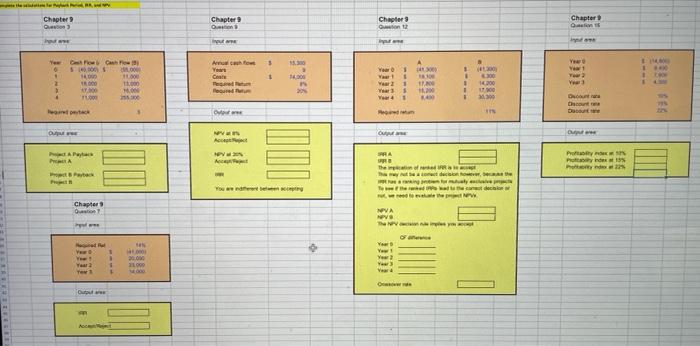

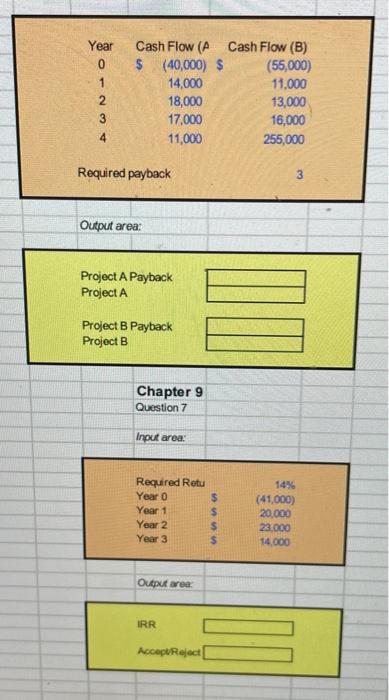

Question: Please fill out yellow parts woth each corresponding question! will thumbs up! Required payback 3 Output area: Project A Payback Project A Project B Payback

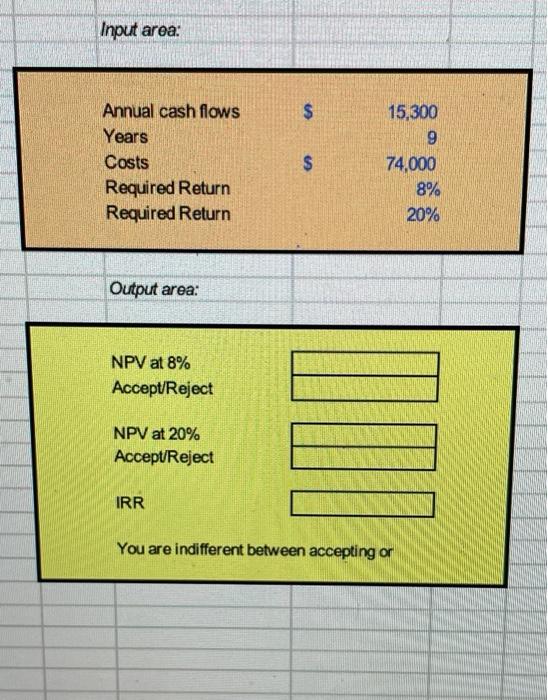

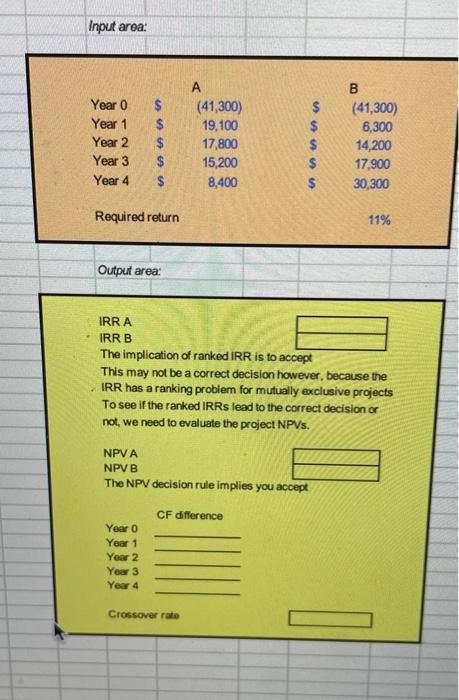

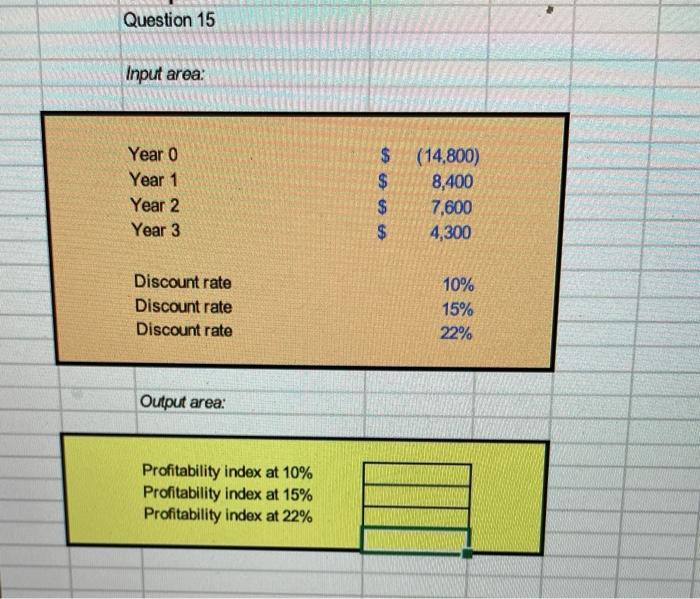

Required payback 3 Output area: Project A Payback Project A Project B Payback Project B \begin{tabular}{|} \\ \hline \\ \hline \end{tabular} Chapter 9 Question 7 Input area: Outpur area: IRR AccoplReject Input area: \begin{tabular}{lrr} Annual cash flows & $ & 15,300 \\ Years & 9 \\ Costs & $ & 74,000 \\ Required Return & 8% \\ Required Return & 20% \\ & \\ \hline \end{tabular} Output area: NPV at 8% Accept/Reject NPV at 20% Accept/Reject IRR You are indifferent between accepting or The implication of ranked IRR is to accept This may not be a correct decision however, because the IRR has a ranking problem for mutually exclusive projects To see if the ranked IRRs lead to the correct decision or not, we need to evaluate the project NPVs. Question 15 Input area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts