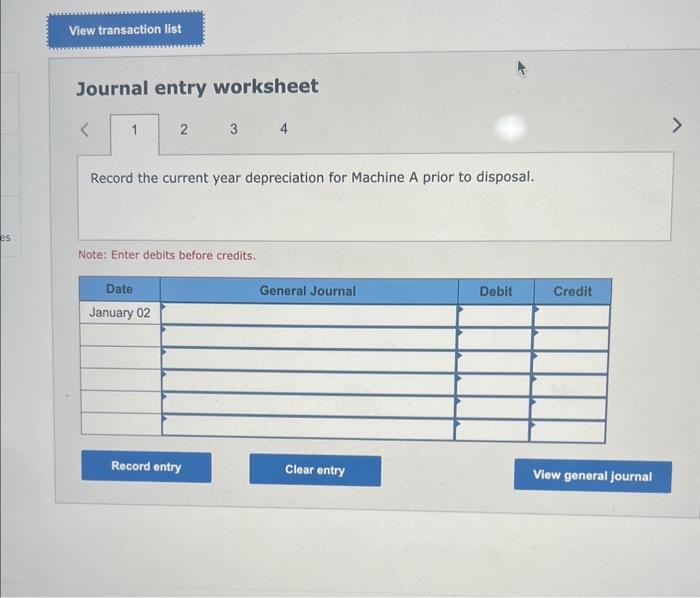

During the current year, Rayon Corporation disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 2, for $35,200 cash. b. Machine B: On January 2, this machine was scrapped with zero proceeds (and zero cost of removal). Required: 1.82. Prepare the journal entries related to the disposal of Machine A and Machine B on January 2 of the current year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the current year depreciation for Machine A prior to disposal. Note: Encer debits before credis. 1.\&2. Prepare the journal entries related to the disposal of Machine A and Machine required for a transaction/event, select "No Journal Entry Required" in the 1 Record the current year depreciation for Machine A prior to disposal. 2 Record the disposal of Machine A. 3 Record the current year depreciation for Machine B prior to disposal. 4 Record the disposal of Machine B. Note : = journal entry has been entered Journal entry worksheet 2 Record the current year depreciation for Machine A prior to disposal. Note: Enter debits before credits. During the current year, Rayon Corporation disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following: The machines were disposed of in the following ways: a. Machine A: Sold on January 2, for $35,200 cash. b. Machine B: On January 2, this machine was scrapped with zero proceeds (and zero cost of removal). Required: 1.82. Prepare the journal entries related to the disposal of Machine A and Machine B on January 2 of the current year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the current year depreciation for Machine A prior to disposal. Note: Encer debits before credis. 1.\&2. Prepare the journal entries related to the disposal of Machine A and Machine required for a transaction/event, select "No Journal Entry Required" in the 1 Record the current year depreciation for Machine A prior to disposal. 2 Record the disposal of Machine A. 3 Record the current year depreciation for Machine B prior to disposal. 4 Record the disposal of Machine B. Note : = journal entry has been entered Journal entry worksheet 2 Record the current year depreciation for Machine A prior to disposal. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts